Hyperliquid Storms Past dYdX as Market Cap Taps $10B—DeFi’s New Volume King

Move over, legacy protocols—Hyperliquid just flipped dYdX in daily trading volume while eyeing a $10 billion valuation. Not bad for a platform that didn’t exist three years ago.

Who needs Wall Street’s ‘liquidity moats’ when code eats everything? (Though let’s be real—half this volume is probably degenerate leverage traders chasing the next meme coin.)

One thing’s clear: The race for decentralized derivatives dominance just got spicy.

Hyperliquid Trading Volume Surpasses dYdX

Hyperliquid, a high-performance L1 trading blockchain, has been enjoying many successes recently. Earlier this month, it captured more than 60% of the perpetuals trading market, and its HYPE token hit a 3-month high shortly afterward.

Yesterday, analysts noticed that Hyperliquid’s all-time trading volume surpassed dYdX, and it reached $1.5 trillion today.

Hyperliquid’s all-time volume is nearing $1.5t and surpassing what DYDX achieved in four years

Hyperliquid pic.twitter.com/IZKiMMhWLG

dYdX is a decentralized perpetuals exchange that has been active for five years, whereas Hyperliquid’s platform only launched in 2023.

Nonetheless, the younger protocol has overtaken it. After launching its native token in 2021, dYdX began employing it to reimburse users’ trading fees, boosting its volumes. It then built community hype around an informal “trading contest” with competitors.

Hyperliquid, on the other hand, did not rely on dYdX’s incentive strategy. After its own TGE last year, it managed to accumulate huge volumes through functionality, word-of-mouth, and product quality.

2024 was a peak year for crypto perpetuals trading, and the HYPE TGE took advantage of the moment. This has apparently proved to be a more durable approach.

Additionally, Hyperliquid directs the vast majority of its trading fees to token buybacks, which dYdX only instituted months later, and to a lesser degree.

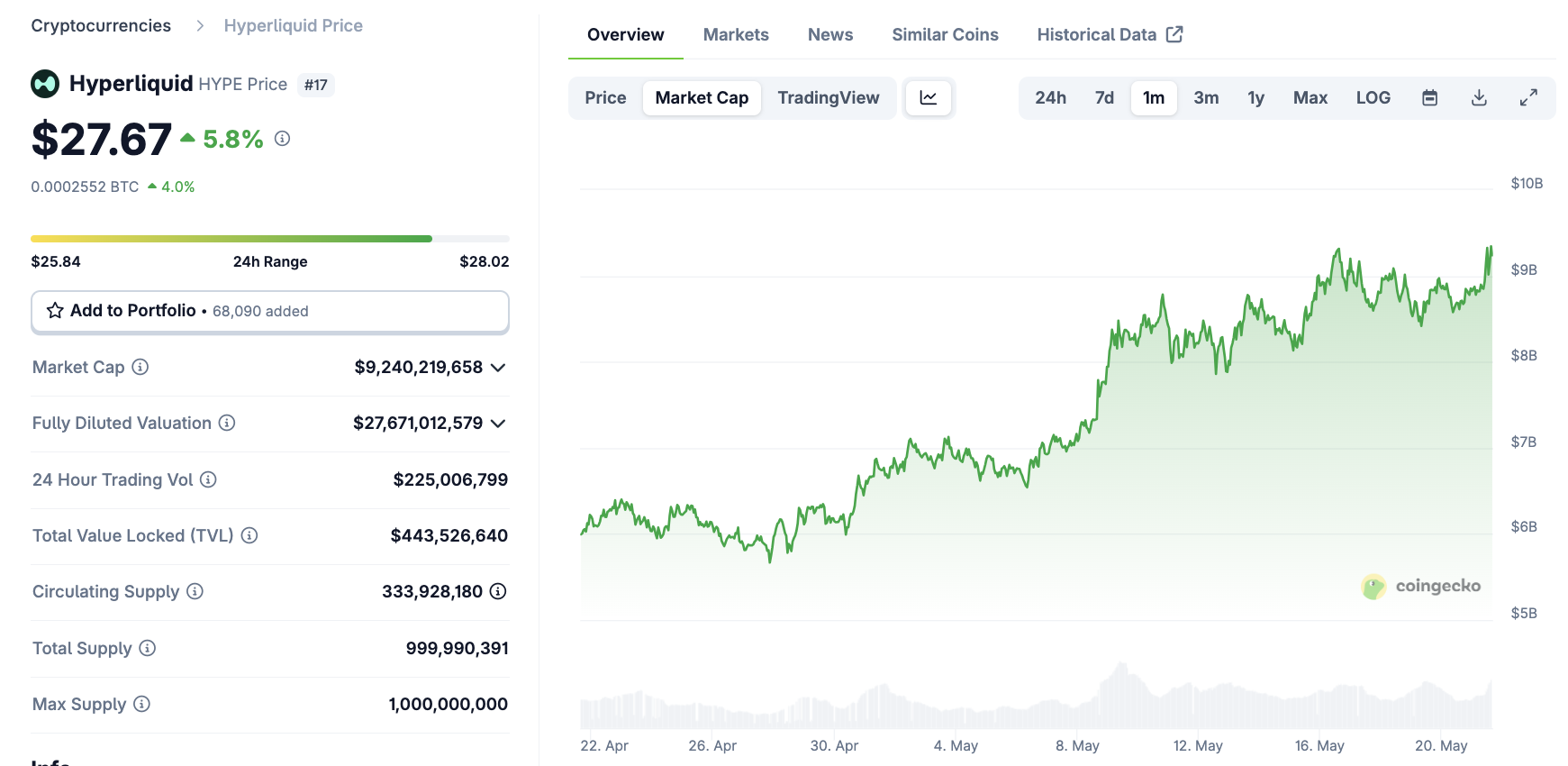

This helped the firm repurchase 17% of the total circulating HYPE tokens, providing several key advantages. Over the last month, HYPE’s market cap has been steadily rising towards $10 billion:

Despite its strong rise, Hyperliquid has also seen several major controversies. For example, it denied claims of a Lazarus Group security breach despite clear on-chain evidence last year.

In March 2025, it unleashed a major scandal when it delisted JELLYJELLY in response to a short squeeze. This led to accusations of market manipulation and substantial losses.

dYdX hasn’t suffered a public debacle like that in many months, but Hyperliquid did act quickly to rebuild its reputation. So far, this seems to have worked.

Earlier today, Hyperliquid also reached a new all-time high in open interest, surpassing $8 billion. If it can maintain this momentum, the exchange can build a commanding lead over DeFi’s perpetuals market.