From $6.8K to $1.5M: The Hyperliquid Trader Who Defied Crypto Odds in 2025

A hyperliquid trader just pulled off the unthinkable—turning a modest $6,800 into a jaw-dropping $1.5 million. Here’s how they did it (and why your bank’s savings account still pays 0.1%).

### The Playbook: Leverage, Timing, and a Dash of Insanity

While Wall Street hedgies were busy shorting Bitcoin at $30K, this degen spotted an asymmetric opportunity. Hyperliquid’s low-latency infrastructure let them execute trades faster than a CEX bot—slippage? Not today.

### The Numbers Don’t Lie

220x returns in a single market cycle. That’s not luck—that’s leveraged perfection. The trader rode altcoin volatility like a surfboard on a tsunami, flipping positions with surgical precision.

### The Aftermath: Champagne Problems

Now sitting on seven figures, the trader faces the ultimate crypto dilemma: Lambo or ledger? Meanwhile, traditional finance still thinks ‘blockchain’ is a spreadsheet upgrade.

Another Hyperliquid User Makes Legendary Trades

Decentralized perpetuals exchange Hyperliquid has been making headlines in Q2 due to the viral trading of James Wynn. The Bitcoin whale became the most famous degen among the crypto community in a short time.

While the James Wynn saga ended with a $100 million loss, another new trader has quietly emerged into the spotlight.

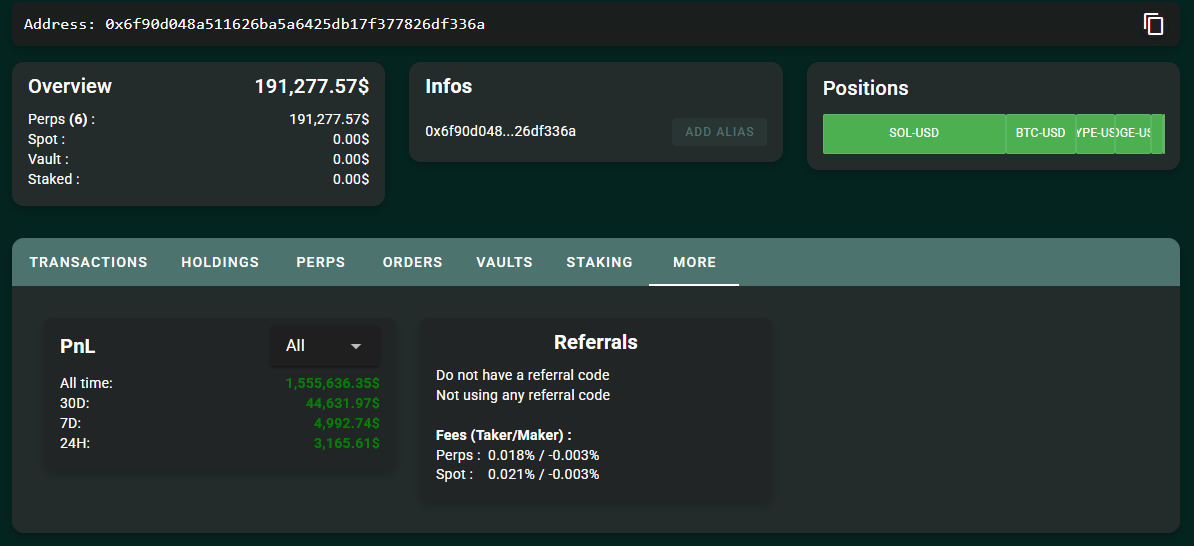

Over the last few months, the wallet ‘0x6f90…336a’racked up more than, with the trader withdrawing profits along the way.

The strategy hinges on placing market-making orders that earn small rebates from the exchange rather than trying to guess where prices will go.

A Quiet Giant: 3% of Hyperliquid’s Volume

On decentralized exchanges like Hyperliquid, traders who provide liquidity by placing Maker orders get paid a small fee rebate for doing so. This is called a.

In contrast,, which are filled immediately, pay a fee.

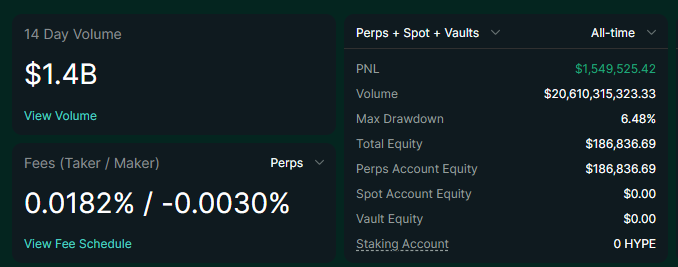

On Hyperliquid, the maker rebate is currently –0.0030%, meaning traders are paid 3 cents for every $1,000 in volume they provide. While this may seem small, it adds up rapidly with scale.

Despite managing less than $200,000 in capital, this trader reportedly accounts foron the exchange.

The trader has been observed quoting only one side of the market at a time—either bids or asks—minimizing directional risk.

They also maintained a net exposure of less than $100,000 throughout. This suggests a tightly controlled strategy focused entirely on, not making bets on price.

Small Capital, High Frequency

Over 14 days, the trader recorded $1.4 billion in volume, turning over their capital hundreds of times per day. The low maximum drawdown of 6.48% reveals just how risk-averse the system is.

What’s most surprising is the scale. Achieving overwith a sub-$200,000 account, mostly from rebates, is rare in decentralized finance.

The performance suggests the use of a highly automated, latency-sensitive trading system. Orders are likely managed through bots that react instantly to market changes and cancel stale quotes.

This requires infrastructure that is fast, consistent, and carefully tuned to avoid exposure during sudden price shifts.

However, it’s important to note that this strategy isn’t easy to replicate. It demands technical know-how, real-time infrastructure, and a DEEP understanding of exchange mechanics.