HBAR Bulls Double Down as Hedera Teeters on the $0.20 Cliff Edge

Hedera’s native token HBAR faces a make-or-break moment—traders are piling into long positions despite the network’s struggle to defend its psychological support level. The $0.20 line in the sand has become crypto’s latest high-stakes poker game.

Why the optimism? Speculators smell blood in the water—a classic ’buy when there’s fear’ play. Never mind that 90% of altcoin rallies evaporate within 48 hours. This time it’s different, right?

Watch the order books: If HBAR gets swept below $0.19, the ’hedge’ in Hedera might start feeling ironic. But for now? The degenerate gambling... sorry, ’contrarian investing’ continues unabated.

HBAR Traders Remain Bullish

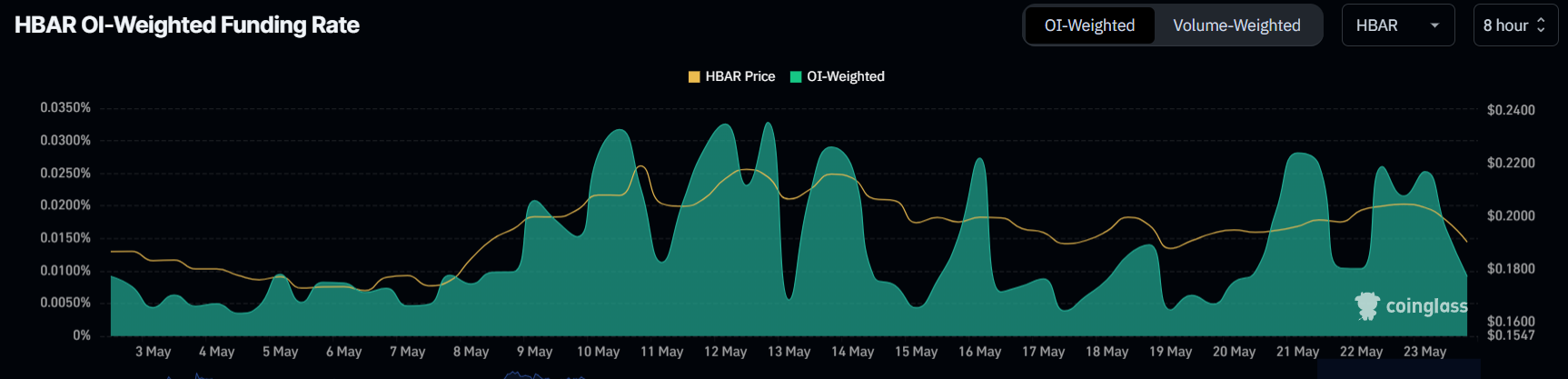

The funding rate for HBAR has been spiking recently, signaling that traders are bullish and expecting further price increases. This increase in funding rate suggests that long contracts dominate the market, with traders betting on the altcoin’s rise.

This positive sentiment could play a crucial role in pushing HBAR’s price upwards, especially if the buying pressure continues to outweigh selling activity. However, despite the overall optimism, HBAR’s struggle to hold $0.20 as a support level has become a point of concern.

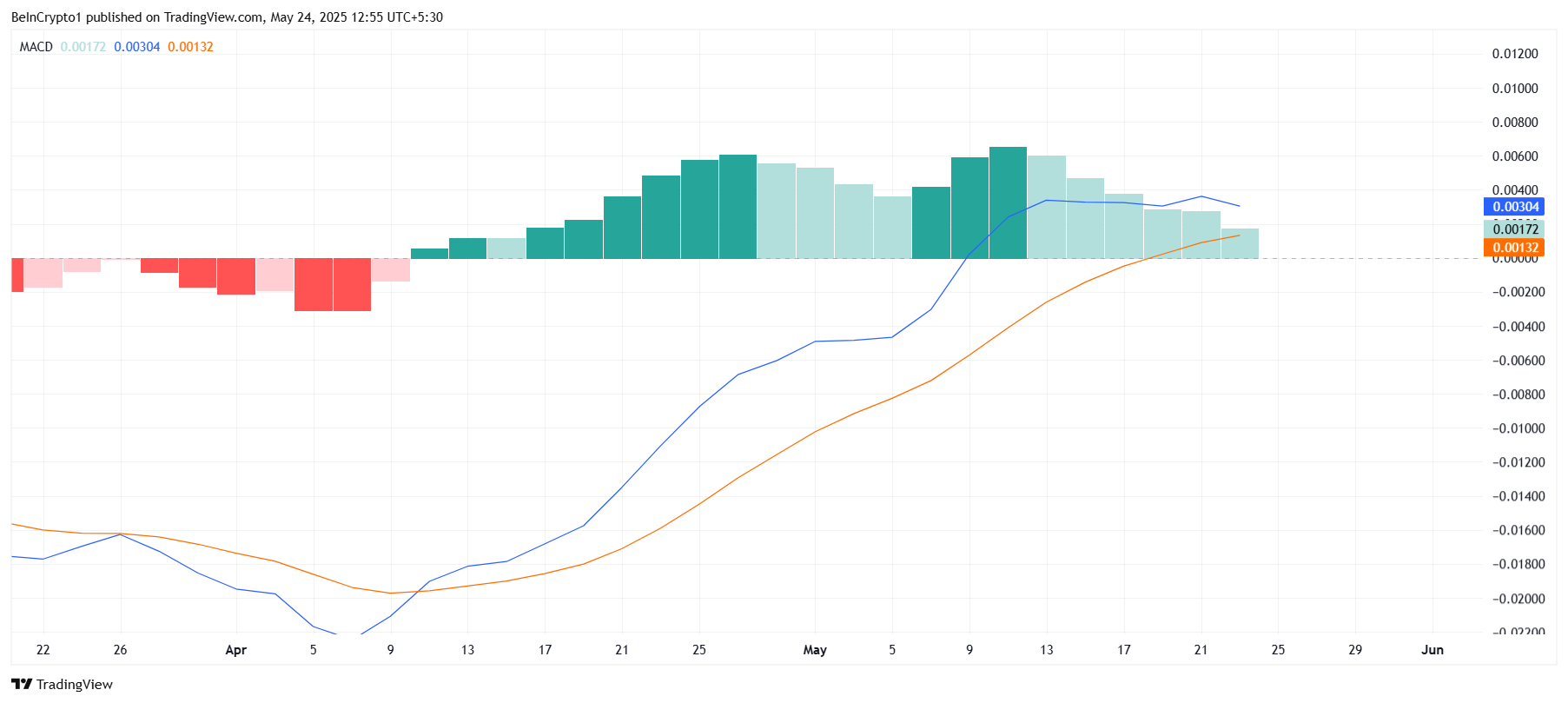

On a broader scale, technical indicators like the MACD show signs that the bullish momentum might weaken. The MACD is nearing a bearish crossover, which WOULD signal the end of the month-long uptrend for HBAR.

A bearish crossover typically indicates declining buying pressure, which could result in a downward price movement. If this trend continues, HBAR might struggle to attract buyers, leading to a potential market correction.

These mixed signals, with strong support from traders but conflicting technical indicators, have created uncertainty about HBAR’s future movement.

While the altcoin has managed to stay in positive territory over the last several weeks, the loss of momentum could be a setback for the price, especially as it nears key resistance levels.

HBAR Price Needs To Find Stability

At the time of writing, HBAR’s price has been down 6% in the last 24 hours, and it is currently trading below the critical $0.20 level.

Despite this short-term dip, the altcoin continues to maintain a seven-week-long uptrend. However, the inability to secure $0.20 as a solid support level could hamper its future growth.

If HBAR fails to stabilize above this price level, the next focus will be the resistance at $0.22. This level is crucial for pushing the price beyond its current consolidation phase.

Yet, mixed market cues could prolong the sideways action, with $0.18 serving as a key support point.

A bearish reversal could occur if HBAR falls below the $0.18 support level. This would suggest that the bullish trend has lost its strength, pushing the price down to $0.16. Such a drop would invalidate the uptrend and lead to significant losses for investors.