🚀 Bitcoin Soars to $110K: Coinbase Premium & Market Greed Signal Unstoppable Rally

Bitcoin just punched through the $110,000 barrier—and the market's frothing at the mouth. Here's why this isn't just another pump.

The Coinbase Premium Effect

When institutional money floods in, Coinbase's price premium spikes. Sound familiar? It should—this was the same tell before the 2021 bull run. Now? Even louder.

Greed Is Back (Like It Ever Left)

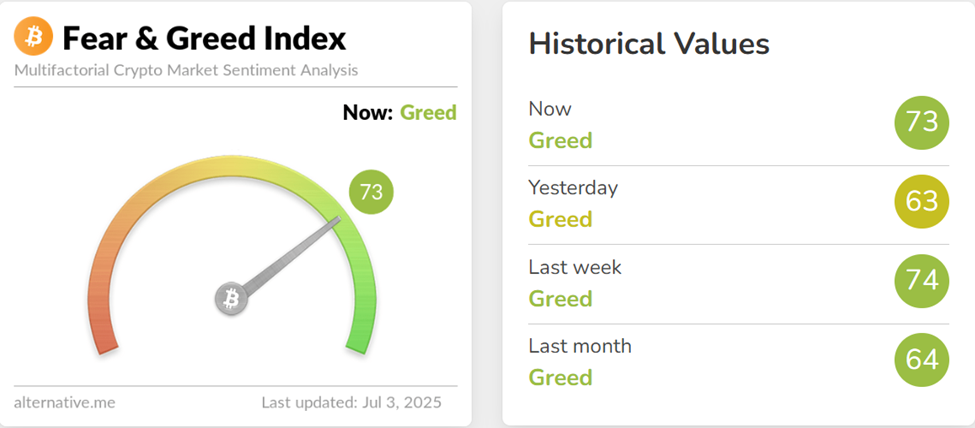

The Fear & Greed Index is blood-red with euphoria. Retail FOMO meets whale accumulation—a classic recipe for parabolic moves. Bonus irony: Wall Street's suddenly 'discovering' crypto again after years of dismissals.

Active traders are rotating profits into altcoins, while HODLers death-grip their cold wallets. Meanwhile, Bitcoin laughs at 'overbought' RSI readings—again.

Closer: $110K is just a pitstop. The real question? How many bankers will try to take credit when it hits $200K.

Coinbase Premium Spike Signals Renewed Institutional Appetite for Bitcoin

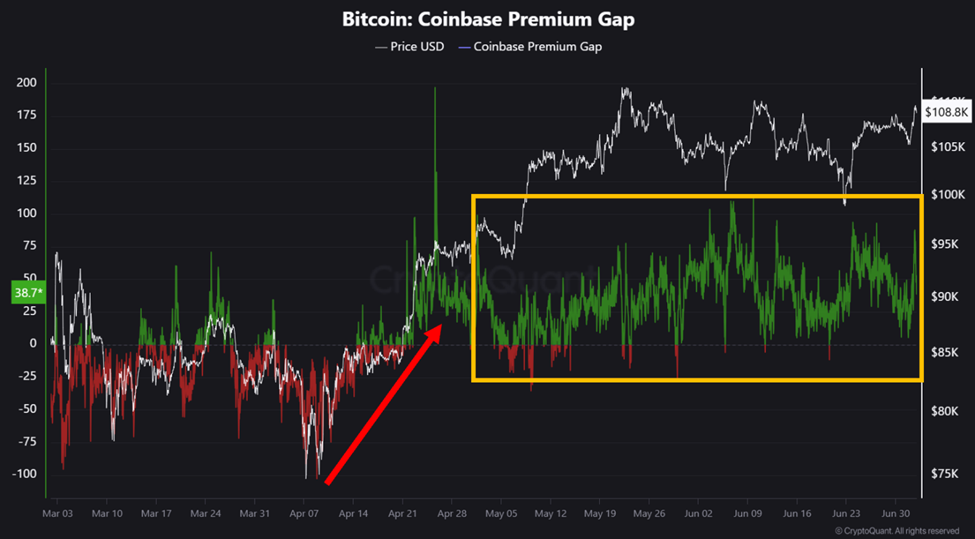

The Coinbase Premium tracks the price difference between BTC/USD on Coinbase and BTC/USDT on the Binance exchange. A positive premium typically signals increased demand from US institutions and high-net-worth individuals.

According to CryptoQuant contributor crypto Dan, the Coinbase Premium Gap has remained positive since May, reflecting sustained US-based buying activity.

“Bitcoin – the direction has already shifted upward…Since April, the selling pressure from US whales and institutions has gradually decreased… currently, their buying pressure is being maintained,” Dan wrote in a recent report.

Elsewhere, StarkWare ecosystem lead, Brother Odin, alluded to market sentiment turning greedy. Echoing sentiment from Crypto Dan, the analyst also pointed to rising premiums and reduced selling pressure as signs that the broader trend may be shifting upward.

“US institutions [are] in accumulation mode… Coinbase premium tracks the BTC price gap between Coinbase (USD) and Binance (USDT)… right now it’s positive and rising,” wrote Odin.

This surge in institutional demand coincides with a Fear & Greed Index reading of 73, as of this writing. The index places the market firmly in “Greed” territory, an outlook that has persisted over the past few weeks.

While this signals strong bullish sentiment, it also raises red flags for some traders. Historically, readings above 70 have preceded short-term corrections in several recent market cycles.

Is Bitcoin Poised for Price Discovery Mode?

Still, sentiment among on-chain analysts remains optimistic. Among them is BitBull, who emphasized the signal strength of the premium spike.

“Coinbase Bitcoin Premium just hit its highest level in a week. This is the best signal of institutional accumulation, which means the rally could extend. If the premium extends for a few more days, BTC will enter the price discovery mode,” BitBull suggested.

The recent surge continues a pattern that BeInCrypto reported three weeks ago. As it happened, a similar rise in the Coinbase Premium sent bitcoin near local highs. That momentum appears to be consolidating now, rather than reversing.

This outlook, in which Bitcoin could enter a price discovery mode, aligns with Crypto Dan’s sentiment. The on-chain analyst pointed to Bitcoin’s consolidation as providing a window for resolving short-term overheating.

“Bitcoin is currently in a consolidation phase where short-term overheating is being resolved,” Crypto Dan observed.

Dan pointed out that while corrections remain possible, the overall market trajectory looks bullish heading into the second half of 2025.

The current combination of rising premiums, bullish on-chain signals, and renewed risk appetite has placed Bitcoin at a pivotal moment.

If institutional accumulation persists and retail follows suit, analysts say the market may be poised to re-enter price discovery mode, where new all-time highs are tested.

Institutional moves on Coinbase always hint at bigger Bitcoin trends ahead.

— nordin.eth (@nordin_eth) July 3, 2025

As of this writing, Bitcoin was trading for $110,001, up by over 2% in the last 24 hours.