ZKJ, KOGE Price Plunge Ignites Market Manipulation Firestorm – What Really Happened?

Crypto markets reel as ZKJ and KOGE tokens nosedive overnight—whispers of foul play grow louder.

Behind the Bloodbath

Trading charts turned scarlet this week when two mid-cap altcoins lost over 60% of their value in 12 hours. The timing? Suspiciously convenient for some well-connected wallets that apparently dumped before the crash.

Market Mechanics or Manipulation?

While exchanges trot out the usual ''market volatility'' statements, blockchain sleuths are tracing unusual pre-crash transactions. One wallet moved three weeks'' worth of accumulated tokens minutes before the freefall began—because nothing says ''organic price action'' like perfectly timed exits.

The Aftermath

Retail traders are left holding the bag (as usual) while the crypto casino keeps spinning. Regulators? Still ''monitoring the situation'' from their 2017 rulebooks.

What Sparked the Sudden Meltdown in ZKJ and KOGE Tokens?

Polyhedra confirmed that the flash crash‘s origin and progression stemmed from abnormal on-chain transactions. Polyhedra is closely monitoring the ZKJ/KOGE trading pair, which has experienced unusual on-chain activities quickly.

The contract linkage with ZKJ may have caused KOGE to be the first token affected. This triggered a domino effect as heavy liquidity withdrawals occurred. On-chain data from Lookonchain indicates that large wallets withdrew liquidity from both pools.

One wallet withdrew 61,130 KOGE, worth $3.76 million, and 273,017 ZKJ, worth around $532,000, before the market plummeted. This MOVE pushed KOGE’s price from $62 to $24 and ZKJ’s from nearly $2 to $0.30, a decline of 61% and 85%, respectively.

Based on these actions, on-chain analyst Ai Yi suggests this flash crash could be a pre-planned “harvesting operation.”

“Three major addresses targeted the huge trading volume and liquidity of the two tokens in the context of Binance Alpha. Tonight, the dual pressure of ‘large withdrawal of liquidity + continuous selling’ caused ZKJ and KOGE to collapse one after another, and no one was spared,” Ai Yi commented.

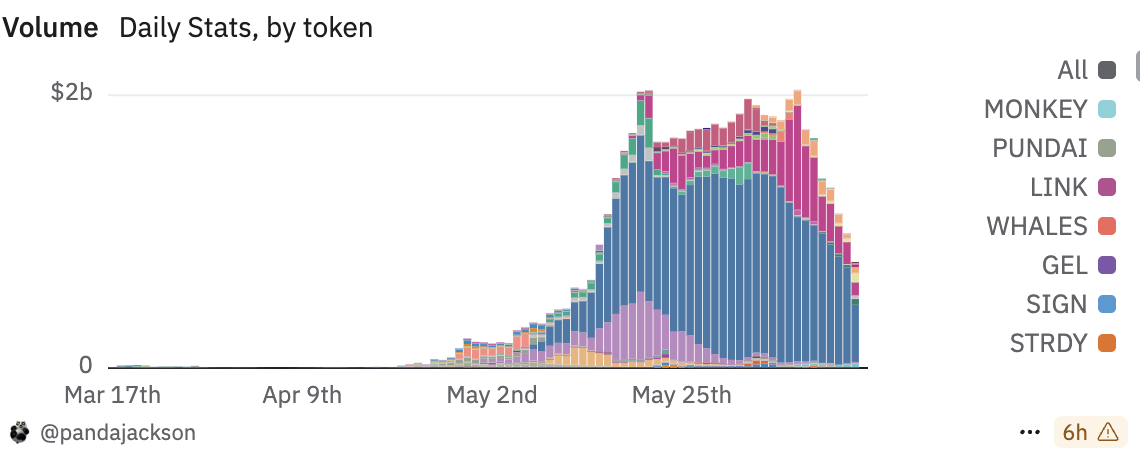

Ai Yi also believes the timing of this flash crash may be linked to a consecutive decline in Binance Alpha trading volume over several days. Data from Dune also shows a downward trend since early June. Notably, after the flash crash, trading volume on Binance Alpha dropped to approximately $770 million. It is significantly lower than the peak of about $2 billion on June 8.

Price Manipulation Allegations

Immediately after the sharp decline in ZKJ and KOGE prices, the community raised suspicions about 48Club, the issuer of KOGE, engaging in price manipulation. However, 48Club quickly denied the allegations. He also announced a new trading reward plan to restore confidence.

Binance adjusted the Alpha Points calculation rules and will be effective from 00:00 UTC on June 17, 2025. According to Binance, the exchange attributed the price volatility to large holders withdrawing liquidity and a liquidation cascade effect.

The decision to exclude trading volume between Alpha tokens (such as ZKJ and KOGE) from point calculations aims to reduce concentration risks and maintain market fairness.

This incident raises questions about the sustainability of trading incentive programs like Alpha Points. Although Polyhedra asserts that the project’s fundamentals remain solid and is reviewing the incident, investors should closely monitor updates from relevant parties.