Stablecoin Surge Signals Bitcoin’s Next Leg Up—Here’s Why the Rally Isn’t Done Yet

Forget 'crypto winter'—stablecoins are flashing green. As institutional money piles into dollar-pegged assets, Bitcoin's runway looks longer than a Wall Street bonus season.

The Stablecoin Pump: Fuel for the Fire

When Tether and friends start printing like the Fed, smart money knows what comes next. Every fresh minted USDT is dry powder waiting to chase BTC's volatility.

Liquidity Tsunami Meets Scarcity

With Bitcoin's supply crunch locked in by halvings and ETF hoarding, stablecoin inflows could trigger the mother of all squeezes. Even Jamie Dimon's skeptical tweets won't stop this math.

So buckle up, degens. The charts say we're not just mooning—we're building a launchpad. (And if you believe this is 'healthy adoption,' we've got a Terra Classic revival to sell you.)

Stablecoins Shaping a New Bullish Cycle

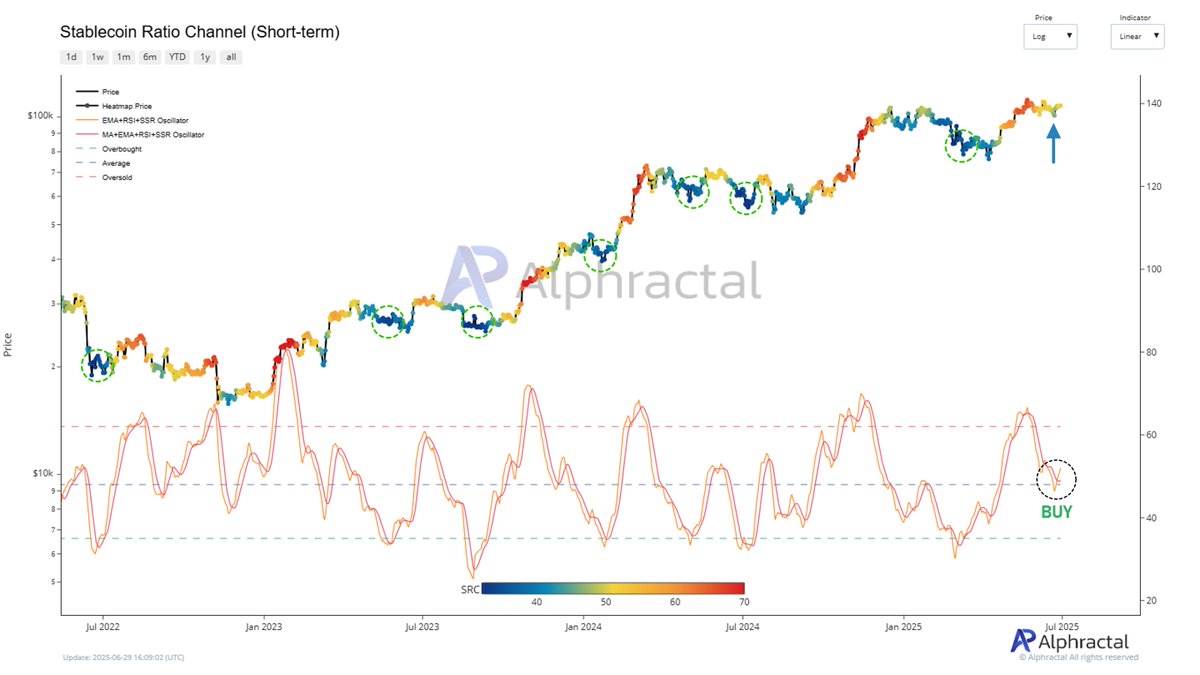

In a recent post on the X platform, Alphractal’s Founder and CEO, Joao Wedson, highlighted three key stablecoin metrics: the Stablecoin Supply Ratio (SSR) Oscillator, the Stablecoin Ratio Channel Long-Term View, and the Stablecoin Ratio Channel Short-Term View. Wedson says these metrics signal optimism, presenting a promising investment opportunity.

“None of these metrics currently indicate overbought conditions, suggesting that Bitcoin (and other cryptos) could continue rising for a few more months” Wedson shared.

First, the on-chain Stablecoin Supply Ratio (SSR) Oscillator serves as a “compass,” measuring Bitcoin’s market capitalization relative to the total stablecoin market cap, smoothed by a 200-day moving average and standard deviation.

This indicator identifies potential buying opportunities when bitcoin is undervalued relative to stablecoin liquidity or warns of overheating markets. Recent Alphractal data shows the SSR Oscillator has not yet reached a sell signal, suggesting Bitcoin still has room for growth.

Additionally, the Stablecoin Ratio Channel provides deeper analysis in both long-term and short-term perspectives.

The long-term view helps investors identify buying opportunities when Bitcoin is reasonably priced relative to stablecoin liquidity while warning of overvaluation.

Meanwhile, with higher oscillation frequency, the short-term view suits swing trading strategies, offering momentum signals for short-term trends. Alphractal’s charts show recent “buy” signals, particularly since early 2025, reinforcing confidence in an ongoing bullish cycle.

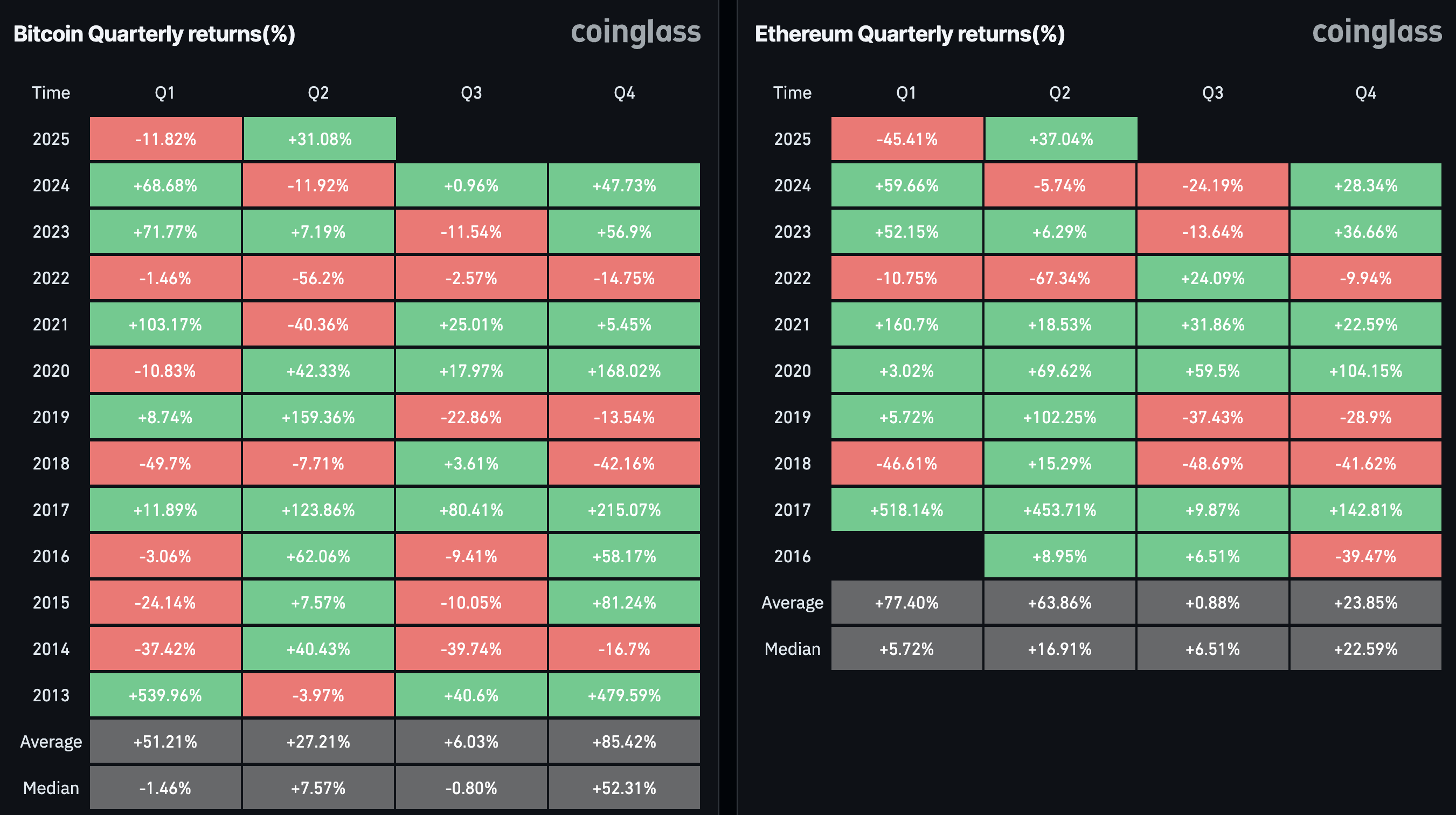

According to Coinglass, Bitcoin’s 31.08% recovery in Q2 2025, combined with Ethereum’s surge (37.04%), reflects the strength of the crypto ecosystem.

However, risks remain. Stablecoin reliance could be impacted by global regulatory volatility, especially as countries like the US and EU tighten oversight. Nevertheless, the outlook remains positive with low interest rates. The US Treasury has also predicted that the stablecoin market could reach $2 trillion.