Bitcoin Blasts Through $110K Barrier as ETF Demand Hits 6-Day Frenzy

Bitcoin’s bull run shows no signs of slowing as the cryptocurrency smashes through the $110,000 psychological barrier. The rally comes alongside six consecutive days of ETF inflows—proving Wall Street’s late embrace of crypto is turning into a full-blown FOMO chase.

Market watchers point to institutional money flooding into spot Bitcoin ETFs as the catalyst. Meanwhile, retail traders scramble to front-run what they hope will be another leg up—because nothing says ’sound investment strategy’ like chasing all-time highs during a liquidity surge.

With volatility likely to intensify at these levels, one thing’s certain: the ’number go up’ crowd isn’t questioning who’ll be left holding the bags when the music stops.

Bitcoin ETF Inflows Climb 85% Amid Bullish Run Above $110,000

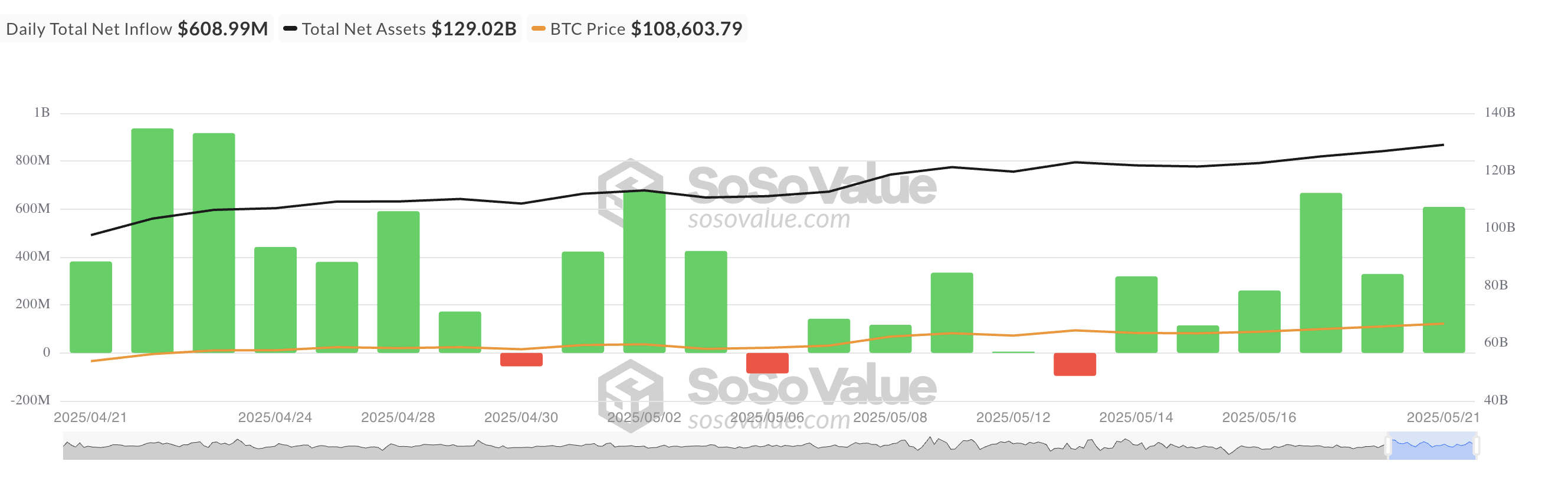

BTC’s break above the $110,000 psychological price mark yesterday triggered notable inflows into spot ETFs. According to SosoValue, investors poured $608.99 million in new capital into these funds, pushing the total net asset value of all BTC spot ETFs to $129.02 billion.

Wednesday’s inflows were 85% higher than the $329 million recorded on Tuesday. This was also the sixth consecutive day of net inflows into BTC spot exchange-traded funds, a sign of growing investor Optimism in the coin.

BlackRock’s ETF IBIT recorded the largest daily net inflow, totaling $530.63 million, bringing its total cumulative net inflows to $46.68 billion.

Fidelity’s ETF FBTC recorded the second-highest net inflow of the day, recording $ 23.53 million. The ETF’s total historical net inflows now stand at $11.83 billion.

Bitcoin Rallies to Fresh Record; Options Traders Show Cautious Optimism

During Thursday’s early Asian session, BTC rallied to a new all-time high of $111,880. Although it has since witnessed a minor pullback to exchange hands at $111,618 at press time, technical readings point to lingering bullish pressure in the markets.

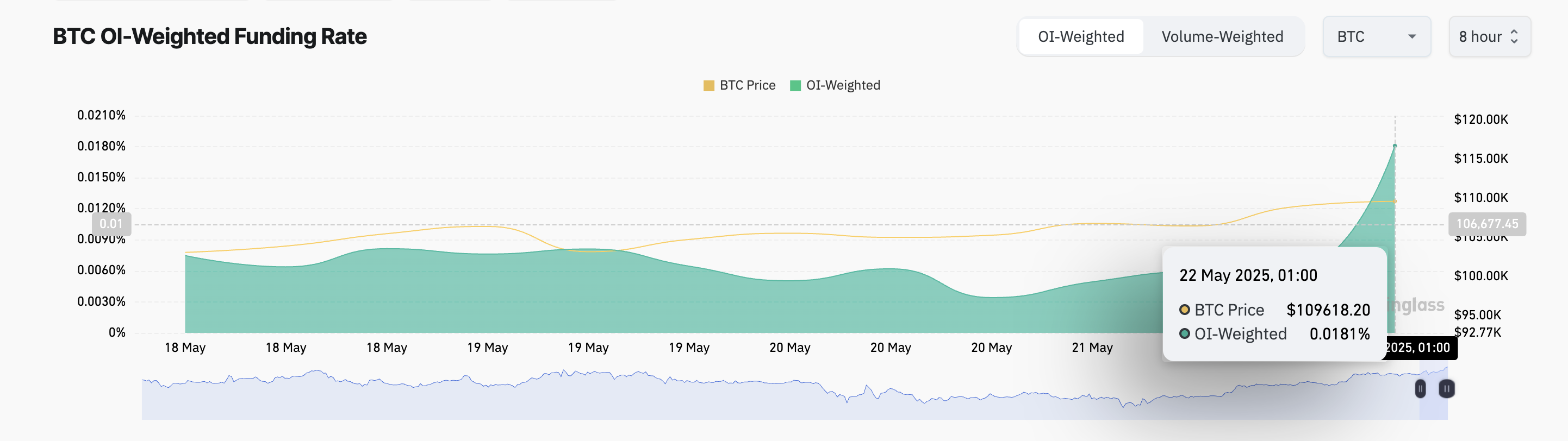

The uptick in price is mirrored in the derivatives market, where demand for long positions has surged. According to Coinglass, BTC’s funding rate currently stands at 0.018%, its single-day highest value since February 22.

The funding rate is a recurring fee paid between traders in perpetual futures markets to keep contract prices aligned with the asset’s spot price. When the funding rate spikes, it indicates that more traders are betting long, signaling heightened bullish sentiment.

However, this also raises the risk of a potential price correction, and options market traders appear to have realized this.

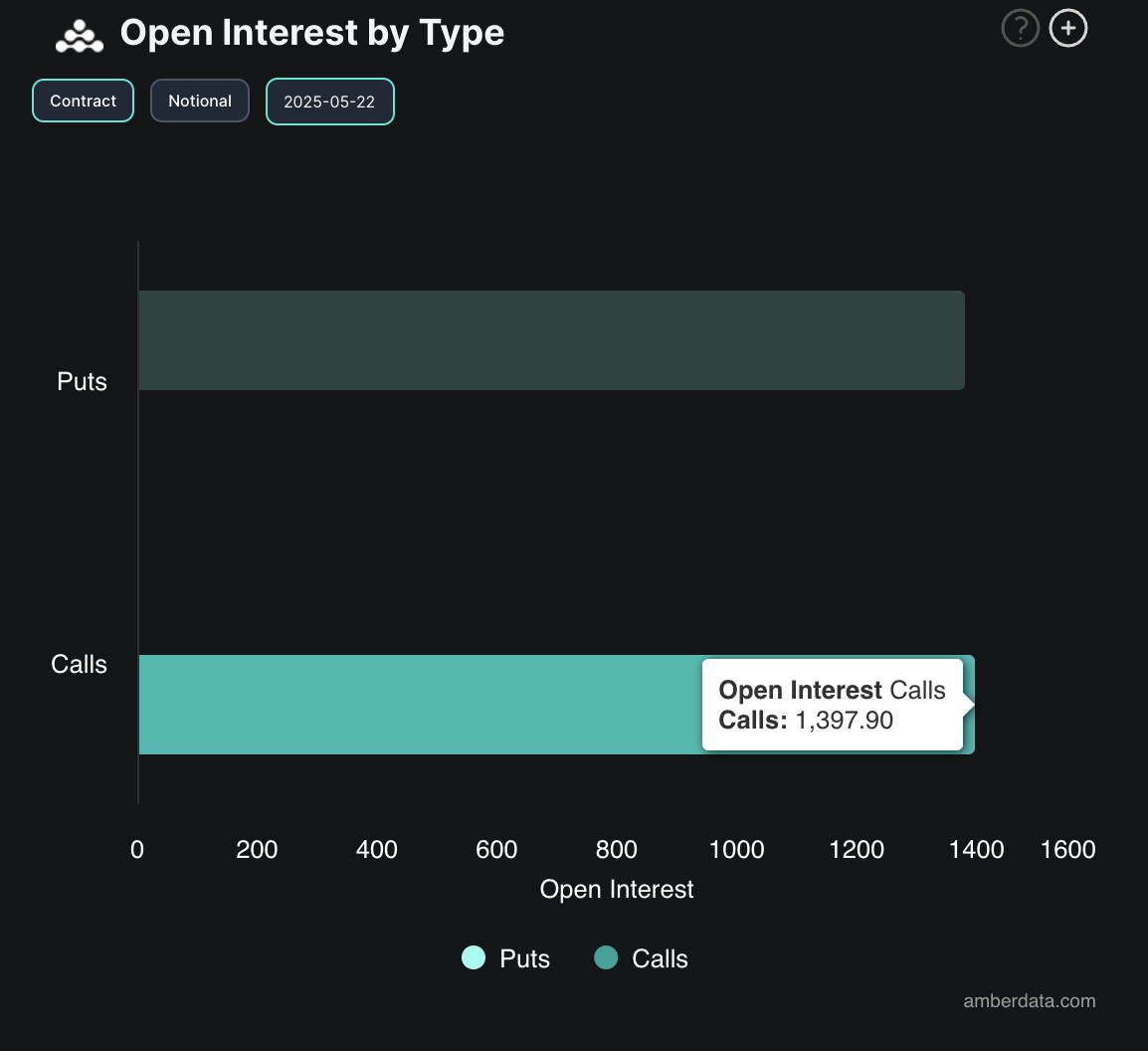

Deribit’s data reveals that BTC options traders maintain a balanced sentiment, with near-equal demand for calls and puts. This reflects cautious optimism, as traders adopt a “wait and see” approach, eager to see whether the coin will sustain its position above $110,000 or if the recent breakout is a bull trap.

Nonetheless, call options — bets that the asset will rise — have a slight edge, pointing to continued upward pressure despite climbing bearish activity.