Bitcoin Hashrate Crashes to 8-Month Low—Miner Bloodbath or Once-in-a-Cycle Buying Opportunity?

Network security just flatlined—mining difficulty plunges to levels not seen since late 2024. The big question: Is this the capitulation event that historically precedes bull runs, or a warning flare for overleveraged operations?

Survival of the fittest

With rigs going dark across Texas and Kazakhstan, inefficient miners are getting flushed out faster than a shitcoin rug pull. The silver lining? Those with hydro-cooled ASICs and sub-5-cent power are quietly accumulating at fire-sale prices.

The institutional wildcard

BlackRock’s mining ETF now holds enough hashrate to influence network dynamics—because nothing says ‘decentralization’ like Wall Street controlling the kill switch. Meanwhile, retail miners face the ultimate stress test: operate at a loss or power down until the next halving.

Bottom line: This is either the smart money’s secret accumulation phase or proof that even Bitcoin isn’t immune to bear market Darwinism. Just remember—when the Fed eventually pivots, the first movers will be those who bought when the mining rigs went cold.

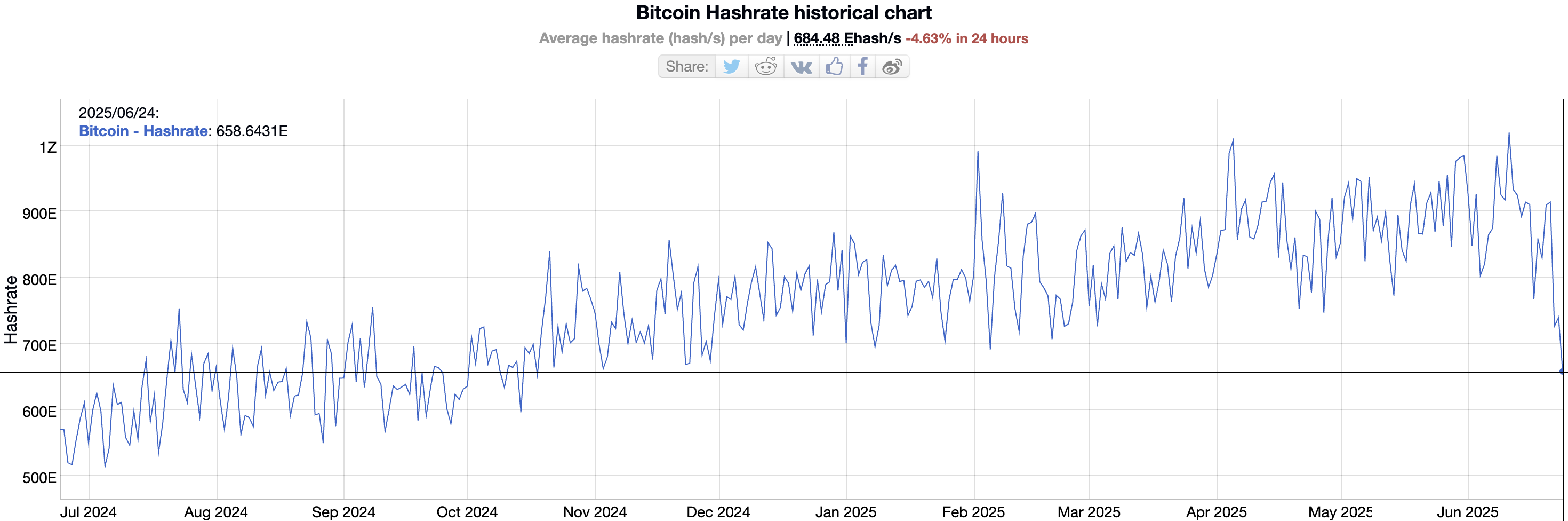

Hashrate has Decreased, but Not to Its Lowest

Although Bitcoin’s current hashrate has fallen to a low level, it is still much higher than the 379.55 EH/s recorded in July 2023. This ensures that the Bitcoin network remains safe to some extent.

The primary cause of this decline could be related to the surge in bitcoin mining costs, which increased by more than 34% in Q2 2025 when the hashrate hit new highs, as previously reported by BeInCrypto. Higher electricity prices and hardware and maintenance costs have forced many miners to suspend operations to avoid losses.

Additionally, energy-saving programs have contributed to the hashrate reduction, as some mining farms participate in grid load reduction initiatives. Or the war in Iran also contributed to this decline.

“Listen, I know “Hashrate is down because Iran got bombed” is a great meme, but if you actually mine Bitcoin you’re looking at US weather patterns.” X user Rob Waren shared.

The Bitcoin market has maintained remarkable stability despite the current hashrate situation. Bitcoin’s price is currently at $106,000, indicating positive investor sentiment.

Bitcoin ETFs, especially BlackRock with $70 billion in assets under management (AUM), continue reinforcing confidence in Bitcoin as a safe-haven asset, even as the US stock market plummets. This reflects the growing separation between Bitcoin and traditional financial markets.

Bitcoin Mining Difficulty Expected to Decrease by 9.37%

Another critical factor is the upcoming mining difficulty adjustment, scheduled for June 29, 2025. According to CoinWarz, the difficulty will drop from approximately 126.41 T to 114.40 T, a reduction of about 9.37%.

This is an opportunity for miners, as the lower difficulty will increase profits, encouraging them to return to the network. However, if the hashrate does not recover in time, the Bitcoin network could face a slight security risk, although the current 684.48 EH/s level is still sufficient to protect the network from 51% attacks.

The hashrate decline could be a positive signal in the long term, as it weeds out inefficient miners. At the same time, Bitcoin’s stable price at $106,000, combined with the growth of ETFs, indicates that the market still believes in Bitcoin’s potential.

However, risks remain. If the hashrate drops further and the difficulty adjustment does not occur in time, selling pressure from miners could cause Bitcoin’s price to decline. Additionally, macroeconomic factors such as geopolitical tensions and the Fed’s interest rate policies could impact the crypto market.