Trump’s Fed Fury Escalates as Inflation Soars and Dollar Tanks – Crypto Markets Brace for Impact

Fed under fire as inflation bites and the greenback stumbles—while crypto traders smell opportunity.

Dollar's decline fuels crypto rally

As traditional markets wobble, Bitcoin and altcoins are seeing renewed interest as inflation hedges. The dollar index (DXY) hits 18-month lows—just as BTC flirts with $70k again.

Trump vs. Powell: Round 47

The former president's latest Fed broadside comes as no surprise to markets. "They're still using dial-up economics in a quantum computing world," quipped one hedge fund manager (between martinis).

Crypto's inflation paradox

While the Fed struggles with sticky inflation, decentralized finance keeps humming along—proving once again that blockchain networks don't need permission to print money.

Will 2025 be the year fiat finally breaks? Probably not. But watching central bankers sweat while crypto thrives? Priceless.

Crypto News of the Day: US Inflation Rises While Spending Slips

The Fed’s preferred inflation gauge, PCE (Personal Consumption Expenditures), rose in May. According to the latest data, the Core PCE Price Index rose 0.2% month-over-month (MoM) and 2.7% year-over-year (YoY), slightly above forecasts.

Headline PCE came in as expected, rising 0.1% on the month and 2.3% YoY

*US MAY PCE PRICE INDEX RISES 0.1% M/M; EST. +0.1%

*US MAY CORE PCE PRICE INDEX RISES 0.2% M/M; EST. +0.1%

*US MAY PCE PRICE INDEX RISES 2.3% Y/Y; EST. +2.3%

*US MAY CORE PCE PRICE INDEX RISES 2.7% Y/Y; EST. +2.6%

Like the US CPI, this is the first rise in PCE inflation since February. Against this backdrop, experts anticipate the Fed pause to continue.

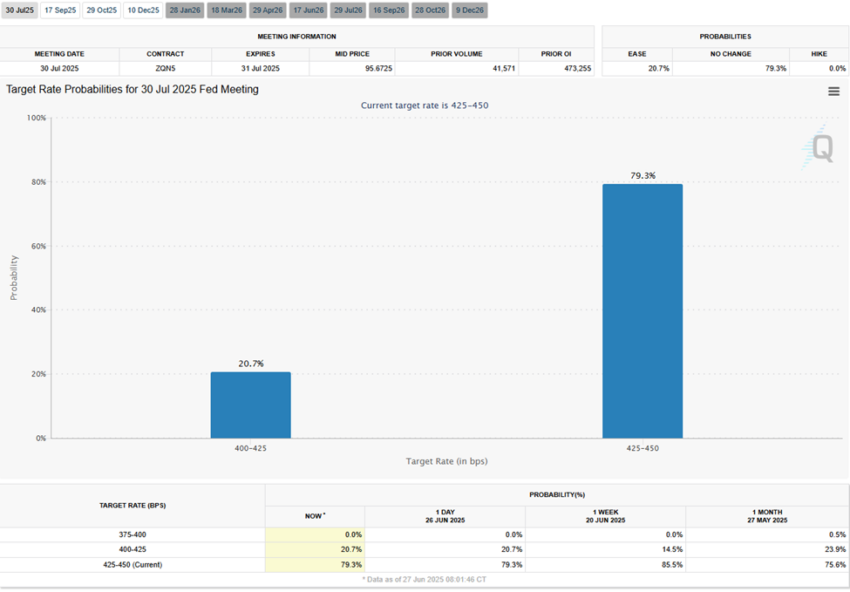

Based on the CME FedWatch Tool, there is a 79.3% probability of the Fed keeping interest rates unchanged in the July 30 meeting.

Further, signs of weakening consumer momentum emerged as personal income fell 0.4%. Meanwhile, real personal spending declined 0.3%. Both of these US economic indicators missed forecasts, reflecting softening economic conditions.

*US MAY PERSONAL INCOME FALLS 0.4% M/M; EST. +0.3%

*US MAY PERSONAL SPENDING FALLS 0.1% M/M; EST. +0.1%

*US MAY REAL PERSONAL SPENDING FALLS 0.3% M/M; EST. +0.0%

While these inflation numbers reinforce the Fed’s cautious stance, political drama overshadows them. The growing possibility that President Donald TRUMP could soon install a MAGA-aligned Federal Reserve chair continues to shake financial markets.

Trump vs. Powell: Markets eye MAGA-friendly Fed Reshuffle

In his recent testimony before the Senate Banking Committee, Fed chair Jerome Powell said he expects inflation to increase this summer because of the Trump administration’s tariffs.

Meanwhile, reports indicate that Trump is considering replacing Powell with a loyalist as early as this summer.

There is DEEP momentum in Washington building for Jerome Powell’s resignation.

— Pulte (@pulte) June 26, 2025While his term ends in May 2026, the move WOULD undercut Powell’s final year in office, potentially injecting political risk into an institution long prized for its independence.

The political maneuvering triggered a sharp reaction in the currency markets, sending the US dollar to a three-year low. The dip comes amid fears of a politicized monetary policy environment ahead of 2026.

Trump, frustrated by Powell’s refusal to cut interest rates, has escalated his rhetoric, as indicated in previous US crypto News publications.

In recent weeks, he’s called Powell the “WORST” and a “dummy” who is “costing America $Billions.” Behind closed doors, insiders say Trump is vetting candidates who would be “unstintingly loyal” and willing to implement rate cuts aligned with his economic agenda.

Reacting to the news, the US Dollar Index (DXY) is trending lower, revisiting levels last seen in 2022.

As inflation reawakens and spending slows, markets grapple with a new risk: that monetary policy could once again be steered by political loyalty rather than economic logic.

Chart of the Day

Byte-Sized Alpha

Here’s a summary of more US crypto news to follow today:

- Is 0.1 Bitcoin the New American Dream? CZ, Saylor, and Pulte think so.

- Trump Family, Hut 8, and Tether fast-track a new era of hyper-scale Bitcoin mining.

- TRM Labs report shows crypto theft hits record $2.1 billion in stolen funds in H1 2025.

- Bakkt Holdings files S-3 to raise $1 billion, eyes potential Bitcoin investment.

- US Congress passes Deploying American Blockchains Act: What it means for crypto.

- Zilliqa 2.0 launch sparks a surge in inflows, with the launch introducing full EVM support and cross-chain communication.

- The APT price hits a 16-day high as the first-ever Aptos Spot ETF inches closer to reality.

- Three macroeconomic factors to watch closely to know whether Bitcoin will thrive or struggle in Q3.

- Pi Network team drops 3 major updates ahead of Pi2Day, but Pi Coin price dips 16%.

- Bitcoin remains near its ATH above $100,000, yet spot volume lags, reflecting a cooling market absent of speculative intensity.

- Layer 2 tokens show explosive valuations—Arbitrum’s FDV-to-fee ratio hits 137.8x, while Starknet’s reaches an unsustainable 4,204x.

- Ethereum ETFs attract steady inflows amid dull price action—A setup for a July surge?

- XRP’s Liveliness indicator shows long-term holders accumulating, suggesting confidence in XRP’s long-term potential and providing a buffer against volatility.

Crypto Equities Pre-Market Overview

| Company | At the Close of June 26 | Pre-Market Overview |

| Strategy (MSTR) | $386.63 | $385.19 (-0.37%) |

| Coinbase Global (COIN) | $369.21 | $374.27 (+1.37%) |

| Galaxy Digital Holdings (GLXY) | $20.48 | $21.12 (+3.31%) |

| MARA Holdings (MARA) | $15.27 | $15.19 (-0.52%) |

| Riot Platforms (RIOT) | $10.51 | $10.54 (+0.29%) |

| Core Scientific (CORZ) | $16.36 | $17.62 (+7.70%) |