3 US Crypto Stocks Primed for Action Post-Trump’s Israel-Iran Ceasefire Bombshell

Geopolitical shockwaves meet digital assets—again.

When Trump brokered the unexpected Israel-Iran ceasefire, markets twitched. But crypto stocks? They didn’t just blink. Here’s where the smart money’s looking now.

1. The Miner That Defies Gravity

While traditional markets yawned, one Bitcoin miner’s stock chart went vertical. No, it’s not just riding BTC’s coattails—this play’s got institutional backing and a war chest to outlast the next halving.

2. The Exchange That Eats Volatility for Breakfast

When tensions flare, trading volumes explode. One US-listed exchange saw derivatives activity spike 300% during the ceasefire announcement. Guess who takes a cut on every frantic trade?

3. The Infrastructure Bet Wall Street Missed

Behind every crypto surge sits overlooked infrastructure plays. This company’s nodes process 40% of stablecoin transactions—and their stock’s still priced like it’s 2022.

Remember: In crypto markets, ‘buy the rumor’ often means selling before the politicians finish their press conference. But these three? They’ve got the charts—and the balance sheets—to back up the hype.

LQWD Technologies (LQWD)

LQWD rose 107% during Monday’s trading session, making it one of the crypto stocks to watch as the market rebounds today.

This three-digit spike followed the company announcement of the grant of 788,000 stock options to its team, signaling internal confidence and long-term commitment. The options, priced at C$3.70 (approximately $2.70 USD) and vesting over 24 months, suggest strategic alignment among executives and stakeholders.

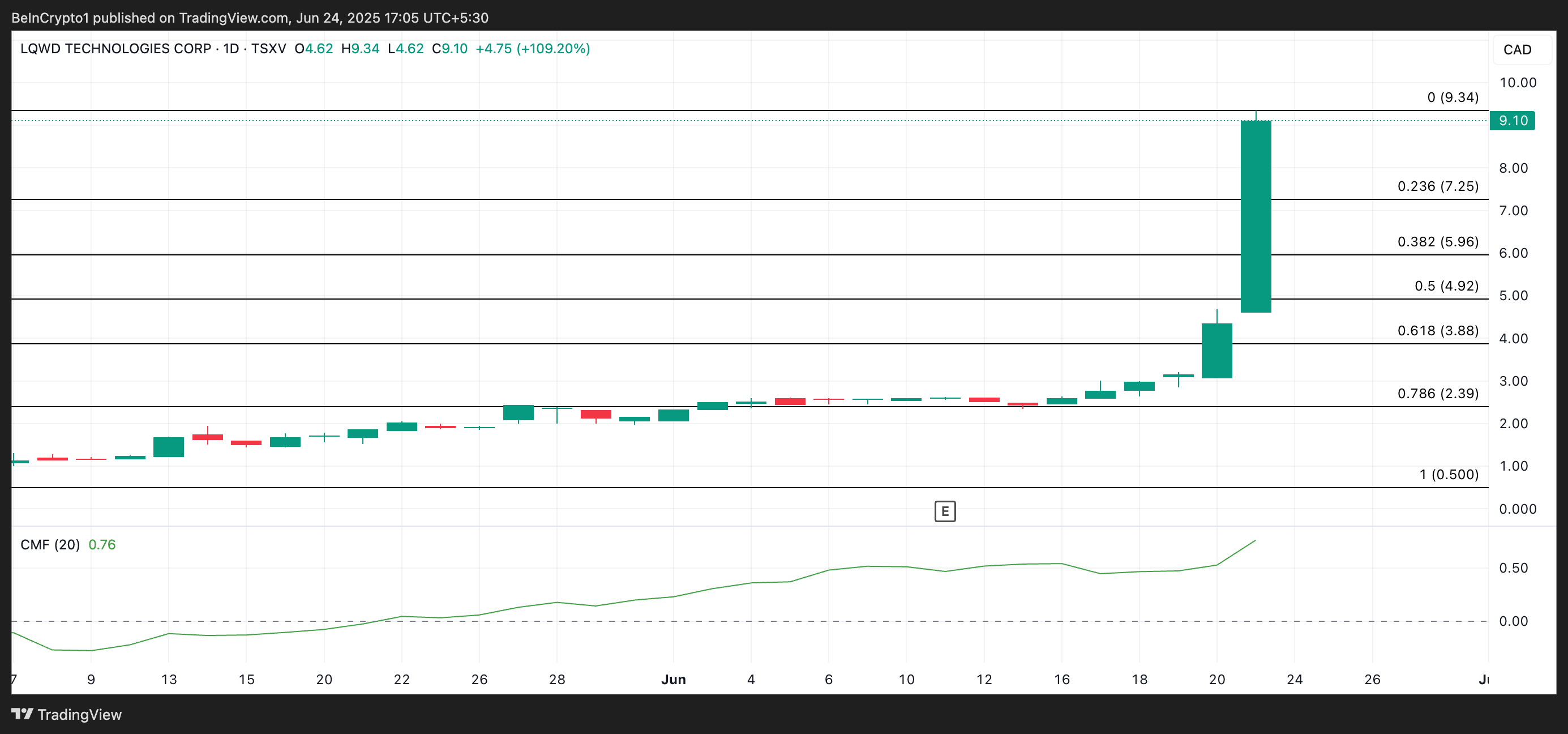

Readings from the LQWD/USD one-day chart show that the stock climbed to an all-time high of $9.34 during Monday’s session. On that day, its Chaikin Money FLOW (CMF) also rose to a high of 0.76, confirming the high demand for the stock.

If demand remains high once trading begins today, LQWD could rally to new price peaks.

On the other hand, if it sees a surge in profit-taking, it could fall to $7.22.

IREN Limited (IREN)

IREN shares are up 2% in pre-market trading on Tuesday, still enjoying momentum following the issuer’s successful closing of a $550 million offering of 3.50% convertible senior notes due 2029.

On the daily chart, IREN’s Relative Strength Index (RSI) is at 65.34 and is in an uptrend, signalling a high demand for the asset.

The RSI indicator measures an asset’s overbought and oversold market conditions. It ranges between 0 and 100. Values above 70 suggest that the asset is overbought and due for a price decline, while values under 30 indicate that the asset is oversold and may witness a rebound.

IREN’s RSI, at 65.34, confirms the buy-side pressure. If this persists, the stock’s price could climb to $11.72.

However, if demand falls, the stock’s value could fall toward $10.46.

BIGG Digital Assets Inc (BIGG)

BIGG Digital Assets shares are climbing today following the launch of a new PlayStar Casino activation within its immersive VIRTUAL platform, the Intraverse, developed by its subsidiary TerraZero Technologies.

The initiative allows users to access the virtual casino directly via mobile or desktop. It generates affiliate revenue for each verified account sign-up and drives organic traffic through upcoming artist-led campaigns and customizable fan experiences.

BIGG closed strongly on Monday, with the stock surging by 4%. If trading volume climbs further once trading resumes today, BIGG could extend its gains and climb toward $0.135.

BIGG Price Analysis. Source: TradingView

However, if selloffs mark the day, BIGG’s price could dip to $0.125.