GENIUS Act 2025: When Will This Game-Changing Legislation Finally Pass?

Congress is playing hot potato with the GENIUS Act—while crypto traders lose sleep over delayed regulatory clarity.

Here's the inside scoop on Washington's slow-motion revolution.

The Political Grind

Lobbyists swarm Capitol Hill like DeFi yield farmers chasing the next pump. Meanwhile, the bill collects dust in committee purgatory.

Market Impact

Every delayed vote sends another ripple through crypto markets—because nothing excites traders like government paperwork.

The Final Countdown

Insiders whisper Q3 2025... but then again, they said that about last year's infrastructure bill too.

Wall Street's already pricing in the legislation—because nothing says 'innovation' like hedge funds front-running Congress.

Passing the House of Representatives

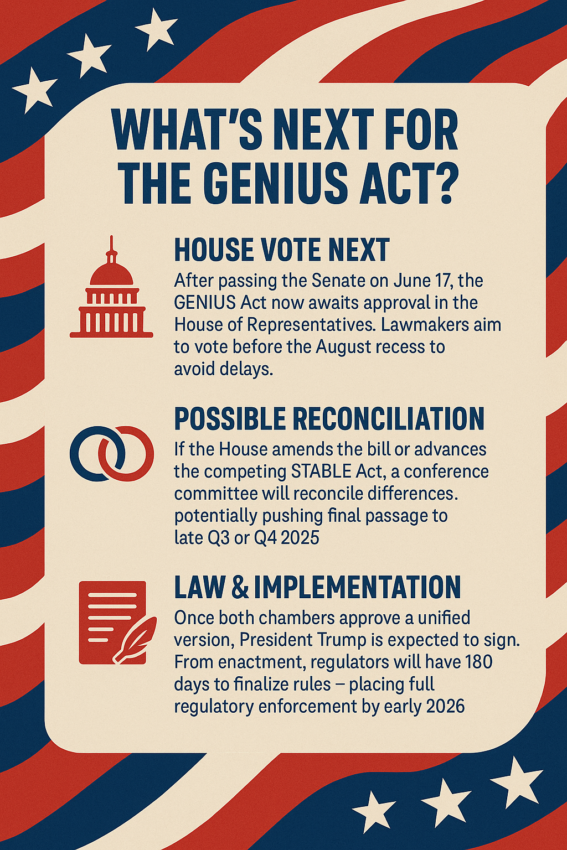

The bill now goes to the House, which has two main paths:

- Adopt the Senate version swiftly, avoiding delays.

- Or advance the STABLE Act, its own stablecoin bill, then reconcile differences through a conference committee.

The. Majority pressure and executive signaling may push timing.

The House of Representatives and the Senate are two separate chambers of the US Congress, each with distinct membership, rules, and political dynamics.

The bill passed the Senate 68–30, showing strong bipartisan support. That signals cross-party consensus, especially on systemic safeguards and institutional guardrails for stablecoins.

Prospects in the House are cautiously optimistic, but here’s a more nuanced view:

Positive Indicators:- Senate momentum adds pressure on the House to act quickly, especially before the August recess.

- Bipartisan Senate vote provides political cover for moderate House members to back it.

- Key House Republicans (especially on the Financial Services Committee) support regulatory clarity for stablecoins.

- Some House Democrats remain skeptical, particularly around consumer protection and systemic risk oversight—some labeled the Senate version as too industry-friendly.

- Maxine Waters, the ranking Democrat on the Financial Services Committee, has pushed the alternative STABLE Act, which is stricter on reserves, audits, and government-issued token dominance.

- House leadership may insist on modifications—triggering a conference committee to reconcile with the Senate version.

Conference Committee (If Needed)

If the House modifies language, both chambers will FORM a conference committee to negotiate a unified text. This stage addresses discrepancies, such as oversight regimes, reporting frequency, and issuance thresholds.

After agreement, both the House and Senate must.

Presidential Signature

Once both chambers pass identical text, it goes to. The president has(excluding Sundays) to sign it into law or otherwise let it become law without signature.

Upon enactment, agencies (Fed, OCC, FDIC, CFTC, etc.) haveto issue final rules capturing oversight, reserve requirements, audits, licensing, disclosures, and enforcement protocols.

GENIUS Act Timeline Summary

| By late July, before recess | Expected Timing |

| House vote | By late July before recess |

| Conference Committee (if needed) | Late July – early August |

| Final congressional approval | Mid-August |

| Presidential signature | Late August (within 10 days post-passage) |

| Rulemaking completion | Approximately late February 2026 (180 days after enactment) |

If the House fails to act by August, the GENIUS Act risks losing momentum.

While it won’t kill the bill outright, it could push final resolution intoor even, depending on how political winds shift.

Overall, speed matters now if lawmakers want to lock in bipartisan support and capitalize on institutional readiness.