Hedera (HBAR) Price Plunge Threatens $38 Million Liquidation Bloodbath

Hedera's HBAR teeters on the edge of a cascading sell-off as leveraged positions face annihilation.

Liquidation Domino Effect

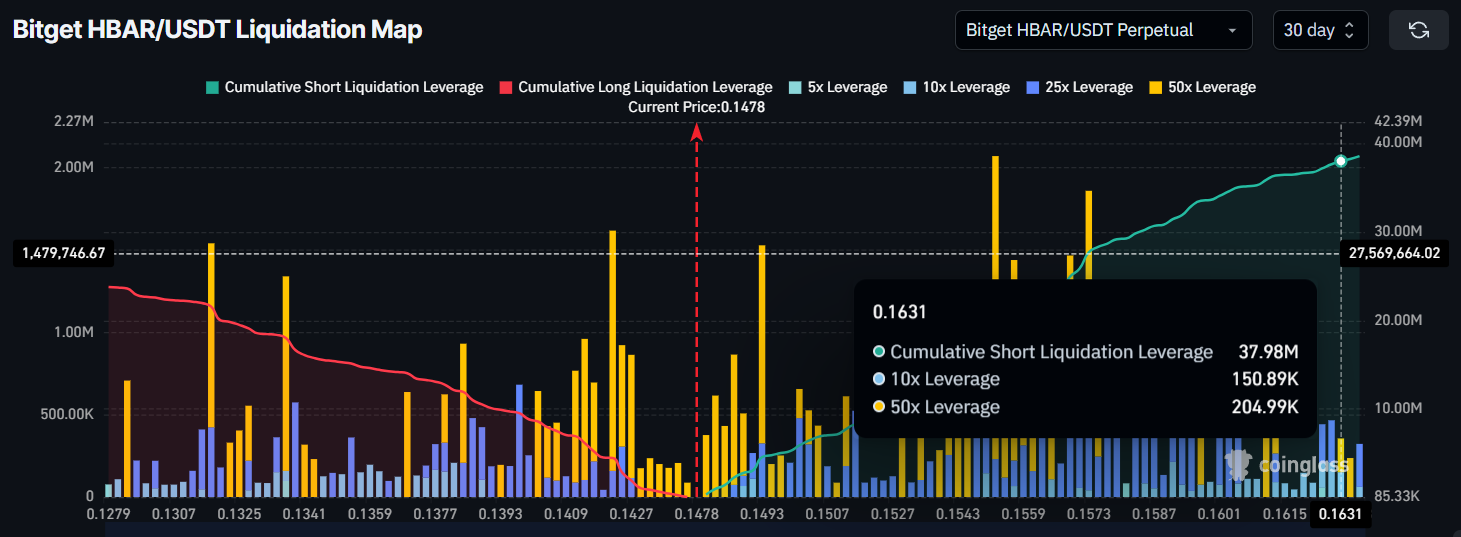

A 15% dip from current levels would trigger $38 million in forced liquidations—turning paper losses into very real pain for overextended traders. The derivatives market's house of cards trembles.

Network Activity vs. Price Reality

Despite 2.3 million daily transactions last quarter, HBAR's price action ignores fundamentals. Another reminder that in crypto, adoption metrics and token economics exist in parallel universes.

Vultures Circle

Market makers already widened spreads by 40% on perpetual swaps—the sharks smell blood in the water. Meanwhile, 'HODL' memes flood social channels as retail bags get heavier.

Finance never changes: the only thing faster than algorithmic traders? The speed at which 'long-term investors' become panic sellers when margin calls hit.

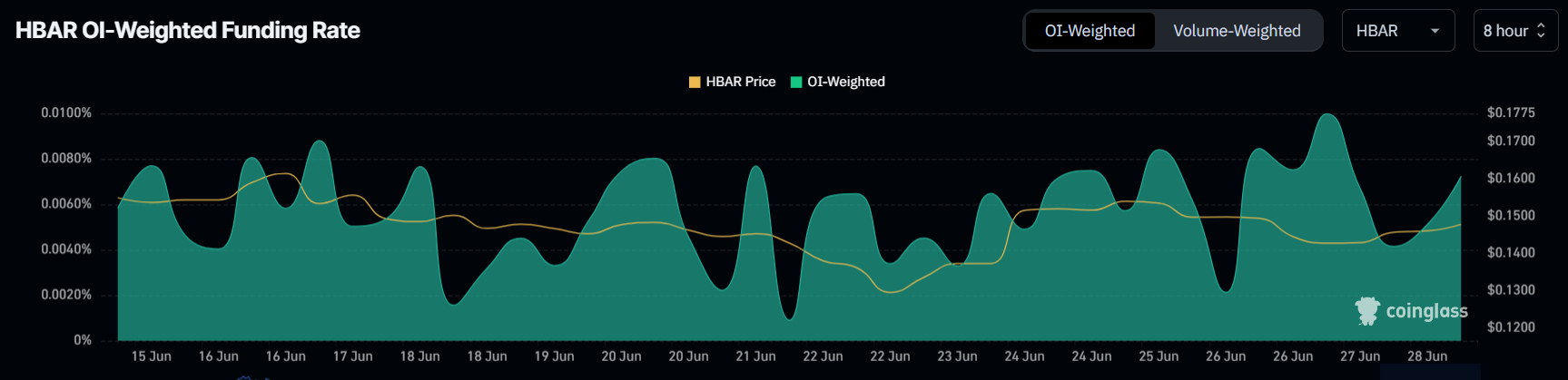

HBAR Traders Are Bullish

Throughout this month, traders have shown strong bullish sentiment toward HBAR. The funding rate has remained positive consistently, indicating a dominance of long contracts in the market.

This suggests that traders are confident about a potential price recovery and are positioning themselves to capitalize on a rise in value. The consistent Optimism reflects a belief that HBAR can rebound from its current downtrend.

Also, the positive funding rate shows that more investors are willing to place bets on the future of altcoin despite the ongoing challenges.

The macro momentum for HBAR reveals that short traders could face substantial losses if the price rises. The liquidation map indicates that approximately $38 million worth of short contracts could be liquidated if HBAR breaks its current downtrend and rises to $0.163.

This WOULD have a significant impact on the market, potentially fueling further buying momentum.

Short traders have been betting on continued price declines, but a breakout above key resistance levels could force them to exit their positions. This would create additional buying pressure, supporting the potential for a larger upward move.

HBAR Price Is Awaiting A Boost

At the time of writing, HBAR is trading at $0.148, just under the critical resistance level of $0.154. The altcoin is looking to breach this resistance and break the downtrend line that has been holding it back.

A successful push past this level would be a key milestone in HBAR’s recovery.

The factors supporting a potential breakout indicate that HBAR could rise to $0.163 if it manages to flip $0.154 into support. Reaching this level could trigger the liquidation of short positions, further driving the price up.

This could help HBAR gain momentum and recover from its recent downtrend.

However, if the broader market turns bearish, HBAR’s price could fall to $0.139. Losing this support would be a bearish signal, potentially driving the price further down to $0.133.

Such a decline would invalidate the bullish thesis and shift the market outlook back toward the bears.