3 US Crypto Stocks Primed for a Breakout This Week

Crypto's wild ride isn't slowing down—these three US stocks are flashing bullish signals as institutional money floods the sector.

MicroStrategy 2.0? One Nasdaq-listed firm just doubled down on BTC holdings—while short sellers pile in.

The ETF Effect BlackRock's surprise crypto custody move sparks speculation about which public companies could be next to benefit.

Mining's Comeback Kid A once-battered mining stock surges 300% YTD as hash rate recovers—just in time for the halving hype cycle.

Remember: 'Blockchain adoption' looks suspiciously like hedge funds playing hot potato with retail bags. Trade accordingly.

IREN

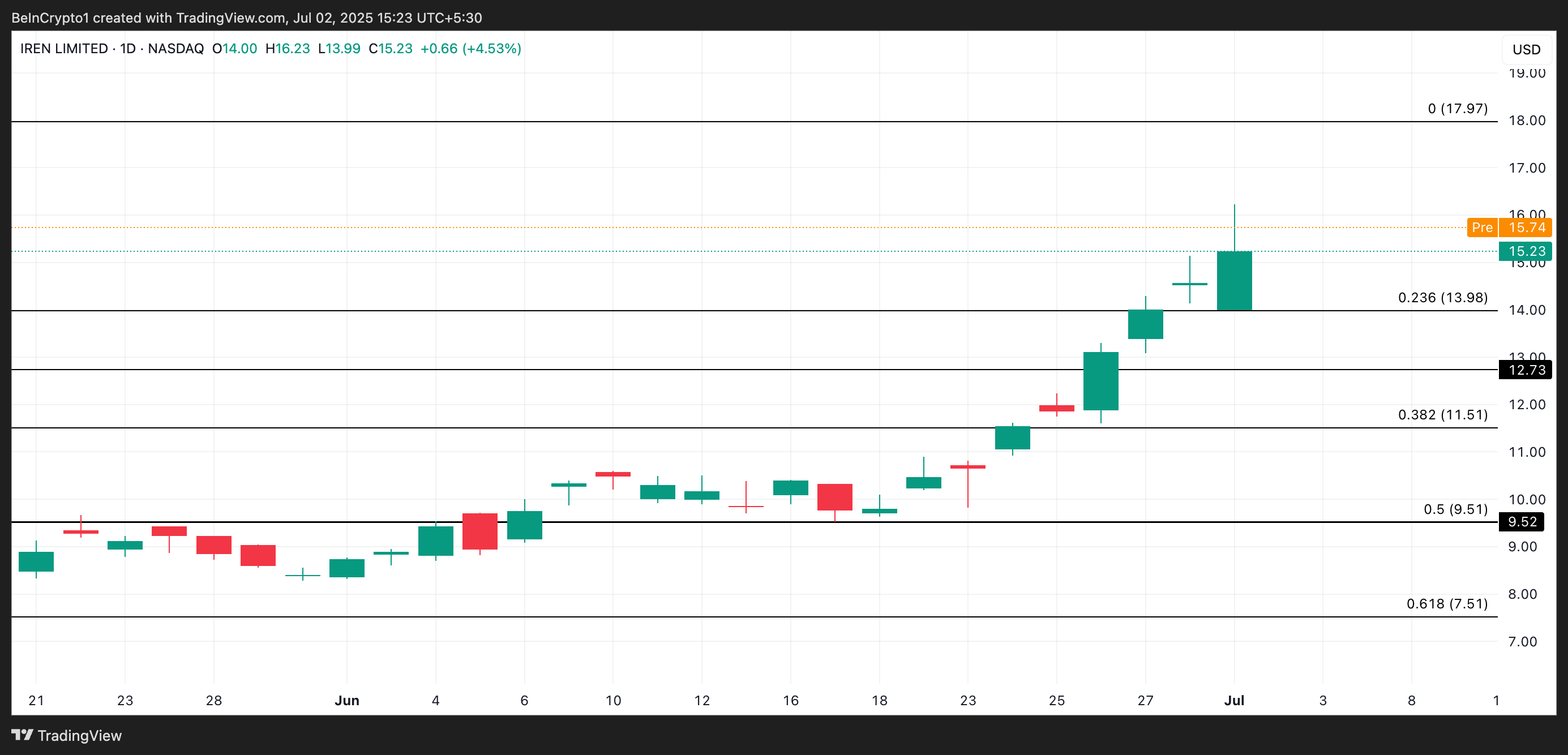

IREN surged 4.19% in the last session to close at $15.23. It is one of the crypto stocks to pay attention to today, following news of a key leadership appointment.

In a press release on Tuesday, IREN announced the appointment of Anthony Lewis as Chief Capital Officer, a newly created role tasked with leading the company’s capital markets activity. Lewis will be responsible for shaping IREN’s capital structure and financing strategy as the company pursues new investments in AI infrastructure.

In premarket trading today, IREN is up at $15.74. If bullish demand holds through the session, the stock could climb further to $17.97.

On the downside, if selling pressure builds, the price risks pulling back to $13.98.

HIVE Digital Technologies (HIVE)

HIVE jumped 15% in the previous session to close at $2.07. This followed its recent reporting of strong financial results for the fiscal year ended March 31, 2025.

The company posted total revenue of $115.3 million, supported by digital currency mining and significant growth in its AI-powered high-performance computing (HPC) business. HIVE’s HPC and AI cloud revenue soared threefold to $10.1 million, reflecting surging demand for AI computing services.

Despite challenges from the April 2024 Bitcoin halving and rising mining difficulty, the company mined 1,414 BTC, expanded its hashrate by 40%, and strengthened its HODL position to 2,201 BTC. Gross operating margins stood at 21.8%, while Adjusted EBITDA reached $56.2 million, representing 48.7% of total revenue.

At premarket today, HIVE trades at $2.15. If current buying momentum continues into the market open, the stock’s price could climb toward $2.55.

However, if demand weakens, it risks pulling back to $1.26.

LQWD Technologies (LQWD)

LQWD Technologies is gaining significant traction following the announcement of its newly formed bitcoin Advisory Board. On June 26, 2025, the company appointed Bitcoin experts Sam Callahan, Jesse Myers, and Coyn Mateer to the board.

This MOVE aims to accelerate LQWD’s Bitcoin treasury growth and enhance BTC deployment across its Lightning Network-based transaction infrastructure. The news has fueled investor optimism. At last trade, LQWD stock was up 5.18%, closing at $3.86.

At press time, the stock trades higher at $4.95. If demand increases when markets open, the price could surge toward $5.96.

Conversely, if bullish momentum fades, it risks dropping back to $3.88.