Why Is Bitcoin Spot Volume Drying Up Even as Prices Tease New ATHs?

Bitcoin's flirting with record highs—so where’s the trading frenzy? Spot volumes are shrinking while price tags balloon, and the disconnect has traders scratching their heads.

The Liquidity Paradox

Exchanges report thinner order books despite BTC hovering near its 2021 peak. Retail’s sitting this dance out—maybe they’ve finally learned that buying the top hurts.

Derivatives Eat Spot’s Lunch

Perps and options now dominate flows. Why settle for owning the asset when you can 100x your regret with leverage? (Thanks, Wall Street playbook.)

OTC Whispers Grow Louder

Institutions bypass exchanges entirely. Dark pools and block trades siphon volume—because nothing says ‘healthy market’ like opacity.

As always in crypto, the real action happens where regulators aren’t looking. Spot’s decline isn’t a death knell—it’s just another sign this market’s growing up… or getting better at hiding its tantrums.

Bitcoin Price Decouples from Spot Volume — What Does It Mean?

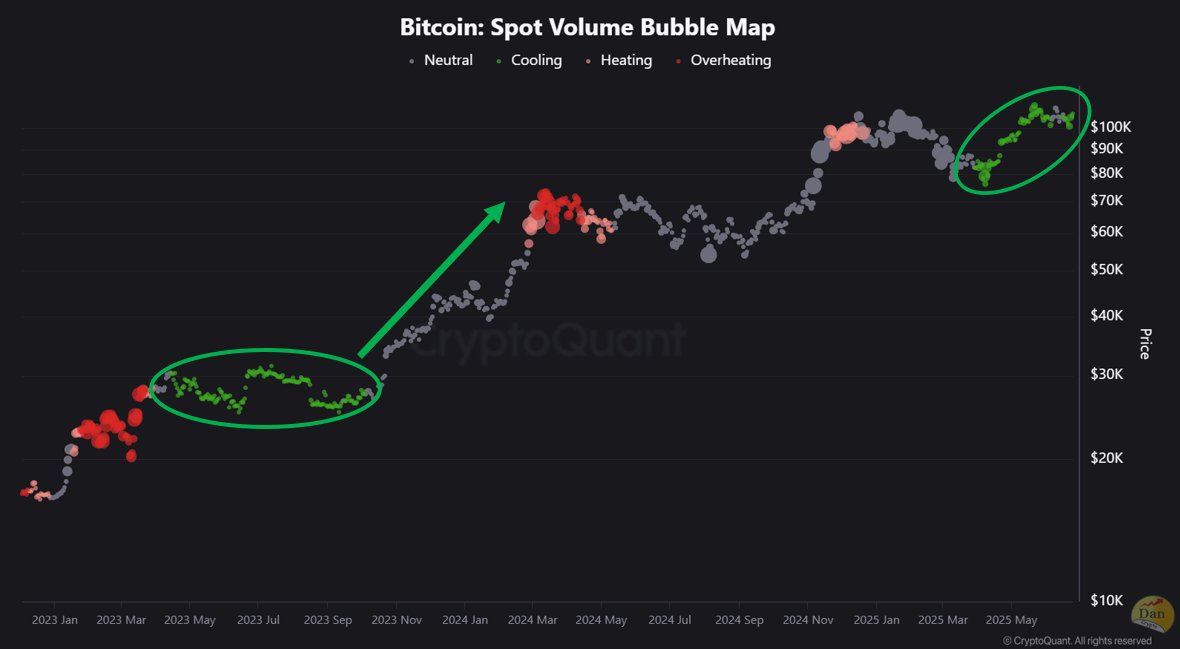

According to Dan from CryptoQuant, the market is currently in a “cooling” phase without signs of overheating.

The chart illustrates that the size of each circle represents trading volume, while color indicates the growth rate of that volume. A drop in volume signals a cooling market. A neutral market shows no sharp changes, and rapid increases in volume may indicate overheating.

At present, green circles — which represent cooling — dominate the chart, even as Bitcoin nears its ATH. This suggests the absence of speculative frenzy. Dan emphasized that this phase calls for patience.

“Currently, bitcoin is near its all-time high, but the market shows a cooling trend without signs of overheating. To break past its all-time high, macroeconomic catalysts like interest rate cuts or regulatory easing may be needed. However, the market has already established a stable foundation. Thus, a strategy of patience, keeping an eye on major market events, and waiting for opportunities seems promising,” Dan noted.

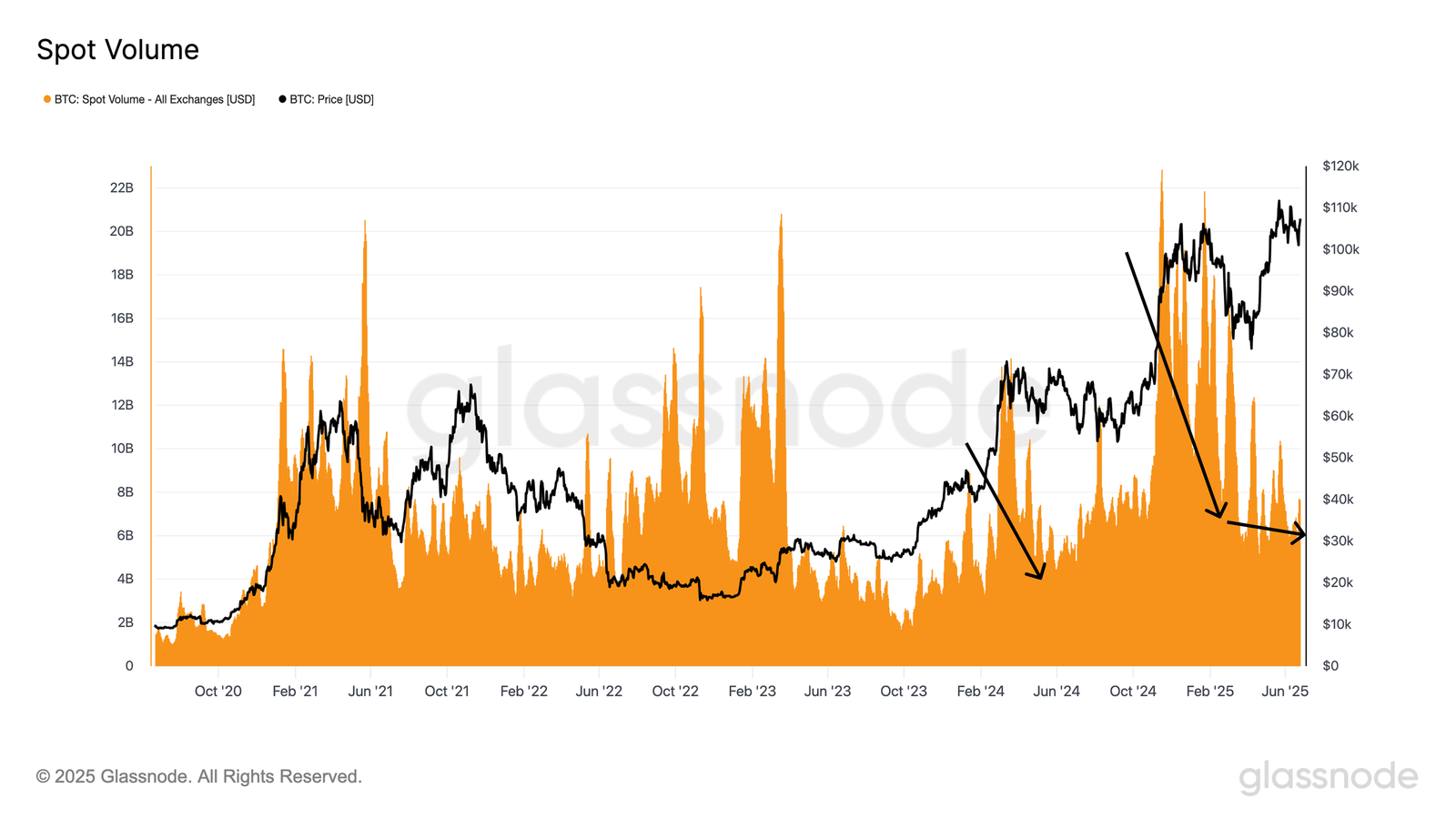

Additionally, Glassnode’s Week 25 report echoes CryptoQuant’s assessment. It pointed out that, unlike the ATH rallies in Q2 and Q4 of 2024, the recent climb to over $100,000 has not been accompanied by a corresponding rise in spot volume.

This reflects a lack of speculative intensity — a key characteristic often seen in earlier bull runs.

Instead, Glassnode suggests that accumulation strategies likely drive the current price rise. Long-term investors appear to be holding their Bitcoin rather than selling for profit.

“Current spot volume sits at $7.7 billion, significantly lower than the cyclical peaks observed earlier in this bull market. This divergence further underscores the lack of speculative intensity, highlighting the market’s hesitancy and reinforcing the consolidation narrative,” the report stated.

Shrinking Liquid Supply Adds to the Puzzle

Another critical factor is the declining liquid supply of Bitcoin.

According to data from Glassnode and other sources, only about 25% of the total Bitcoin supply remains liquid. The remaining 75% is held by illiquid entities — typically long-term holders or institutions with no intent to sell.

“Bitcoin illiquid supply keeps climbing & is at all-time-highs. Only 25% of Bitcoin’s supply remains ‘liquid.’ The supply shock will be brutal!” Nic, co-founder of Coin Bureau, said.

This creates a potential supply crisis. With fewer coins available on the market, even moderate demand can drive prices higher. This helps explain why Bitcoin remains NEAR ATH levels without a spike in spot trading volume.

The drop in spot volume may signal a lack of retail investor FOMO, which fueled previous bull cycles. Instead, it could indicate a shift toward long-term value investing over short-term speculation.

Still, without macroeconomic catalysts like interest rate cuts or technical breakthroughs to boost market confidence, Bitcoin’s price could stagnate.