Solana Defies Market Pressure: Where Will SOL Price Go Next?

Solana dodges a bullet as selling pressure eases—bulls eye the next breakout.

Subheader: The SOL Resilience Play

While other cryptos flounder, SOL's network speed and defi dominance keep it afloat. No panic sells here—just traders stacking for the next leg up.

Subheader: Charting the Escape Route

The 50-day moving average held firm, creating a launchpad for potential gains. Watch for a close above $150 to confirm bullish momentum.

Subheader: The Institutional Wildcard

Hedge funds still treat crypto like a casino—but they’re placing bigger bets on SOL’s table. Mainstream adoption could trigger the mother of all short squeezes.

Closing Hook: Solana’s not just surviving—it’s rewriting the rules. Again. (Meanwhile, Wall Street still can’t tell a blockchain from a spreadsheet.)

Solana Investors Stick To Accumulation

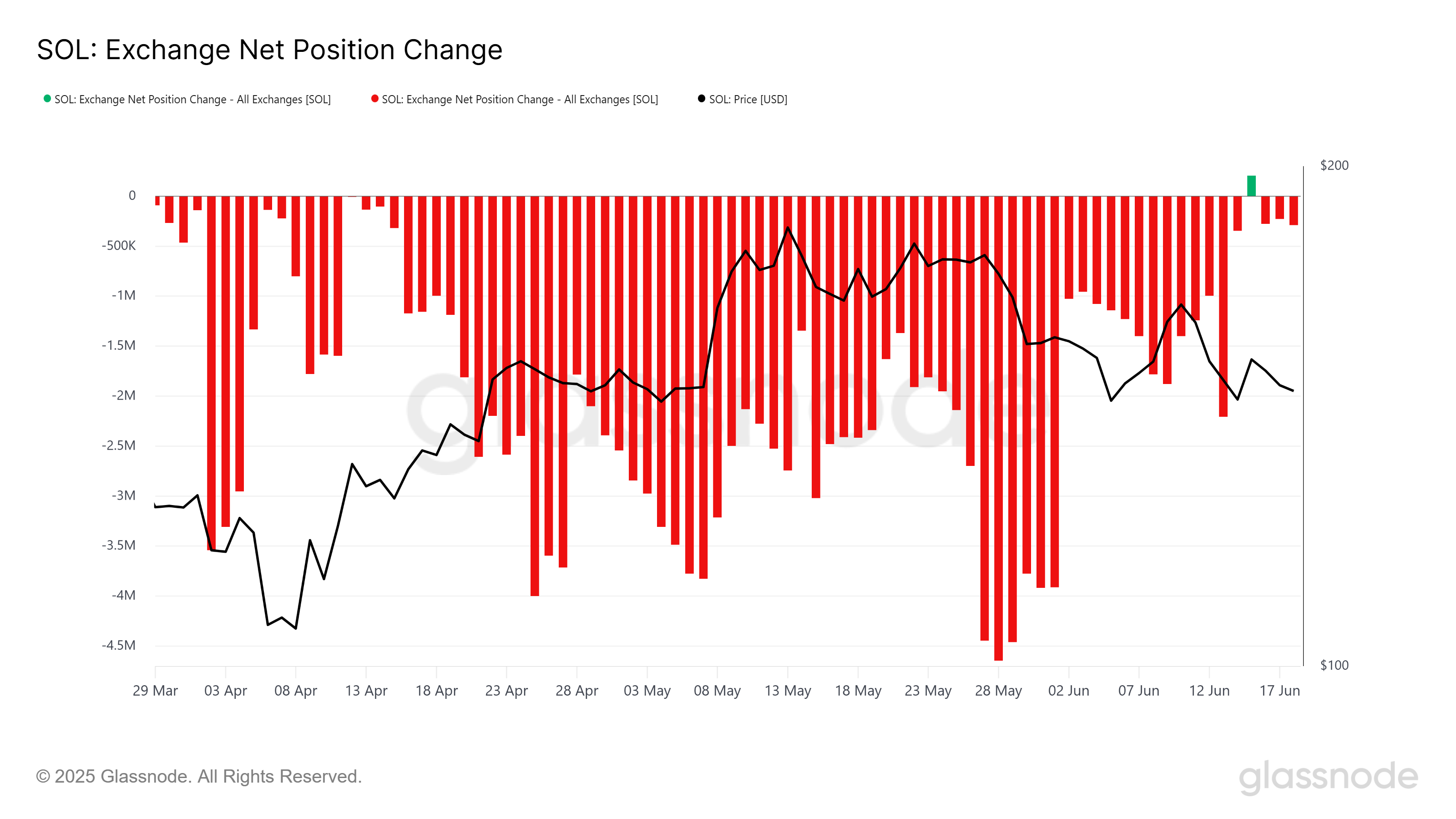

Solana’s market sentiment remains strong, with exchange net position changes indicating a trend of accumulation among investors. In nearly three months, there has been only one instance where selling surpassed accumulation.

This accumulation trend also highlights a shift in investor behavior, with many choosing to hold rather than liquidate their positions. Such a stance indicates confidence in the long-term prospects of Solana, suggesting that SOL could see a recovery once market conditions improve.

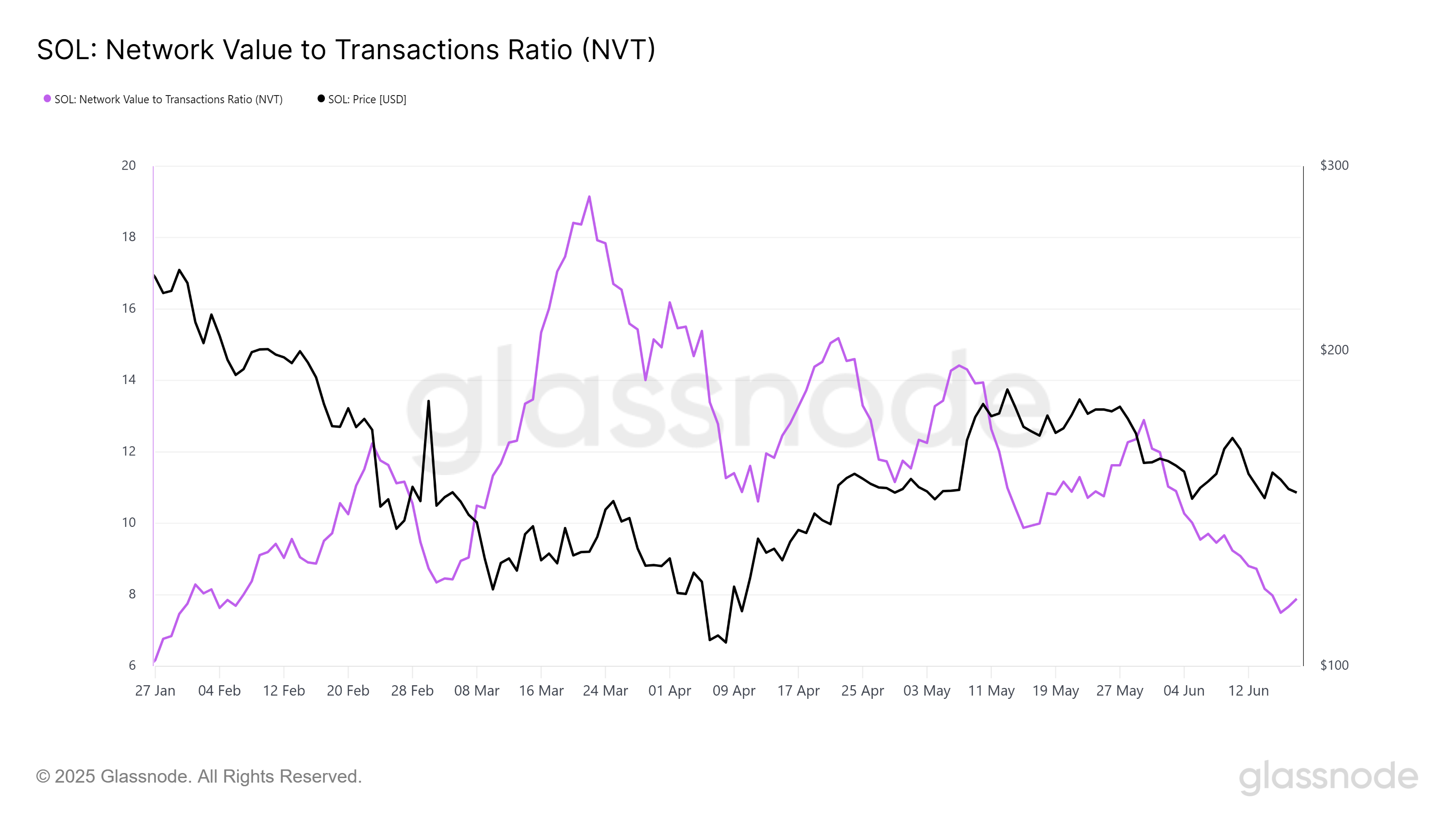

The overall macro momentum for Solana appears promising, with the Network Value to Transactions (NVT) ratio showing a downward trend. A declining NVT ratio signals that the network value is aligning with transaction activity, meaning that the asset is not overheated.

As Solana’s NVT ratio declines, it could help the asset recover from its recent price challenges. A lower NVT ratio typically points to the potential for price growth, as it suggests that the network’s value and user activity are balanced.

SOL Price Awaits Bounce Back

Solana’s price is currently holding at $146, staying above the critical support level of $144. This support has been crucial in preventing a sharp decline this month. The continued ability to hold above $144 signals that SOL has some bullish momentum despite the broader market challenges.

The bullish signals emerging from Solana at this time suggest a potential price rise. If SOL successfully bounces off the $144 support, it could aim for the $152 resistance, with a clear path to $161.

However, if the bullish momentum fades and bearish pressures increase, Solana could see a drop below the $144 support level. In this case, the price could slide to $136, invalidating the current bullish outlook.