Tron Dominates: USDT Volume Crushes Ethereum by 5x as Retail Traders & Whales Fuel Explosive Growth

Tron isn't just competing—it's lapping Ethereum when it comes to USDT transactions. The network now handles five times the stablecoin volume of its older rival. What's driving the surge? A mix of retail traders chasing low fees and whales moving big bags without blinking at gas costs.

Retail flocks where the friction dies

While Ethereum struggles with its 'ultrasound money' identity crisis, Tron's pitch is brutally simple: cheap, fast transactions. No wonder budget-conscious traders pile in—why pay $10 to move stablecoins when you could pay pennies?

Whales don't care about narratives

The big players aren't here for ideological debates. They're arbitraging exchanges, rebalancing portfolios, and parking liquidity where it works. Tron's no-frills efficiency makes it a conveyor belt for big-ticket USDT moves.

Ethereum's 'high-end boutique' problem

There's a reason luxury brands don't dominate Walmart's sales charts. Ethereum positions itself as the premium network—but in crypto, convenience often beats prestige. Meanwhile, Tron keeps eating its lunch where it matters most: actual usage. Just don't tell the degens holding ETH bags that their 'store of value' is getting outsold by a discount chain.

How Tron Surged Ahead of Ethereum in USDT Transactions

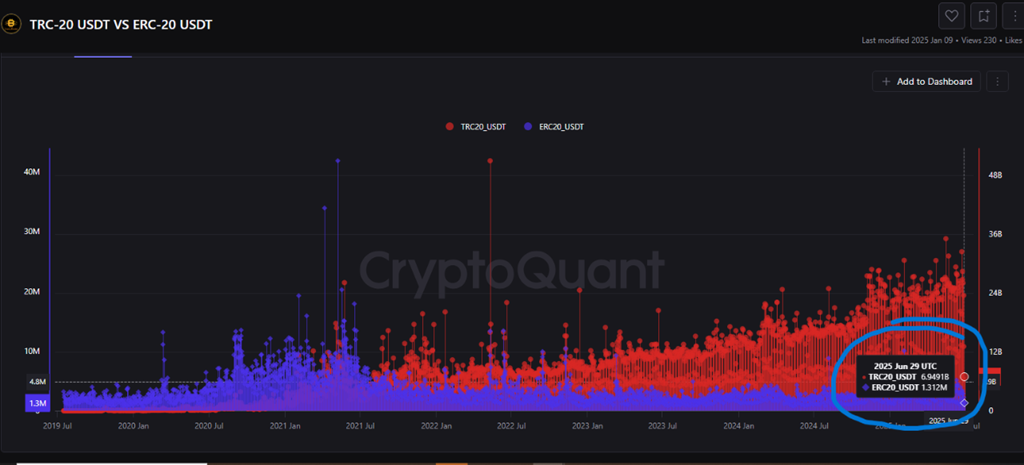

A recent report from CryptoQuant points out that on June 29, the amount of USDT transferred on TRON reached $6.949 billion. This figure is 5.29 times higher than the $1.312 billion recorded on Ethereum.

This trend is not short-lived. It has remained steady since 2021, confirming Tron’s increasingly solid position in the race with other major blockchains.

“Asia plays a key role in this trend. tron is now the leading network for USDT adoption and volume across Asian markets, driven by its low-cost infrastructure for large transfers. This regional dynamic enhances its global relevance,” analyst Carmelo_Alemán explained.

Tron’s dominance comes from whale trading activity and widespread participation from retail users.

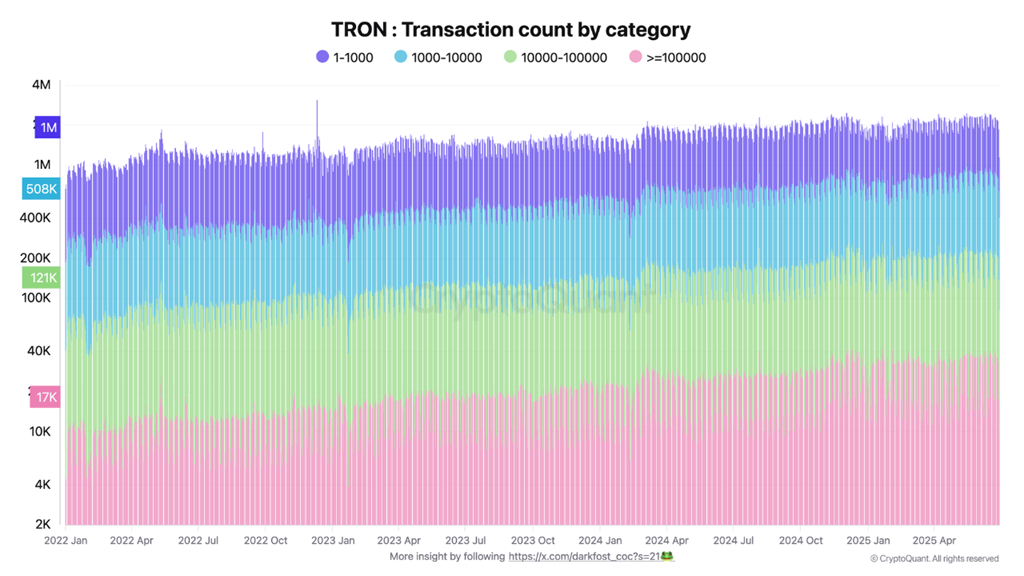

CryptoQuant data also shows that small transactions (under $1,000) make up the majority, with over 1 million daily transactions. This proves Tron has become a favored platform for everyday users thanks to low fees and fast transaction speeds.

However, when USDT volume on Tron is broken down by transaction size, large transactions over $100,000 dominate and account for most of the total volume.

“This contrast highlights TRON’s dual role as both a popular platform for everyday users and a preferred network for large-scale institutional actors,” analyst Darkfost noted.

These factors boost demand for TRX, helping its market cap surpass Dogecoin and placing it eighth in the market.

SRM Entertainment Deepens Interest in DeFi on Tron

Institutional interest is also a crucial force driving Tron’s growth. One notable case is SRM Entertainment—a company once famous for making toys for Disney and Universal.

Recently, SRM successfully launched a TRON investment strategy worth $100 million. In addition, SRM staked 365,096,845 TRX tokens through the JustLend platform to optimize yields of up to 10% annually.

This MOVE reinforces trust in the Tron ecosystem and reflects the deeper participation of Nasdaq-listed companies in the decentralized finance (DeFi) sector.

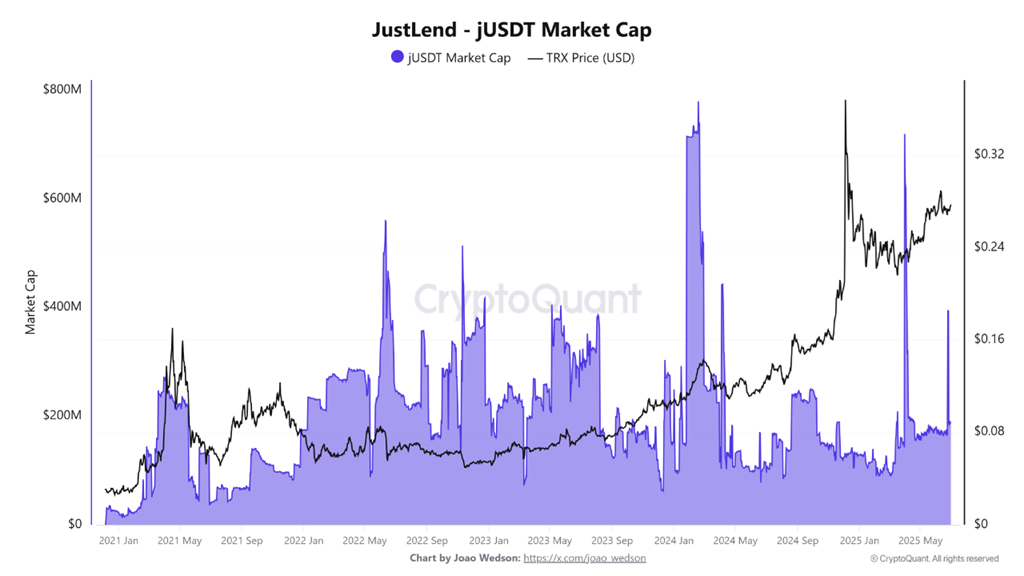

Meanwhile, the latest data from JustLend shows impressive peaks in jUSDT transfer volume and market cap, signaling renewed investor interest in lending activity on Tron.

As of June 30, 2025, the market cap of jUSDT reached $186.58 million. Total borrowing stood at $120.83 million, offering attractive annual interest rates of 4.04% (Borrow APY) and 2.49% (Supply APY).

“The charts highlight significant peaks, such as mid-2024 and early 2025, suggesting capital movements and growing adoption. These patterns, combined with TRX price fluctuations, point to investors returning to explore yield farming opportunities,” analyst joaowedson commented.

A recent analysis from BeInCrypto also suggests that with rumors of a possible IPO and connections to Eric Trump’s family, the TRX price could break past the $0.3 resistance level.