Bitcoin Primed for $110K Surge as Whales Halt 60-Day Selling Spree

After two months of relentless dumping, Bitcoin''s big players are finally holding—and the market''s responding with rocket fuel.

Whales flip the script

The same institutional holders who''ve been suppressing prices since April just slammed the brakes. Their wallets are locked, their sell orders vanished. Like a Vegas high-roller leaving the blackjack table, they''ve decided the house advantage isn''t worth it anymore.

Technical breakout incoming

With $110,000 now in play, the charts look like a coiled spring. Every resistance level from here to six figures appears paper-thin—classic setup for a liquidity grab that''ll leave shorts screaming. Of course, Wall Street will claim they saw it coming all along (right after they finish covering their positions).

Just remember: in crypto, ''institutional adoption'' means they buy the dip so they can dump it back to you at 3x the price.

Bitcoin Has Its Investors’ Support

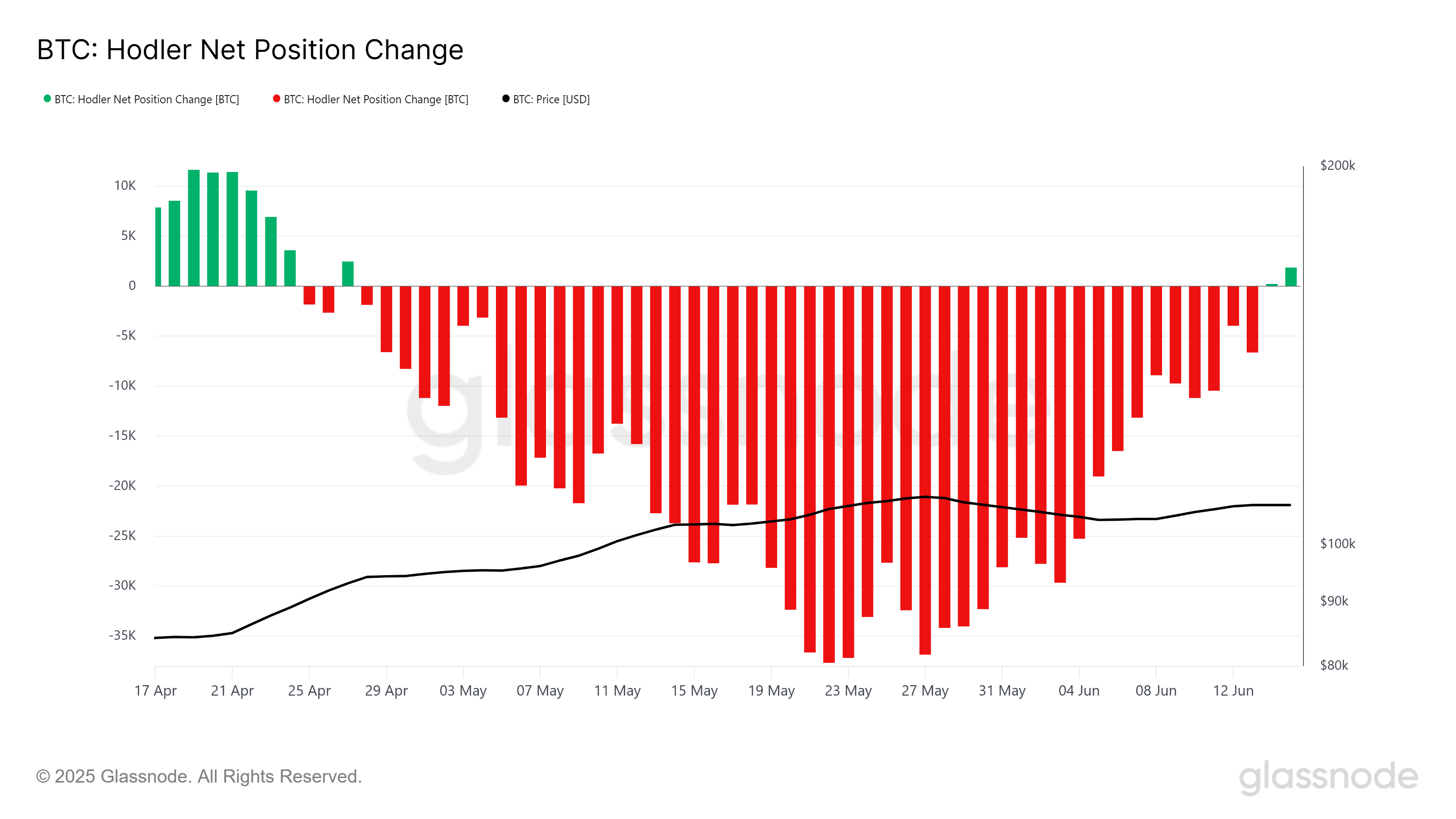

After nearly two months of limited movement, the stance of Bitcoin’s long-term holders (LTHs) has begun to change. The recent HODLer net position change data indicates that outflows have subsided, suggesting that LTHs have stopped booking profits. This shift signals growing confidence among investors.

Over the last 24 hours, minor inflows were observed, hinting that LTHs are beginning to re-enter the market. If these inflows increase, Bitcoin’s price could gain momentum and recover, reflecting renewed investor optimism.

The reversal of LTHs’ selling behavior is an encouraging sign. If the trend continues, it could support further price growth for Bitcoin.

On the macroeconomic front, Bitcoin ETFs have played a significant role in recent market developments. Last Friday, Bitcoin ETFs collectively saw inflows of $301.7 million following the Israel-Iran conflict. This marked the second-highest inflow of the week, with each day registering consistent inflows. The fact that institutional investors were undeterred by the geopolitical tensions suggests a bullish outlook from this segment of the market.

However, this positive momentum could shift depending on how institutions respond in the coming days. Should institutional inflows continue, bitcoin could see further support, keeping its price trajectory upwards. Conversely, if institutional sentiment turns negative or inflows slow down, the price of Bitcoin could experience a reversal. Monitoring ETF inflows in the upcoming week will be crucial for gauging the market’s direction.

BTC Price Needs To Push Through Key Barriers

Bitcoin’s price recently bounced off the support level of $105,572 after holding above $105,000 for the past few days, trading at just under $107,000. This indicates that Bitcoin has found a solid support zone, and traders are targeting the next resistance at $108,000.

Breaching this level will be key for the cryptocurrency to gain further traction. If Bitcoin succeeds in surpassing the $108,000 barrier, it could push toward the next major resistance levels.

Clearing the psychological resistance at $108,000 would open the door for Bitcoin price to challenge the $109,476 level, bringing the $110,000 mark into reach. If Bitcoin can reclaim this as support, the path towards a new all-time high (ATH) of $111,980 becomes more achievable.

However, if Bitcoin struggles to breach the $108,000 resistance and sees a shift in investor sentiment, the cryptocurrency may fall back to the $105,572 support level. A drop below this support WOULD suggest a bearish reversal, with Bitcoin potentially slipping below $105,000.