XRP Futures Explode with $25.6M Volume in Just 48 Hours on CME

Wall Street’s latest crypto flirtation just got serious. XRP futures racked up $25.6 million in trading volume within two days of launching on CME—proving institutional interest isn’t just Bitcoin’s game anymore.

The derivatives giant’s move signals growing acceptance of altcoins in regulated markets, though skeptics whisper this could just be hedge funds practicing their pump-and-dump strategies with extra steps.

XRP Futures Make a Strong Entry on CME

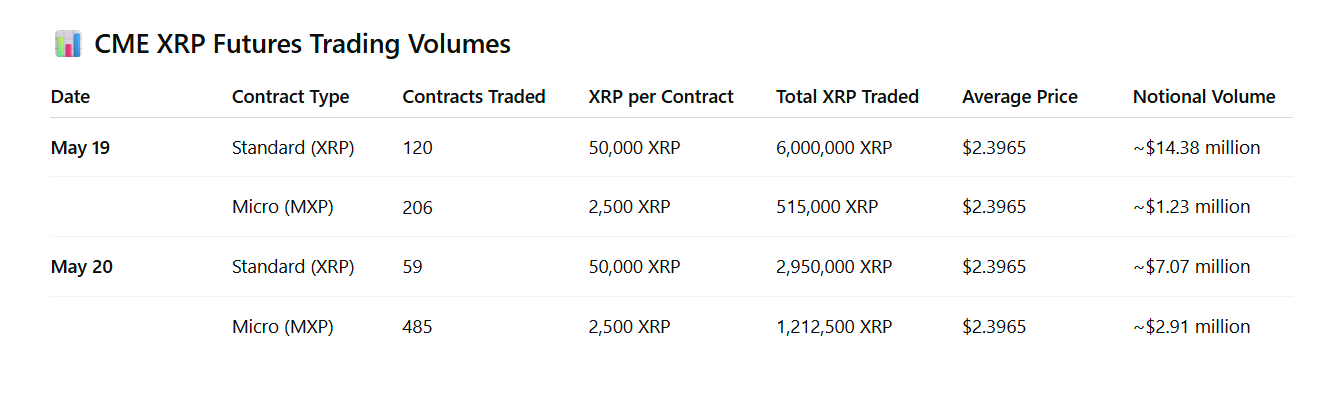

CME began trading XRP futures on May 19, offering both standard (50,000 XRP) and micro (2,500 XRP) contracts.

According to official CME data and corroborating reports, 120 standard and 206 micro contracts were traded on May 19, totaling approximately 6.5 million XRP.

On May 20, the exchange logged 59 standard and 485 micro contracts, adding another 4.1 million XRP to the tally.

So, using XRP’s current market price of $2.39, the total trading volume across both days equals approximately $25.6 million.

This volume positions XRP’s debut ahead of other altcoin launches on CME. solana (SOL) futures, which debuted in March 2025, recorded $12.3 million in first-day notional volume.

In contrast, Bitcoin and ethereum had more modest openings in their early days. BTC futures launched in 2017, and ETH followed in 2021—although both have since become institutional mainstays.

Futures Mirror XRP Spot Price, Hint at Stable Outlook

CME’s XRP futures are cash-settled and based on the CME CF XRP-Dollar Reference Rate. This is updated daily at 11 am Eastern Time.

This structure means the futures are pegged closely to the spot market. With XRP currently trading at $2.39, the futures contracts are not reflecting a premium or discount. This suggests traders expect price stability in the short term.

So far, there is no indication of strong bullish or bearish sentiment among futures participants. This could reflect broader market indecision or simply the fact that participants are using the contracts for hedging rather than speculation.

The debut’s success highlights growing institutional interest in XRP, especially after regulatory clarity around Ripple’s operations.

Overall, it sets the stage for future growth as traders explore more nuanced ways to gain exposure to XRP in a regulated environment.