$800 Million Crypto Bloodbath as US-China Tensions Escalate

Crypto markets got steamrolled today as geopolitical shockwaves triggered mass liquidations—because nothing says ’decentralized’ like kneejerk reactions to centralized policy moves.

Sanction saber-rattling between Washington and Beijing sent leveraged positions into freefall, proving once again that when elephants fight, the grass gets trampled. And by grass, we mean your altcoin portfolio.

Funny how ’uncorrelated assets’ always seem to correlate perfectly with old-school financial panic. Maybe Satoshi should’ve coded a ’don’t panic’ button into the whitepaper.

How Would Trump’s China Sanctions Affect Crypto?

Over the past few months, Trump’s tariffs have threatened a US-China trade war, bringing deleterious effects to the crypto market.

Derailed talks brought crashes, settled deals meant prosperity, and rumors had a powerful impact on the entire market. Unrelated to tariffs, TRUMP is reportedly considering sanctions on China, sending TradFi into panic:

BREAKING: US plans wider China tech sanctions with subsidiary crackdown.

The rule WOULD cover subsidiaries of Chinese firms under US curbs.

US index futures are tanking on this news.

Here we go again! pic.twitter.com/FMNty6uarE

Specifically, this sanctions plan aims at China’s growing tech industry, targeting subsidiaries of major conglomerates like Huawei or semiconductor manufacturers.

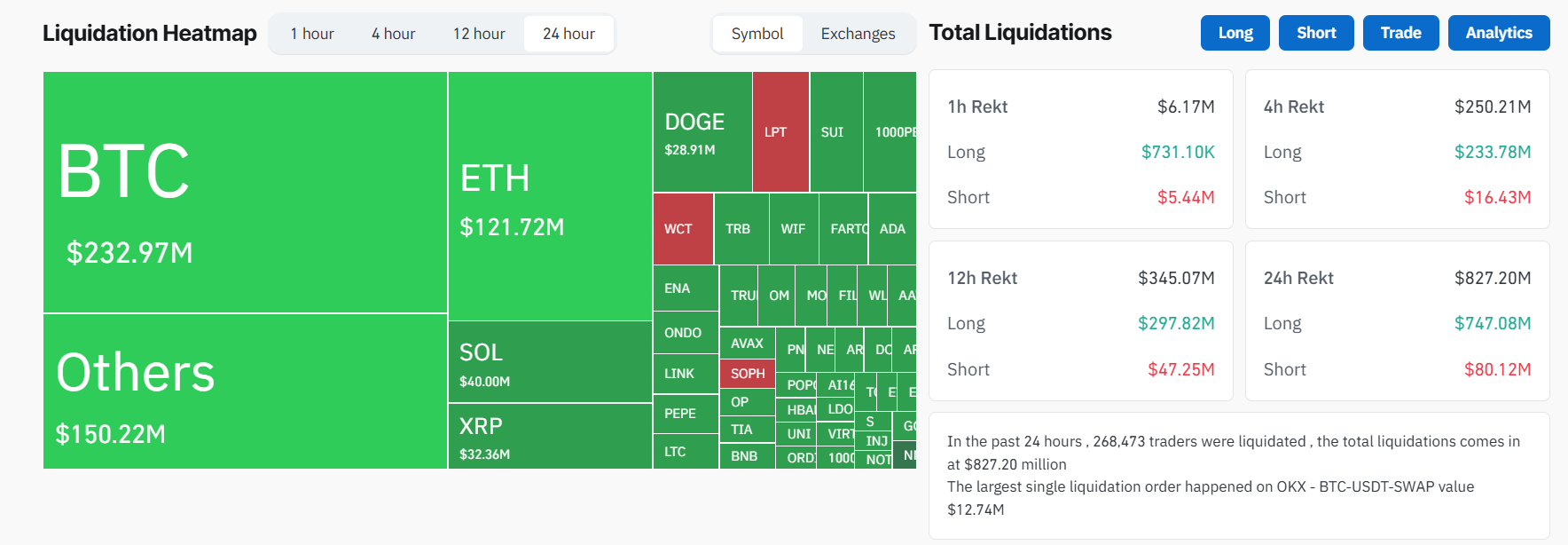

Bloomberg reported that these alleged sanctions won’t take place until June, but crypto immediately reacted. The whole market fell 5%, Bitcoin fell below $105,000, and total crypto liquidations reached $827 million.

Even before today’s sanctions news, markets remained wary of renewed tariffs and a cautious Federal Reserve. In early February, a similar sell-off saw bitcoin slide 6 percent on fears of a trade-war-induced global slowdown.

Today’s actions reinforced those worries, triggering a slide in both equities and crypto.

China and the US settled their tariff negotiations less than a month ago, but the threat of new sanctions could reignite all the same recession fears.

Leading Chinese economists warn that this MOVE may be a prelude to further trade wars, especially because the US is targeting China’s largest growth industries. There are clear reasons to be nervous about escalation.

For example, on May 29, the US already moved to broaden export controls on chip design software, certain chemicals, and industrial tools destined for China, revoking existing licenses and choking off key semiconductor inputs.

Heightened US-China tech friction spooked risk-asset investors, who view crypto as a volatile barometer of broader market sentiment.

BREAKING: President Trump says China has “totally violated its agreement with us.”

In an apparent breakdown of the trade deal, Trump says “so much for being Mr. Nice Guy.”

Did the US-China trade deal just collapse? pic.twitter.com/bEssPlOQIL

Another round of economic saber-rattling will surely bring chaos, but could there be an upside for crypto? As the US economic policies turn increasingly erratic, de-dollarization is gaining traction in Asia.

As part of this trend, economies are shifting from the dollar towards assets like gold, the Chinese yuan, and cryptocurrency.

In other words, if the US sanctions China yet again, investors across the whole region might park their capital in Bitcoin instead of USD.

Still, this may be a marginal advantage, as the US is more integrated with crypto markets. There’s a lot of debate over how crypto would perform during a US recession, and it’s too early to have a definitive answer.

Hopefully, Trump will back down from additional China sanctions, just like he did with tariffs. If so, this could allow crypto markets to return to business as usual, as they’ve been exhibiting low volatility.

However, in the event of another trade war escalation, crypto may behave in some unexpected ways.