Solana Investors Dump $420M FOMO-Bought Holdings—Price Recovery Stalls

Solana''s rebound hits a wall as traders cash out $420 million in panic-fueled positions. The sell-off—classic ''buy high, sell low'' genius—leaves SOL struggling to regain momentum.

Market psychology 101: When weak hands fold, diamonds get left on the table. But hey, at least someone''s booking those ''tax-loss harvesting'' opportunities.

Solana Investors Are Skeptical

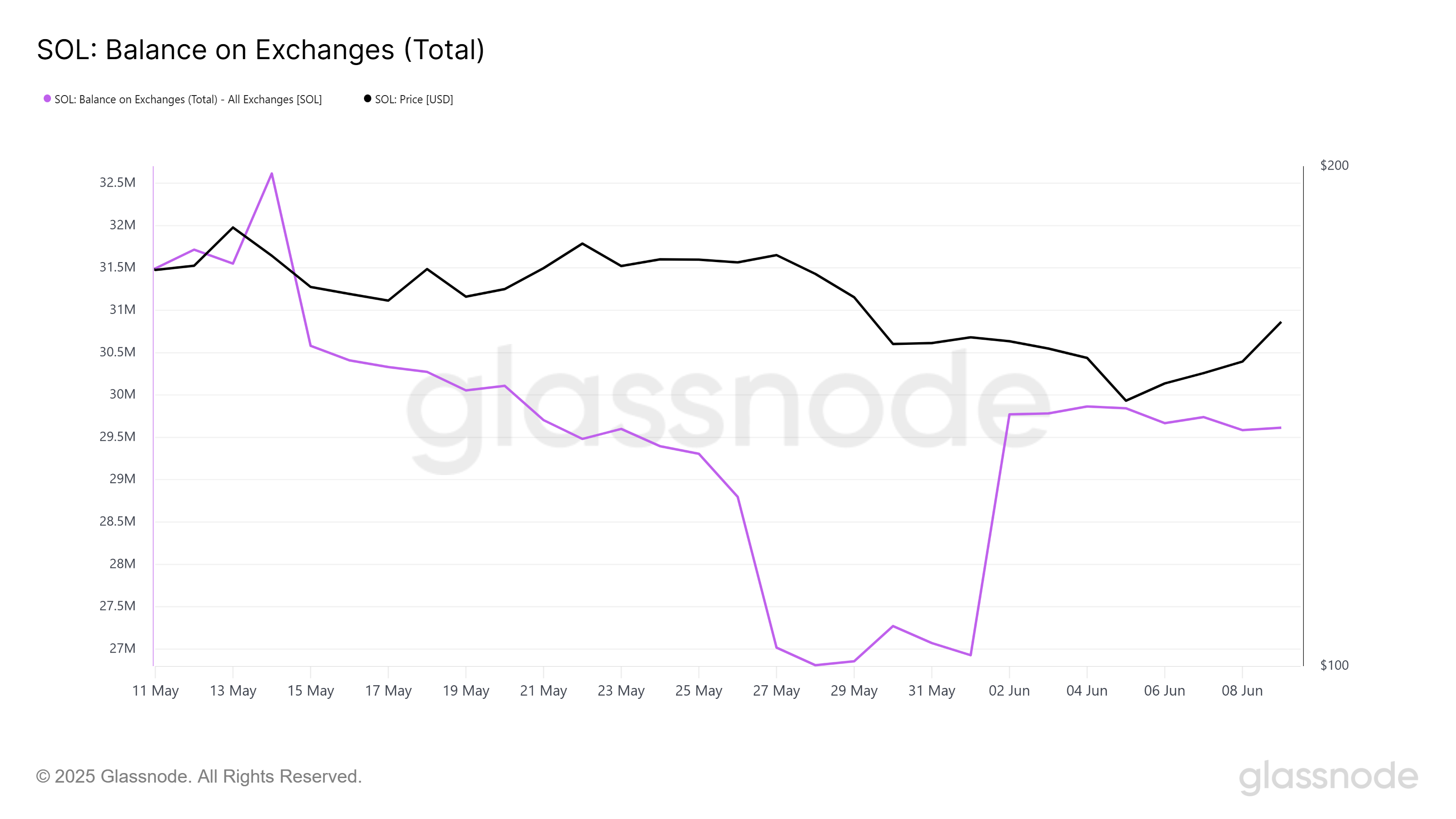

Solana’s exchange balances show an inflow of 2.7 million SOL, worth more than $423 million, in the last nine days. The initial price decline this month prompted investors to sell before the situation worsened, securing their positions.

Interestingly, 2.71 million SOL were purchased within five days from May 23 as the price rose, suggesting FOMO (fear of missing out) accumulation. This supply, bought out of speculation, has now been largely sold off, impacting Solana’s price recovery.

The large inflow and subsequent outflow reflect the volatile sentiment in Solana’s market. Investors who jumped in during the price spike have now opted to sell, causing a cycle of buying and selling that hampers price stability.

Solana’s macro momentum is somewhat improving, though technical indicators like the Relative Strength Index (RSI) still suggest that the market remains in a bearish phase. The RSI shows that the overall bearish momentum is slowly subsiding, but the indicator has not yet crossed the neutral mark into support.

This shift is crucial for confirming a reversal into bullish territory. Until this happens, Solana’s price remains uncertain, with the possibility of further declines if investors’ sentiment does not strengthen.

SOL Price Faces Resistance

Solana is currently trading at $158, showing a 9.5% rise over the last few days. However, it remains just below the critical resistance level of $161.

For Solana to move higher and target the next price point of $176, it must first break through this resistance. SOL needs to rise 11% to make it to $176, and this move would signal a solid recovery if the momentum continues.

If selling pressure persists and Solana fails to breach $161, it could slide back to the $152 or $144 range. This WOULD suggest a continuation of the downtrend, with investors continuing to sell off their holdings. Such a decline would set back Solana’s progress and delay a possible recovery.

On the other hand, if broader market conditions turn bullish, Solana could secure $161 as a new support level. A successful rise above this resistance could see Solana MOVE toward $168, invalidating the bearish thesis and strengthening investor confidence.