Bitcoin ETF Demand Soars While Price Lags – The Curious Divergence Explained

Wall Street’s hunger for Bitcoin ETFs hits record highs—so why isn’t BTC budging? Here’s the breakdown.

The ETF Frenzy vs. Price Paralysis

Institutional money floods into Bitcoin ETFs, yet the king of crypto trades sideways. Traders scratch their heads as demand fails to ignite the usual price fireworks.

The Liquidity Black Hole

Market makers absorb ETF inflows like a sponge, hedging instead of buying spot BTC. A classic case of ‘paper demand’ not translating to market-moving action.

The Whale Watch

While retail investors front-run ETF approvals, big players quietly accumulate. When they’re done loading up—watch out.

Wall Street’s Ironic Twist

The same institutions that mocked crypto now drive its adoption. Funny how nine-figure inflows change the narrative—almost like they planned it that way.

Bitcoin’s Tepid Response to ETF Inflows

In a recent post, Matrixport highlighted the mismatch between the BTC price and inflows into spot Bitcoin ETFs over the past eight weeks.

“Bitcoin ETFs keep buying — but why isn’t the price surging?” the firm noted.

Despite sustained demand from institutional vehicles, Bitcoin’s sluggish response implies that other forces may offset the inflows. The latest 10x Research report echoes that sentiment.

In a new report on Thursday, 10X researchers warned of significant, yet largely invisible, selling that may be flowing from long-term holders or early investors.

Why Bitcoin Isn’t Rallying—Even After $12 Billion in Inflows

Why this report matters

Bitcoin has absorbed over $24 billion in demand since mid-April—yet price action has stalled.

Something beneath the surface is offsetting those inflows, and few are talking about it.

While… pic.twitter.com/cgm7JVy5vz

The subdued reaction has also raised questions about the behavior of high-profile corporate buyers like MicroStrategy (now Strategy).

MicroStrategy’s current accumulation pace appears more restrained than its more aggressive purchasing after Donald Trump’s election. This suggests a cautious or distribution-heavy market environment.

“Notice how each time they buy, the position amount shrinks drastically (avg, -52%),” financial analyst and Whalewire CEO Jacob King said recently.

Meanwhile, the mismatch between bitcoin ETF inflows and the associated BTC price reaction refreshes concerns about “paper BTC.”

In September 2024, BlackRock filed to amend its spot Bitcoin ETF (IBIT) amid concerns over Coinbase’s custodial practices.

At the time, some investors feared that ETF issuers were being settled with IOUs rather than real BTC, undermining price discovery.

Coinbase CEO Brian Armstrong denied the claims and said all ETF-related transactions are settled on-chain within one business day.

Similarly, Bloomberg’s ETF analyst slammed the speculation, refuting the rumor that Coinbase was writing Bitcoin IOUs for BlackRock and suppressing prices.

The analyst attributed the lack of correlation between BTC ETF inflows and Bitcoin price to selling pressure among native Bitcoin holders rather than ETF issuers or BlackRock.

Balchunas lauded the issuers for actually stabilizing the market.

I get why these theories exist and ppl want to scepegoat the ETFs. Bc it is too unthinkable that the native HODLers could be the sellers. But they are. The call is coming from inside the house. All the ETFs and BlackRock have done is save btc’s price from the abyss repeatedly.

— Eric Balchunas (@EricBalchunas) September 14, 2024Notwithstanding, the speculation has resurfaced amid the current bitcoin price stagnation.

Macro Uncertainty Clouds Sentiment

Meanwhile, geopolitical instability may also be weighing on price momentum, particularly the tension between Israel and Iran, with the US now taking a position.

According to Santiment, the ongoing conflict between Israel and Iran has led to a visible increase in volatility across crypto. Between June 12 and 15, bearish sentiment surged, wiping out over $200 billion from the total crypto market cap.

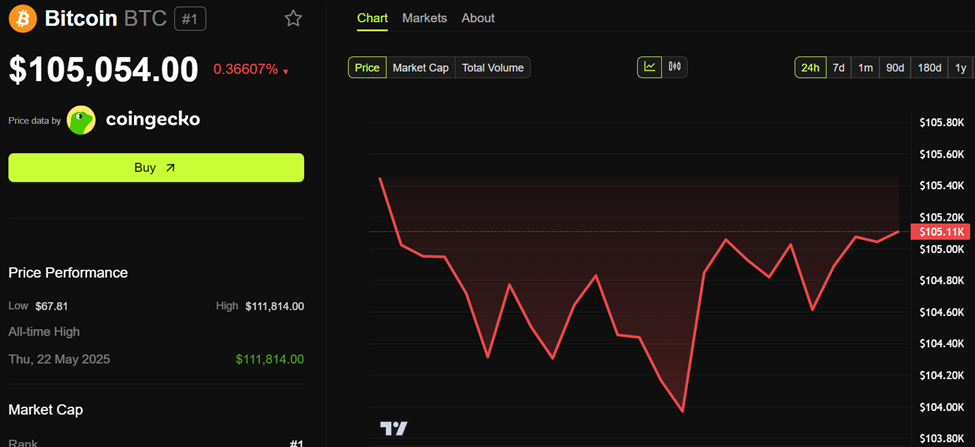

Bitcoin dropped 4–6% before stabilizing NEAR $105,000. Santiment analysts say this pattern is reminiscent of previous geopolitical shocks like Russia’s invasion of Ukraine or the October 2022 Israel-Palestine conflict.

“Despite the initial panic, Bitcoin has remained in the $104,000 to $105,000 range, aided by consistent ETF inflows and a lack of follow-through in military actions, mirroring the typical ‘risk-off, then stabilize’ pattern seen in previous geopolitical crises,” Santiment said in a post.

Despite persistent ETF inflows and steady on-chain fundamentals, traders are hesitant. Volatility is compressing, and liquidity appears thin beneath the surface.

According to 10x Research, traders bet on a breakout or brace for a breakdown.

In essence, the Bitcoin price action may now reflect a deeper structural tension. There is a clash between bullish flows from institutions, cautious re-entry from sidelined retail, and strategic selling from long-time holders.

Until that imbalance resolves and confidence in the price formation returns, Bitcoin may defy the inflow narrative.

BeInCrypto data shows BTC was trading for $105,054 as of this writing, down by 0.36% in the last 24 hours.