86% of Traders Lose on Hyperliquid: What’s Really Driving the Platform’s Explosive Growth?

Hyperliquid’s trading volumes are soaring—but 86% of its users are getting wrecked. Here’s why the house always wins.

The Perpetual Profit Machine

Leverage, liquidations, and the brutal math of crypto derivatives: Hyperliquid’s design guarantees most traders lose. Yet inflows keep climbing—just like clockwork.

Growth vs. Gains

The platform’s TVL doubled this year. User counts tripled. But the loss ratio? Stuck at 86% since launch. Coincidence? Or a feature, not a bug?

Crypto’s Oldest Lesson, Again

‘Number go up’ seduces fresh capital. The fine print? You’re not the customer—you’re the product. Some things never change (looking at you, Wall Street).

How Many Hyperliquid Traders Are Actually Making Money?

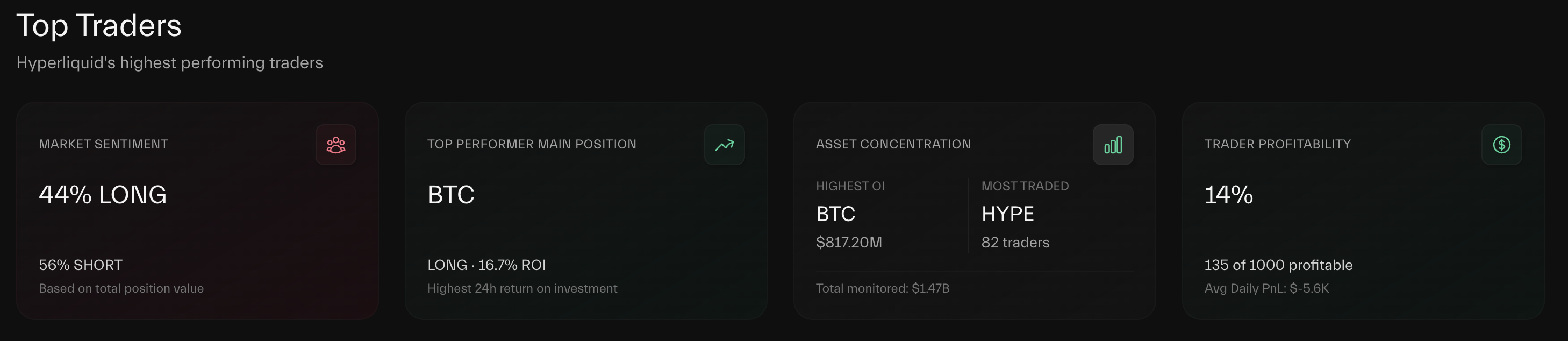

According to the Hyperdash data, just 135 out of a sample of 1,000 traders have recorded profitable outcomes. The average daily profit or loss (PnL) across all traders is a loss of $5,600.

This suggests that most Hyperliquid users are incurring losses, a trend consistent with the high-risk nature of Leveraged trading.

Furthermore, crypto analyst DeFi Mochi highlighted on X (formerly Twitter) that only 170 traders on Hyperliquid have accumulated profits exceeding $10 million. Meanwhile, 1,589 traders have earned over $1 million. These figures include both profits from perpetual trading and rewards from airdrops.

However, Mochi pointed out that many of these 8-figure profit earners have a return on investment (ROI) of less than 200%. This relatively low ROI suggests that these top traders likely started with significant initial capital, using their existing resources to leverage larger positions and amplify their profits.

“That’s just people that got a good AirDrop and sit on it lol,” a user commented.

This raises questions about the sustainability of profit concentration among a small cohort of well-capitalized traders on the platform.

Despite the profitability challenges for most traders, Hyperliquid continues to dominate the decentralized finance (DeFi) sector. BeInCrypto reported recently that the platform’s hybrid decentralization model has attracted substantial investor capital and boosted trust.

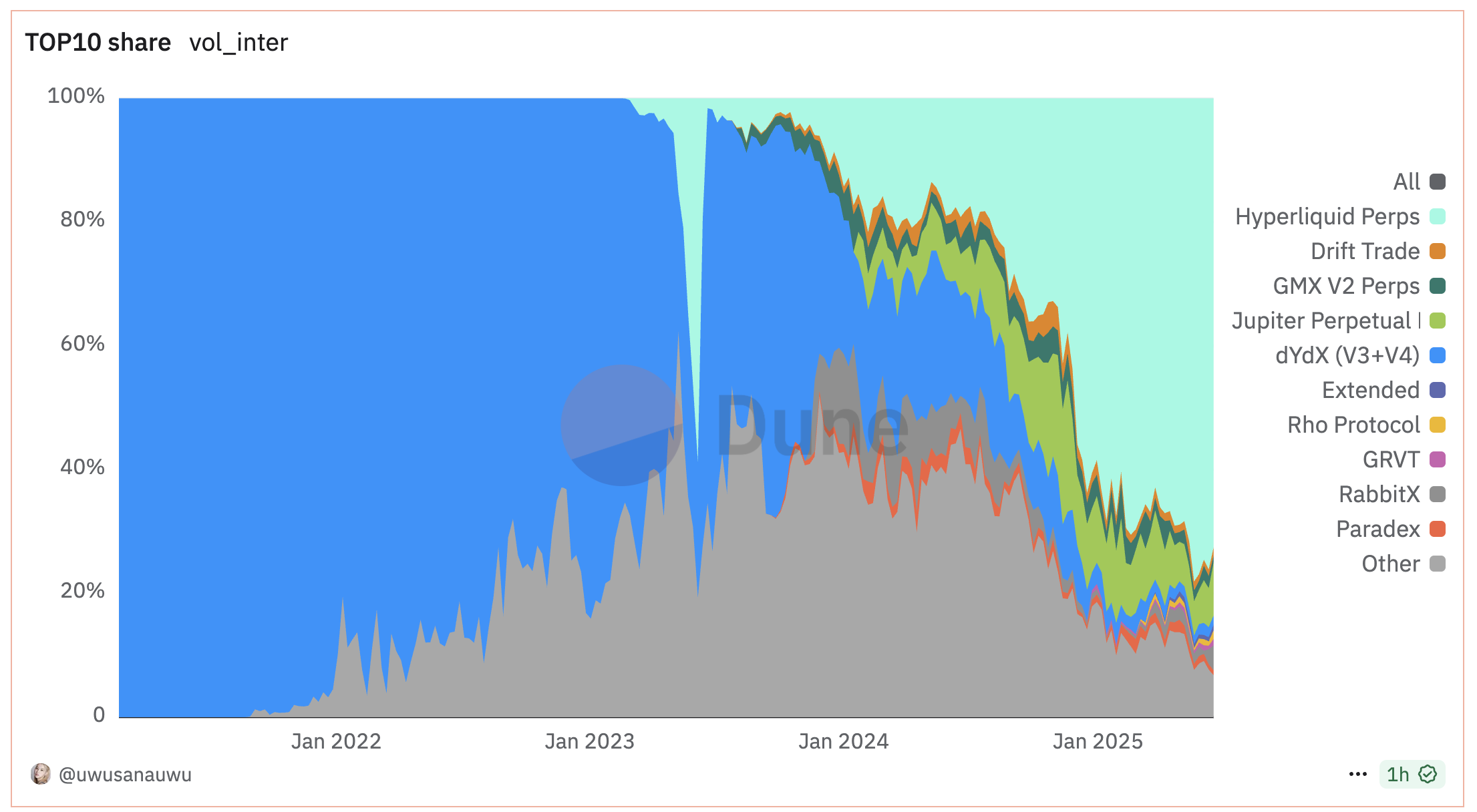

Data from Dune Analytics further highlighted Hyperliquid’s strong position. The platform commands over 60% of the market share among perps platforms.

In addition, Hyperliquid boasts 499,231 users. Over the past 30 days, the platform has processed $188 billion in trading volume, generating $37.61 million in fees, highlighting strong usage in the DeFi space.

Thus, while not all traders may experience profits on the platform, Hyperliquid remains a preferred choice for many, as evidenced by its market position, substantial user base, and continued growth in the decentralized finance sector.