Crypto Whales Are Loading Up: These 3 Altcoins Dominated June 2025’s Final Buying Spree

Crypto whales just tipped their hand—and retail traders are scrambling to front-run their moves. Here’s where the smart money parked its bags in June’s home stretch.

### The Whale Watch: Three Tokens That Made the Cut

While Wall Street hedgies were busy shorting meme stocks, crypto’s big players quietly accumulated positions that could shake Q3’s markets. No insider leaks required—just follow the blockchain breadcrumbs.

### Why This Matters More Than Ever

When whales move, altcoins pump. And when they pump, your broker suddenly remembers they ‘always believed’ in crypto (right after calling it a scam at $20K BTC).

### The Bottom Line

These buys aren’t random—they’re calculated bets on protocols with real traction. Or maybe just hedges against inflation while the Fed pretends 2% is still the target. Either way, the chains don’t lie.

Uniswap (UNI)

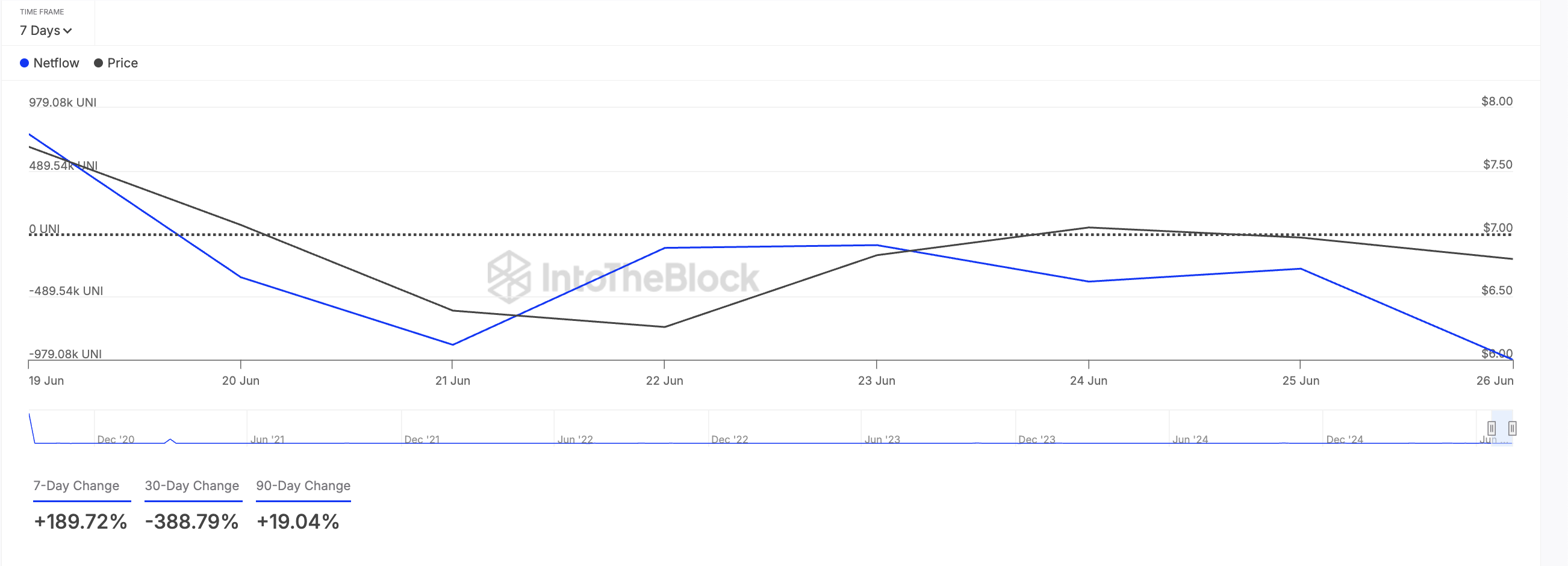

This week, decentralized finance (DeFi) token UNI has received significant whale attention. This is reflected by its large holders’ netflow, up 190% over the past seven days, per IntoTheBlock.

Large holders are investors that hold more than 0.1% of an asset’s circulating supply. Their netflow measures the difference between the amount of tokens that they buy and sell over a specified period. When it surges like this, it signals strong accumulation by whales, suggesting growing confidence or a bullish outlook on the asset.

Moreover, the surge in large holder netflow could prompt retail traders to ramp up their UNI accumulation. If this buying pressure continues, the altcoin could break into the $7 price zone.

On the other hand, if demand falls, the token’s price could dip to $5.91.

Worldcoin (WLD)

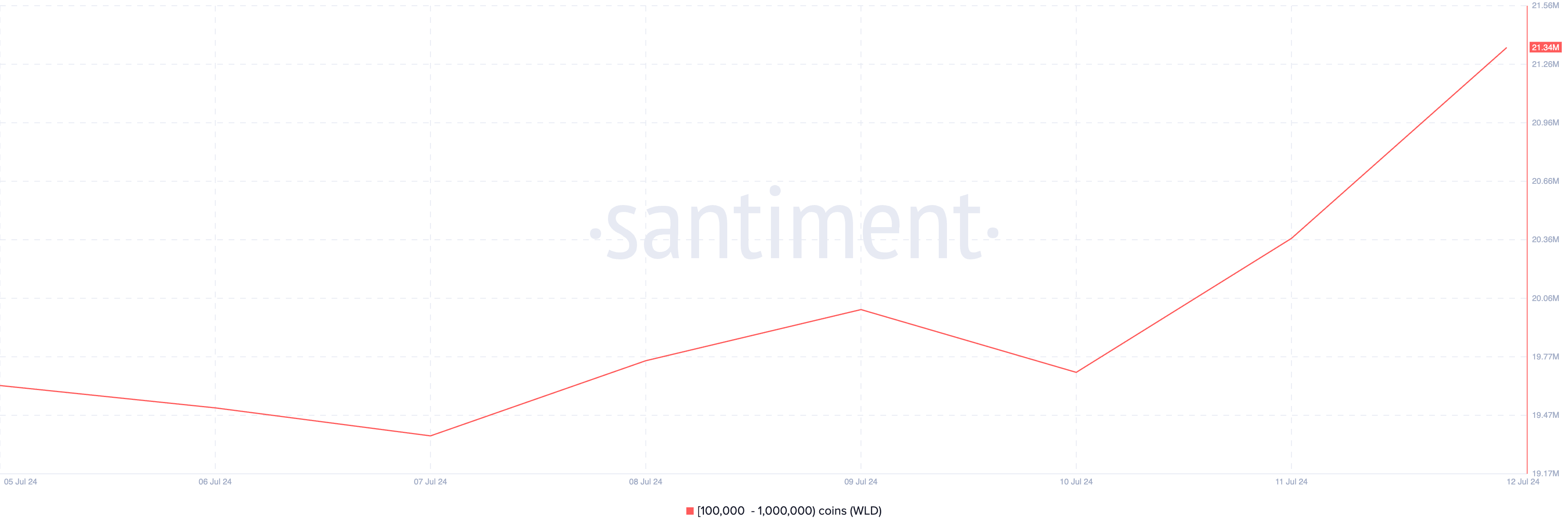

WLD, the token that powers Sam Altman’s Worldcoin, is another altcoin that crypto whales have bought this week. Data from Santiment shows a notable rise in the coin holding of whale wallet addresses that hold between 100,000 and 1 million WLD tokens.

During the week in review, this cohort of WLD holders acquired 1.72 million tokens, which are currently valued at over $3 million.

If this whale demand soars, it could propel WLD’s price above the resistance at $0.97 in the NEAR term.

However, if sentiment flips bearish and whales sell for profit, WLD could shed some of its value and plunge toward $0.57.

The SandBox (SAND)

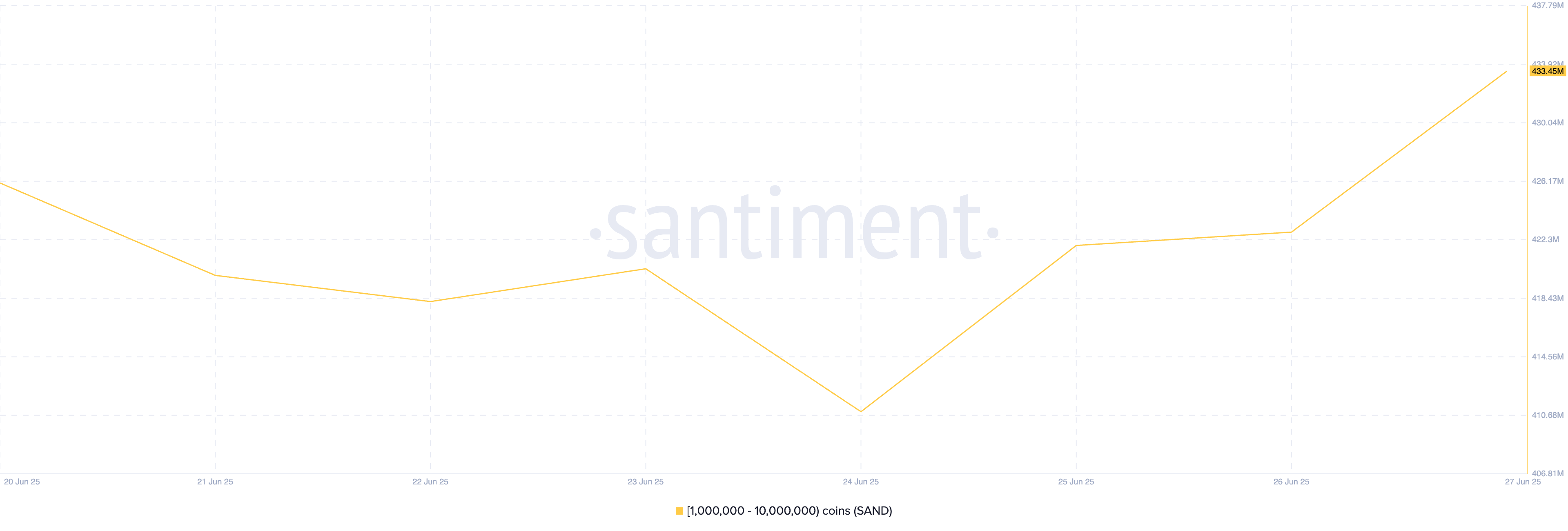

Metaverse-based token SAND is another asset that has seen a surge in crypto whale activity this week. According to data from Santiment, large investors holding between 1 million and 10 million tokens have accumulated 7.45 million SAND over the past week.

This significant uptick in whale accumulation suggests growing confidence in SAND’s long-term potential.

If this buying trend extends to retail traders, it could further strengthen the token’s bullish momentum in the coming weeks and push its price toward $0.30.

On the other hand, if demand buying activity declines, SAND’s value could dip to $0.21.