Ethereum Staking Hegemony: How Three Platforms Now Control the Game

The staking wars are over—and the spoils go to the big three.

Ethereum's proof-of-stake revolution was supposed to democratize network participation. Instead, it's become a playground for institutional giants. Three platforms now dominate ETH staking, turning 'decentralization' into Wall Street-style consolidation.

Who needs 51% attacks when you've got 66% market share?

The numbers don't lie: the ETH staking ecosystem has quietly centralized faster than a TradFi merger. While retail investors chase the next meme coin, the real power grab happened in plain sight. Just don't call it a cartel—call it 'efficient capital allocation.'

Welcome to decentralized finance, where the house always wins.

Lido, Binance, and Coinbase Dominate Ethereum Validator Power

Blockchain analytics firm Sentora reports that this is the highest proportion of ETH ever staked. The firm stated that the trend accelerated in June when over 500,000 ETH were staked within the first half of the month.

More than 35 million ETH are now locked in staking, effectively locking nearly 30% of the total ETH supply pic.twitter.com/4RTApX2zdN

— Sentora (previously IntoTheBlock) (@SentoraHQ) June 27, 2025This increase follows clarity from the US Securities and Exchange Commission (SEC). The agency’s May guidance has given institutional investors more confidence in Ethereum’s staking prospects.

As a result, large investors, including whales, have shown growing interest in ETH, opting to stake their holdings to gain more exposure to the network’s long-term value.

Despite the enthusiasm surrounding Ethereum’s staking growth, concerns about its decentralization have emerged.

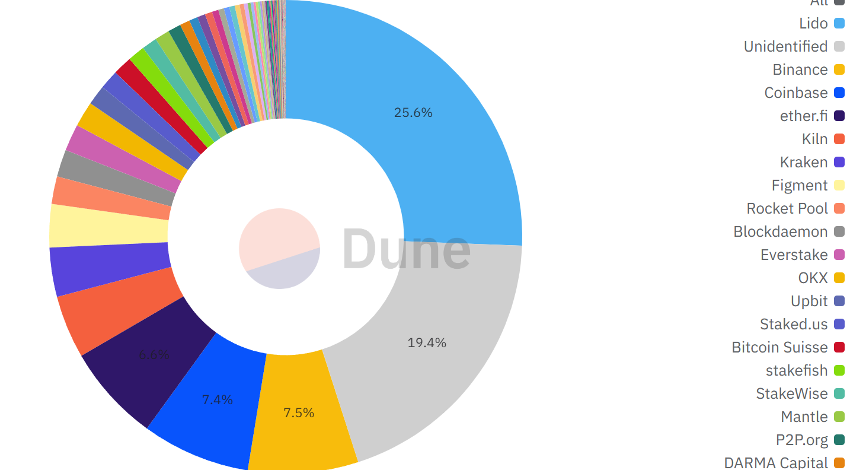

The top three ethereum stakers—Lido, Binance, and Coinbase—now control nearly 40% of all validator balances.

Lido, a dominant liquid staking platform, holds roughly 8.7 million ETH, or 25% of all staked coins. Meanwhile, the two leading centralized exchanges, Binance and Coinbase, each manage around 7.5% of the staking market.

“A censorship or outage event affecting Lido, Binance, and Coinbase, WOULD now hit >40% of new blocks,” Sentora warned.

This concentration of power has reignited discussions about Ethereum’s decentralization model. The dominance of a few entities raises concerns about the network’s future governance and liquidity.

Meanwhile, the surge in staking activity, coupled with around 19% of ETH locked in long-term holdings, is reducing the liquid supply available for trading.

As a result, ETH’s float is approaching levels not seen since before the Merge, causing thinner order books and increased market volatility. Moreover, ETH spot markets are experiencing sharper price swings, which is amplifying both rallies and corrections.

In addition, DeFi platforms are also feeling the squeeze. Sentora pointed out that borrowing rates for liquid staking tokens like stETH, rETH, and frxETH are rising.

Sentora noted that these tokens may feel the pinch if their unit collateral grows scarcer. This could potentially force the lending protocols to adjust their strategies to accommodate the tightening market.