3 Altcoins Primed for Explosive Moves This Week (June 17-23, 2025)

Crypto markets heat up as these under-the-radar plays show breakout potential.

While Bitcoin ETFs soak up institutional attention, savvy traders are stacking these altcoins before their next leg up. Here’s what’s flashing bullish signals this week:

1. The Ethereum Killer That’s Actually Delivering

No more ‘vaporware’ jokes—this Layer 1 just processed 2.3M daily transactions at sub-penny fees. Developers are migrating en masse while Wall Street still debates ‘blockchain vs. legacy rails.’

2. The Memecoin With Institutional Bagholders

Yes, that dog-themed token with a 500% annualized staking yield. Hedge funds quietly accumulated positions during the Q2 dip—now retail FOMO threatens to squeeze shorts into oblivion.

3. The AI Token That Doesn’t Just Hype ‘Partnerships’

Actual on-chain revenue from inference contracts grew 78% last month. Unlike those ‘AI’ projects that just slap ChatGPT on a whitepaper and call it innovation.

Remember: In crypto, the biggest gains go to those who front-run the narrative—not the CNBC headlines. Just ask the ‘patient investors’ still holding bags from 2021.

Immutable (IMX)

Immutable X staking is set to transition to Immutable zkEVM this week, marking a significant milestone for the network and its users. This move is expected to bring bullish momentum to the platform, potentially influencing the price of the native token IMX in the coming days.

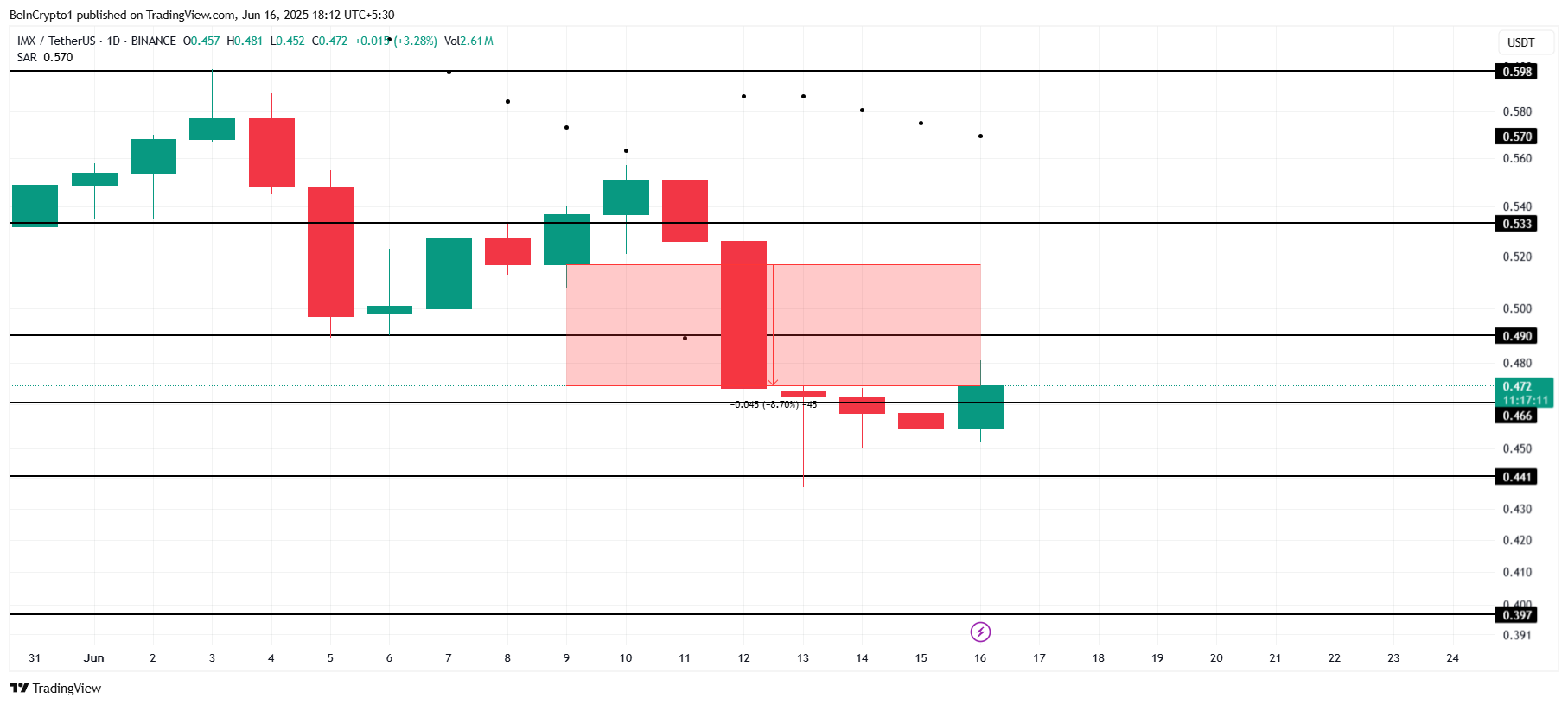

IMX has experienced an 8.7% decline over the past week, with the current price at $0.47. The altcoin is struggling to hold support at $0.46. However, if it successfully secures this level, IMX could target the next resistance at $0.49, with potential gains extending toward $0.53.

The Parabolic SAR is currently above the candlesticks, indicating a growing bearish trend. If this pattern holds, IMX’s price may continue to slide. A drop below the $0.44 support WOULD signal further weakness, invalidating the bullish outlook and increasing the risk of additional losses for investors.

Reserve Protocol (RSR)

RSR is set to undergo its second-ever burn on June 20, following the successful 1.28 million RSR burn on May 21. This event is expected to play a key role in shaping the altcoin’s price action, potentially providing a catalyst for a new wave of investor interest and price movement.

The last RSR burn led to a notable 13.7% price surge. A similar short-term bullish scenario could unfold after the upcoming burn, particularly with the MACD indicator signaling a bullish crossover. If this momentum continues, RSR could target $0.0073, with the next resistance point at $0.0081, drawing further investor attention.

However, if broader market sentiment turns bearish, RSR might struggle to maintain support levels. A break below $0.0064 or $0.0059 would indicate significant weakness and invalidate the current bullish outlook. In this scenario, the altcoin could face a prolonged decline, making careful monitoring of market cues essential for traders.

THORChain (RUNE)

RUNE price has decreased by 5% over the past week, trading at $1.54, just below the $1.57 resistance level. This comes ahead of the V3.7.0 upgrade scheduled for THORChain later this week, which is expected to bring substantial improvements to the network, potentially impacting RUNE’s price.

The upcoming V3.7.0 upgrade introduces a range of changes to the THORChain network, which could lead to a surge in RUNE’s price. The Ichimoku Cloud also suggests a bullish momentum for the altcoin. If RUNE manages to reclaim $1.57 as support, it could drive the price towards $1.67, attracting further investment.

However, if broader market conditions turn bearish, RUNE might face a downward correction. A drop below $1.50 could signal further weakness, with $1.39 acting as the next support level. A break below this level would invalidate the bullish outlook, likely extending losses for investors.