Ethena (ENA) Defies Gravity: Bulls Charge Despite 40M Token Unlock

Market shrugs off dilution fears as ENA buyers swarm in—because nothing says ’rational investing’ like ignoring a 40 million token dump.

The Unlock That Didn’t Matter

Supply floods the market, but price action stays buoyant. Either someone forgot to tell traders about basic economics, or this is another masterclass in crypto illogic.

Bull Stampede Absorbs Sell Pressure

Buyers gobbled up unlocked tokens like a Black Friday sale—proving once again that in crypto, fundamentals are optional when momentum’s on the menu.

Closing thought: If this were traditional markets, SEC lawyers would be drafting subpoenas. In DeFi? Just another Tuesday.

Traders Pile Into ENA as 40 Million Tokens Unlock

According to Tokenomist, nearly 41 million ENA tokens, valued at over $12 million at current market prices, were unlocked around 7:00 a.m. UTC on Monday.

Despite the Ethena token unlock representing a significant increase in circulating tokens, ENA has only slipped by a modest 1% over the past 24 hours. This muted reaction suggests bullish sentiment among token holders has helped absorb the additional supply, preventing a deeper decline.

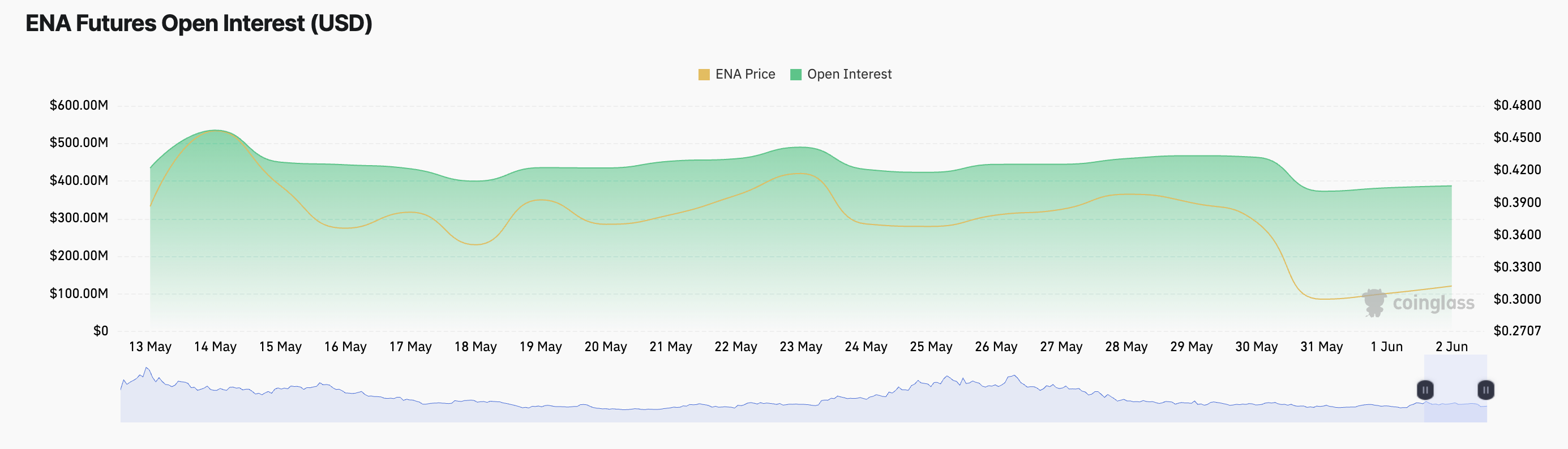

As of this writing, ENA’s futures open interest is up 2%, signaling increased trader participationIt currently stands at $387 million.

Open interest refers to the total number of outstanding derivative contracts, such as futures or perpetual swaps, that have not yet been settled. A rise in OI indicates that new money is entering the market, which can reflect growing interest and conviction among traders.

In ENA’s case, the uptick in OI suggests that traders are opening more positions, likely in anticipation of a rebound or sustained stability despite the token unlock.

Furthermore, the token’s funding rate is positive, indicating a high demand for long positions. At press time, ENA’s funding rate was 0.0059%.

Funding rates are periodic payments exchanged between long and short traders in perpetual futures markets to keep the contract price aligned with the spot market. When funding rates are positive, traders with long positions are paying those with short positions.

ENA’s Next Move: Support Retest or Rally Toward $0.41?

ENA currently exchanges hands at $0.30, trading above the support floor formed at $0.24. If bullish pressure strengthens, the token could climb toward $0.37.

If this resistance breaks, it could propel ENA’s price to $0.41.

However, if selloffs gain momentum, ENA’s price decline could deepen to $0.24.