Forget the White Picket Fence—Owning 0.1 Bitcoin Is the New American Dream (CZ, Saylor & Pulte Agree)

Move over, suburban homeownership—the 21st-century status symbol fits in a digital wallet. Three of crypto's heaviest hitters now argue that accumulating just 0.1 BTC could outpace traditional wealth-building. Here's why they're betting against the old playbook.

The 0.1 BTC Threshold: Why It Matters Now

At current 2025 prices, that fraction represents a stake worth thousands—not millions. But adoption curves suggest it's the minimum viable dose for participating in Bitcoin's upside while dodging the volatility that terrifies boomers.

The Unlikely Trio Rewriting the Rulebook

Binance's CZ sees it as global empowerment, MicroStrategy's Saylor touts it as inflation armor, and philanthropist Pulte calls it 'generational justice.' All three ignore Wall Street's eye-rolls—after all, these are the same suits who dismissed the internet in 1995.

The Fine Print (Because Finance Loves Ruining Fun)

Yes, regulators will howl. Yes, your accountant will weep. But when banks offer 0.5% APY on savings accounts—while monetizing your data—maybe it's time to rethink who's actually 'risky.'

Binance’s CZ Says 0.1 BTC Could One Day Outvalue a House

Changpeng Zhao (CZ), founder and former CEO of the Binance exchange, suggested that owning just 0.1 BTC, worth $10,679 as of this writing, could one day be worth more than a house in the US.

“The current American Dream is to own a home. The future American Dream will be to own 0.1 BTC, which will be more than the value of a house in the US,” the Binance executive shared in a post.

CZ was reacting to a post by William J. Pulte, a US housing policy official and crypto advocate, who announced crypto inclusion as an asset for a mortgage application.

According to CZ, this is great to see, with bitcoin now counting as an asset when applying for a mortgage in the US.

After significant studying, and in keeping with President Trump’s vision to make the United States the crypto capital of the world, today I ordered the Great Fannie Mae and Freddie Mac to prepare their businesses to count cryptocurrency as an asset for a mortgage.

SO ORDERED pic.twitter.com/Tg9ReJQXC3

Pulte is the director of the US Federal Housing Finance Agency (FHFA), which oversees major entities such as Fannie Mae, Freddie Mac, and the Federal Home Loan Banks.

The decision marks a fundamental shift in US financial policy. Enacting this policy, particularly regarding Bitcoin, enhances the pioneer crypto’s popularity among high-net-worth investors. More closely, it legitimizes crypto as a financial asset in federal housing policy.

“When I bought a house last year, I provided a portfolio summary from DeBank as proof of funds. No bank WOULD accept such a document but realtors will accept the document for cash offers,” one user revealed.

This aligns with a broader trend of digital assets gaining mainstream legitimacy in financial infrastructure, including Bitcoin ETFs (exchange-traded funds) and ethereum counterparts.

Notably, Pulte also revealed regulatory momentum, ordering executives at Fannie Mae and Freddie Mae to provide regulatory changes. After a “productive meeting,” Pulte confirmed the addition of crypto to US mortgage qualification.

Did you see we added crypto to US mortgages yesterday?

— Pulte (@pulte) June 26, 2025Meanwhile, like CZ, MicroStrategy (now Strategy) executive chair Michael Saylor sees the MOVE as Bitcoin’s foray into the American Dream.

Congratulations. Future generations will remember this as the moment Bitcoin entered the American dream.

— Michael Saylor (@saylor) June 25, 2025Saylor has long viewed Bitcoin as a long-term store of value. This latest development cements that vision, tying Bitcoin to the foundational aspects of middle-class life such as homeownership.

In a recent US Crypto News publication, BeInCrypto reported Saylor offering MicroStrategy’s Bitcoin Credit framework to calculate credit risk using BTC price volatility and loan duration, among other factors.

Bitwise’s Jeff Park Explains The Rise of the “Wholecoiner”

Elsewhere, Jeff Park says the American Dream is being redefined for younger generations. According to the portfolio manager at Bitwise, becoming a “wholecoiner” (owning 1 full BTC) is replacing suburban homeownership as a symbol of financial independence for Millennials and Gen Z.

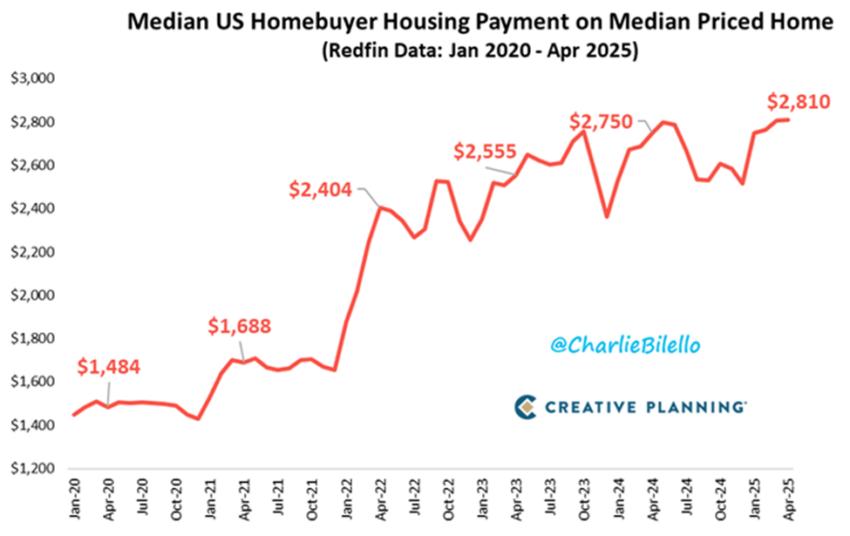

With US home prices soaring, weighing heavily on younger Americans, the dream of owning property is slipping away.

Similarly, student debt is a challenge, with reports suggesting high unemployment rates even for students graduating from top-of-the-line institutions.

The unemployment rate of Harvard's 2025 graduating class of is ~25%, the highest on record.

This is only the beginning.

Meanwhile, Bitcoin, trading at $106,796 as of this writing, represents an alternative grounded in scarcity, autonomy, and global access. A report from Jumper Learn echoes this sentiment.

“Owning one Bitcoin is viewed as a milestone akin to homeownership in previous generations, anchored not to land but to sound money and digital autonomy,” read an excerpt in the blog.

The policy shift reflects a broader cultural transformation. As digital natives prioritize flexibility, decentralization, and sovereignty, Bitcoin is going beyond being just an asset and progressively becoming a lifestyle anchor.

As Saylor, CZ, and Pulte, among others, converge around this narrative, Bitcoin becomes a benchmark of aspiration. The modern American Dream could soon be measured in satoshis, not square footage.