Crypto Whales’ July 2025 Playbook: The Coins They’re Betting On for Massive Gains

Crypto whales are making big moves—here’s where they’re dumping their bags and what they’re stacking instead.

Smart money doesn’t wait for retail to catch up. While normies panic-sell, the whales are quietly loading up on these assets.

Bitcoin dominance slips as altcoins rally

Ethereum killers? More like Ethereum printers. The Layer 1 race heats up with Solana and Avalanche posting double-digit gains while gas fees on mainnet hit new highs.

DeFi blue chips bounce back

After last quarter’s bloodbath, institutional money is flowing back into decentralized exchanges and lending protocols. Aave and Uniswap lead the charge—because even whales need leverage.

NFTs aren’t dead (again)

Profile-picture projects moon on rumors of celebrity endorsements. Because nothing pumps a token like a washed-up actor’s tweet.

Regulators scramble to keep up

The SEC’s ‘regulation by enforcement’ strategy hits another wall as offshore exchanges bypass U.S. restrictions. Meanwhile, Congress debates a bill that’s already outdated.

Bottom line: The market moves fast—and the whales move faster. By the time you read this, they’ve probably already flipped their positions. Happy chasing.

Ethereum (ETH)

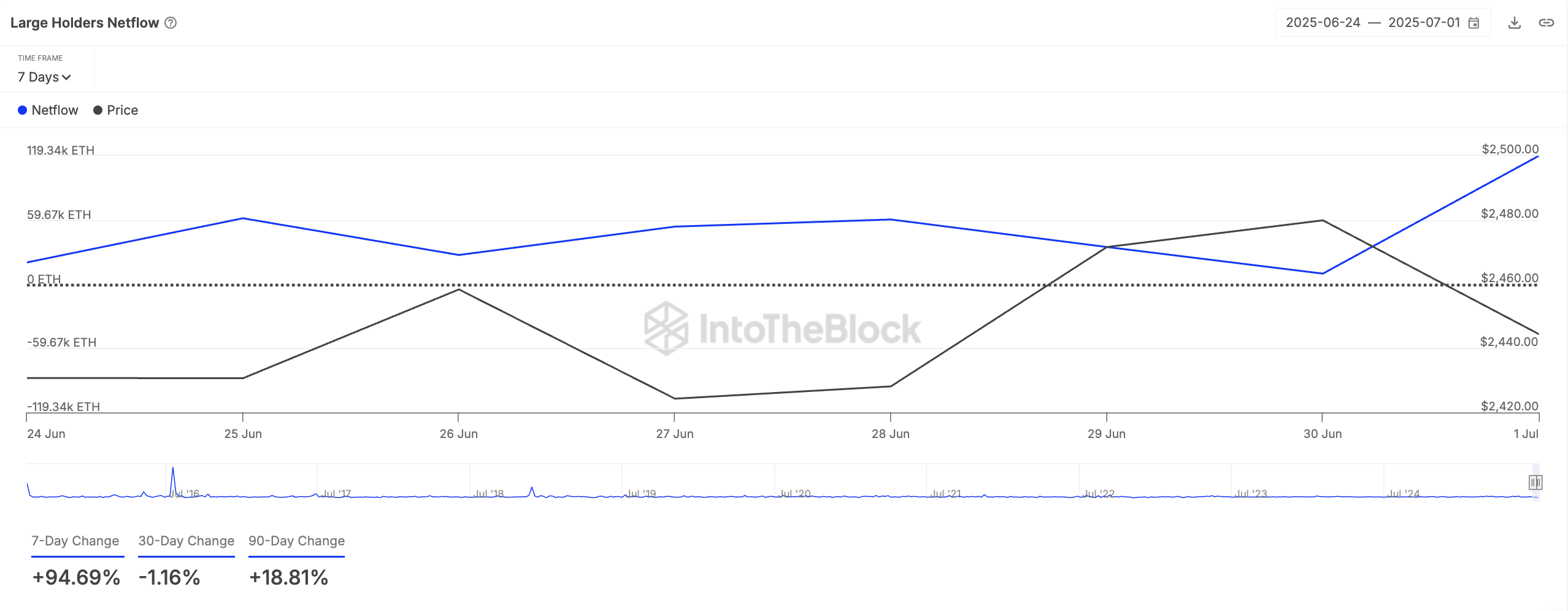

Ethereum remains a top target for crypto whales this month. Despite the altcoin’s lackluster performance over the past week, large holders have seized the opportunity to accumulate. They have increased their net inflows as they position for potential upside in the weeks ahead.

Per IntoTheBlock’s data, ETH’s large holders’ netflow has spiked 95% over the past week, reflecting increased demand from this group of investors.

Large holders are investors that hold more than 0.1% of an asset’s circulating supply. Their netflow measures the difference between the amount of tokens that whales buy and sell over a specified period.

When it climbs, it indicates strong accumulation by whales. The trend could prompt retail traders to ramp up their ETH accumulation, driving up its value in the NEAR term.

ONDO

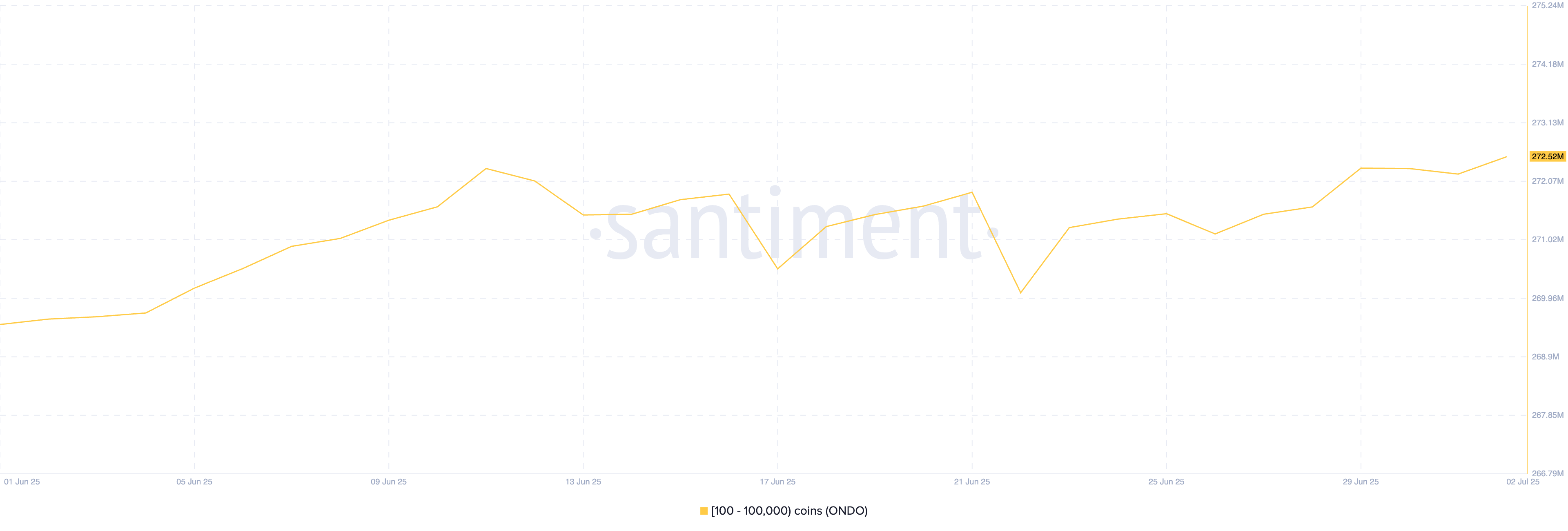

RWA-based token ONDO is another asset that crypto whales are paying attention to this month. Data from Santiment shows a notable rise in the coin holding of whale wallet addresses that hold between 100 and 100,000 ONDO tokens.

Over the past week, this group has collectively accumulated 3 million tokens, signaling growing confidence in ONDO’s near-term performance.

If this whale demand continues to grow, it could provide the momentum needed to push ONDO’s price above the key resistance level at $0.92.

Conversely, if market sentiment shifts and whales MOVE to secure profits, the token risks retracing toward $0.66.

Chainlink (LINK)

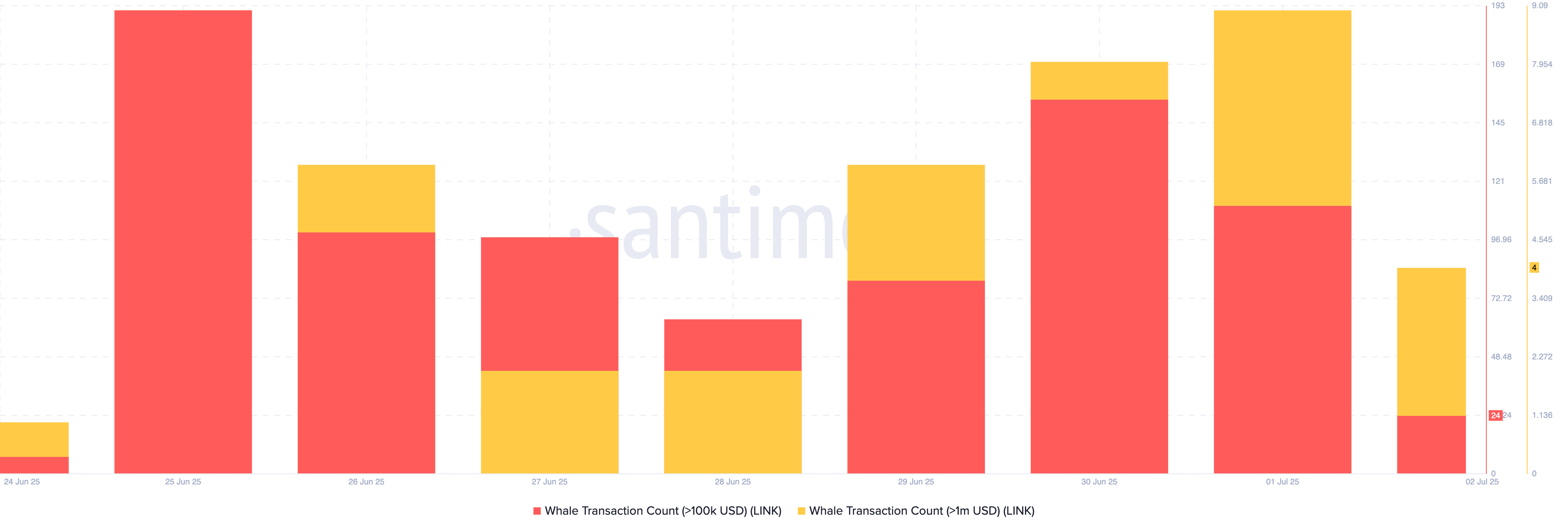

LINK has seen a surge in whale transaction activity over the past few days, signaling growing confidence in the token’s near-term performance.

According to data from Santiment, there has been a steady increase in the number of LINK transactions exceeding $100,000 and $1 million, indicating that large investors are actively positioning for potential gains in July.

This uptick in high-value transactions suggests strengthening bullish momentum for LINK’s price. If this trend persists, it could fuel further upward pressure and push the altcoin’s price to $15.53.

On the other hand, if demand falls, the token’s price could dip toward $11.04.