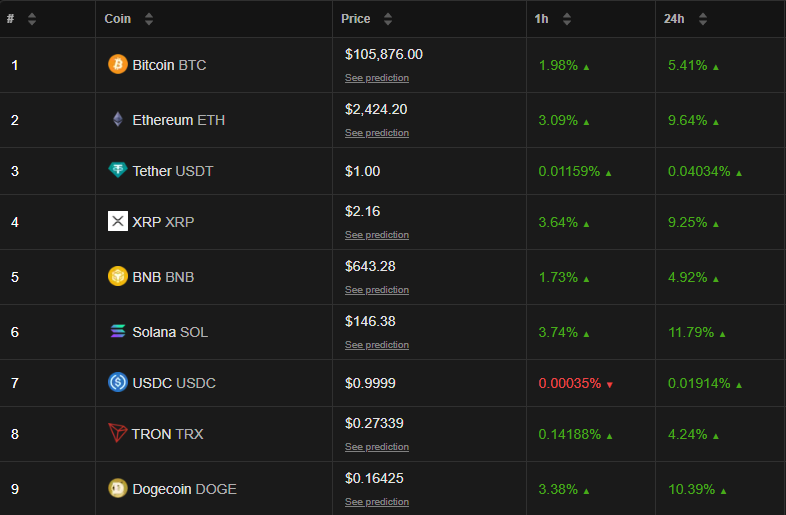

🚀 Crypto Markets Soar as Trump Brokers Iran-Israel Ceasefire—Risk-On Sentiment Explodes

Geopolitical tensions ease—digital assets rally as safe-haven flows reverse. Bitcoin leads the charge with altcoins in hot pursuit.

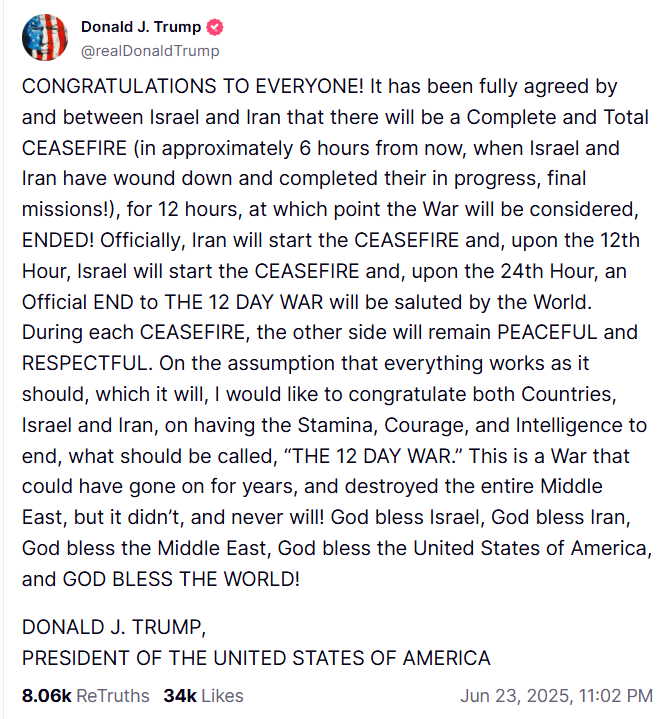

The Trump Effect Strikes Again

Markets hate uncertainty. When former President Trump announced a surprise ceasefire between Tehran and Jerusalem, capital flooded back into risk assets—with crypto leading the pack. BTC punched through resistance levels while ETH and SOL rode the wave.

Altcoin Season Gets a Second Wind

Memecoins and DeFi tokens—left for dead last quarter—saw double-digit bounces. Even Wall Street analysts scrambling to justify the move couldn't dampen the rally. (Though let's be real—they'll still try to credit 'institutional adoption' rather than admit markets run on vibes.)

What's Next?

Watch for profit-taking if the ceasefire holds—but for now, crypto's proving it's still the fastest horse in the macro race. Just don't tell the SEC.

The Market Impact of Iran-Israel Ceasefire

Crypto markets reacted swiftly. Over the weekend, Bitcoin dipped below $100,000 hours earlier amid news of a potential Strait of Hormuz shutdown. Today, BTC rebounded by over 5% on the announcement.

Ethereum also rallied, climbing back above $2,400, while risk sentiment improved across broader digital asset markets.

The ceasefire removed immediate fears of further military escalation and global oil disruption. Also, the de-escalation was widely anticipated, as oil prices began to drop earlier despite Iran targeting US bases in Qatar.

Earlier in the day, Iran’s parliament approved a proposal to shut the Strait of Hormuz, which handles 25% of global oil shipments.

Had that closure gone into effect, it WOULD have sharply driven up oil prices, potentially reigniting inflation and delaying central bank rate cuts.

Instead, the ceasefire has reduced energy market pressure and restored some degree of geopolitical stability, prompting capital to FLOW back into risk assets.

Markets will closely watch whether both sides adhere to the 24-hour ceasefire protocol and if the Strait of Hormuz remains open.

If the truce holds, macroeconomic stability may return quickly, boosting both equities and crypto. However, any breaches or renewed tension could send bitcoin back into risk-off territory.