Geopolitical Shockwaves: How the Israel-Iran Conflict Is Sabotaging Altcoin Season

Missed the altcoin rally? Blame geopolitics, not your timing.

When missiles fly, crypto markets tumble—and the latest Israel-Iran faceoff just kneecapped what should've been a breakout month for altcoins. Here's why traders are scrambling.

The safe-haven shuffle

Bitcoin's acting like digital gold again, sucking liquidity from altcoins as risk appetite evaporates. ETH/BTC charts? Straight downhill since the first Tehran drone strike.

Liquidity black holes

Middle Eastern whales are pulling funds faster than a DeFi hack. Tether premiums in Turkey tell the story—when real bombs drop, stablecoins trump moonshots.

The institutional freeze

Hedge funds that piled into altcoin futures last month now face margin calls on three fronts: oil spikes, equity routs, and that pesky 'world war' narrative CNBC won't stop screaming about.

Silver lining? This dip separates the HODLers from the tourists. Just don't expect your favorite shitcoin influencer to admit they're praying for ceasefire talks instead of new exchange listings.

Bitcoin’s Market Share Grows While Ethereum and Altcoins Lag

Since June 13, after Israel conducted a major operation against Iran, Bitcoin’s dominance has climbed. It currently sits at 65.30%, up by nearly 1% since Israel’s first attack.

On the other hand, the altcoin market cap, excluding the top 10 coins, has dropped during the same period. OTHERS, which tracks the altcoin market share, has continued to decline, and is currently at $230.08 billion.

At the same time, the ETH/BTC ratio has fallen, signaling that Ethereum—along with most altcoins—has continued to underperform against BTC. Even the king coin itself has struggled to maintain upside momentum, further weakening the broader altcoin market.

All signs point to one conclusion: the altcoin season may not be ready.

Bitcoin Dominance Climbs as Middle East Unrest Delays Altcoin Season

In an exclusive interview with BeInCrypto, Agne Linge, Head of Growth at WeFi, confirmed that during periods of global unrest like this, it is not uncommon for investors to MOVE their capital into assets they deem safer.

“Typically, during global conflicts that affect political and macroeconomic stability, investors tend to shift their capital from risky assets to those perceived as safe havens,” Linge explained. “It used to be gold and Treasuries; however, we can now see that bitcoin is also acting as a digital safe haven.”

According to Linge, as the conflict rages on between Israel, Iran, and the US, this rotation in capital can be gleaned from the decline in OTHERS. At press time, this sits at $230.71 billion, shedding $12 billion in ten days.

“The altcoin market cap, excluding the top 10 coins, dropped immediately when the conflict started escalating. That means that the traders were rotating their capital allocation from altcoins to safer haven coins such as Bitcoin and stablecoins,” she told BeInCrypto.

She noted further that BTC’s rising dominance amid the ongoing conflict confirms the capital rotation into the coin.

“BTC.D indicates Bitcoin dominance versus altcoins, and it has been rising since the conflict began,” said Linge.

As of this writing, BTC dominance sits at 65.30%. For context, it briefly climbed to a multi-year high of 65.95% on Sunday before pulling back slightly.

Over the same period, the ETH/BTC ratio has declined.

“ETH/BTC ratio is also an important indicator, since the majority of altcoins are based on the ethereum blockchain, and the rising ratio means that Ethereum is outperforming BTC. The ratio has fallen since June 16 and has remained stagnant,” she added.

These readings suggest that even with BTC’s relatively stagnant price, its market dominance remains strong, further delaying the altcoin season.

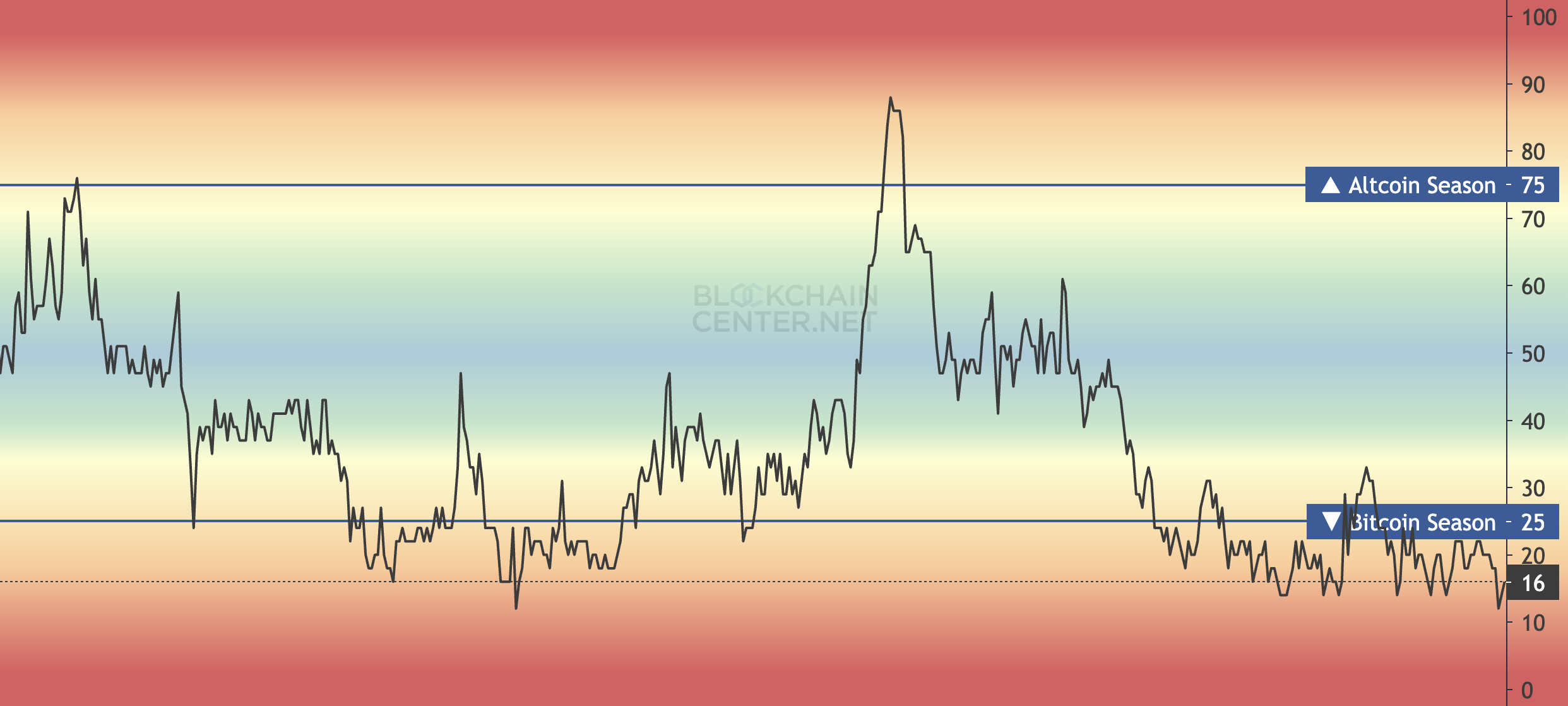

Still in the Bitcoin Season

Readings from the Altcoin Season Index indicate that the market remains solidly in a BTC-dominated phase. An altcoin season commences when at least 75% of the top 50 altcoins outperform BTC over a 90-period.

According to Blockchain Center, only 16% have managed to do so over the past 90 days, showing a lag in altcoin performance and suggesting that a true altcoin season is still far away.