How Plume Skyrocketed RWA Holders by 100%—Leaving Ethereum in the Dust

Plume just pulled off the unthinkable—doubling its real-world asset (RWA) holders in a blistering rally that now eclipses Ethereum's footprint. Here's how the dark horse outmaneuvered the legacy giant.

The stealth takeover no one saw coming

While Ethereum's devs were busy debating gas fees, Plume quietly onboarded institutional capital like a Wall Street whisper campaign. No fanfare, no hype—just a 100% surge in holders who actually care about yields, not JPEGs.

RWAs: The Trojan horse of crypto adoption

Forget 'number go up' tech. Plume's winning by tokenizing assets that exist outside crypto Twitter—real estate, commodities, even private equity. Turns out TradFi investors prefer blockchain when it's wrapped in something they understand.

Ethereum's existential reckoning

The king of smart contracts now faces an identity crisis. Is it a DeFi playground or a settlement layer? Plume's laser focus on RWAs exposes the uncomfortable truth: most 'killer apps' still can't balance a spreadsheet.

One finance veteran's take: 'Ethereum built the arcade. Plume just opened the bank next door—and guess where the suits are going for lunch?'

RWA Holders on Plume Surpassed Ethereum

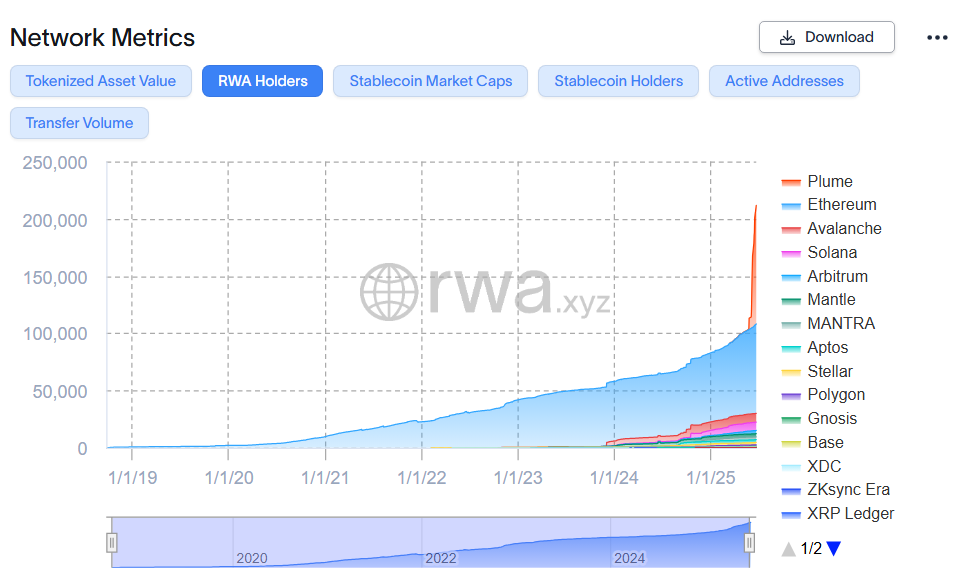

According to data from RWA.xyz, the number of RWA holders doubled over the past 30 days. It jumped from 110,000 at the end of May to over 210,000.

RWA holders represent wallet addresses that hold tokenized real-world assets on each blockchain network.

Notably, Plume Network contributed the most to this growth. It reached 103,000 holders within just two months.

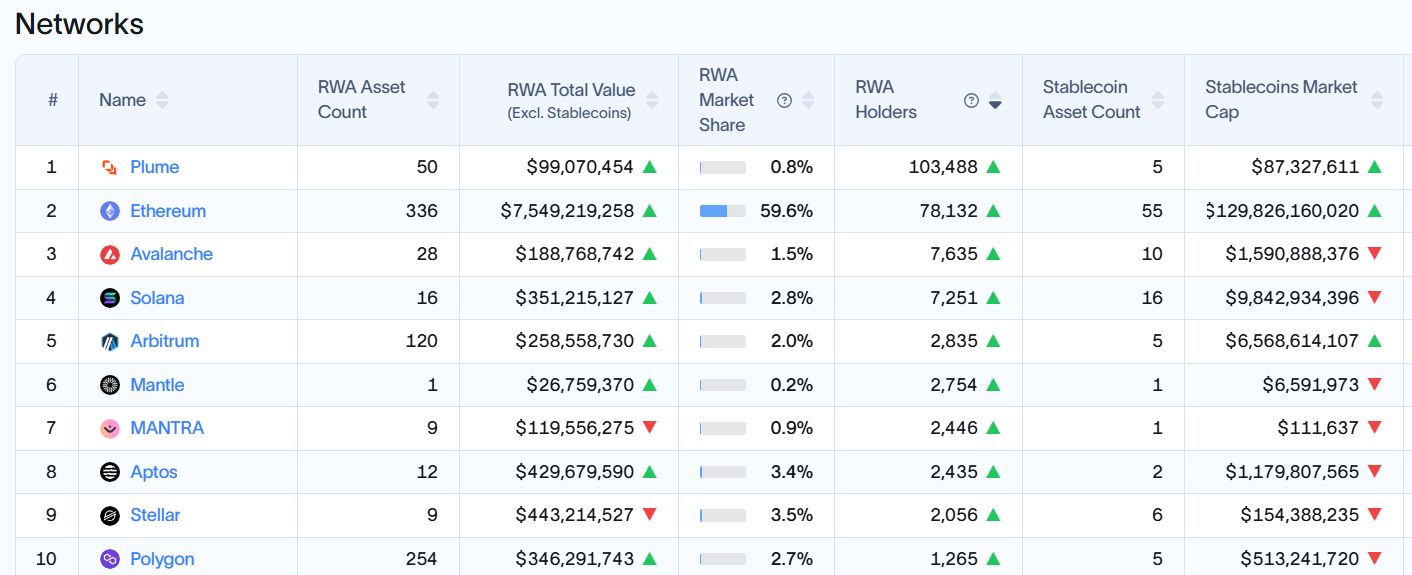

As of now, Plume accounts for 50% of all RWA holders across the market. It has overtaken ethereum to become the blockchain with the largest number of RWA holders.

However, the data also reveals that Plume’s total RWA value remains under $100 million. This modest figure reflects the relatively small asset size held by most network participants.

“More RWA Holders on PLUME than the rest of the top 5 chains combined,” Chris Yin, CEO and co-founder of Plume Network, said.

What Has Plume Done Since Its Co-Founder’s Tragic Death?

Over the past month, Plume has made several notable moves.

Most recently, the Plume Foundation announced a uniform token lock-up rule for all investors and Core contributors. The previously scheduled token unlock has been postponed until January 2026.

This decision aims to prevent short-term sell pressure, stabilize the market, and encourage long-term participation from the community.

In addition, Plume has partnered with Nick van Eck’s Agora to launch the AUSD stablecoin on Plume’s network.

These achievements came after Eugene, Plume Network’s co-founder, passed away at the end of May. Since then, the PLUME token has suffered a sharp decline of more than 40%.

BeInCrypto data shows that PLUME is currently trading around $0.09. Although the price has recovered by 15% today, the gain remains small compared to its drop from a high above $0.20.

On-chain data may paint an optimistic picture of the project’s growth after the co-founder’s passing. However, it has yet to fully convince investors to return to the PLUME token, especially in an altcoin market still plagued by skepticism and fear.