Bitcoin Smashes Records: $109K ATH Sparks Rally vs. Profit-Taking Debate

Digital gold just got pricier—Bitcoin rockets past $109,000, leaving traders torn between diamond hands and exit strategies.

Bull case: Institutional FOMO could fuel the next leg up. Bear trap: Wall Street sharks might ’take liquidity’ faster than a crypto exchange rug pull.

One thing’s certain—the suits will still call it a ’bubble’ while quietly adjusting their long positions.

Bitcoin All-Time High Price Chart. Source: TradingView

Bitcoin All-Time High Price Chart. Source: TradingView

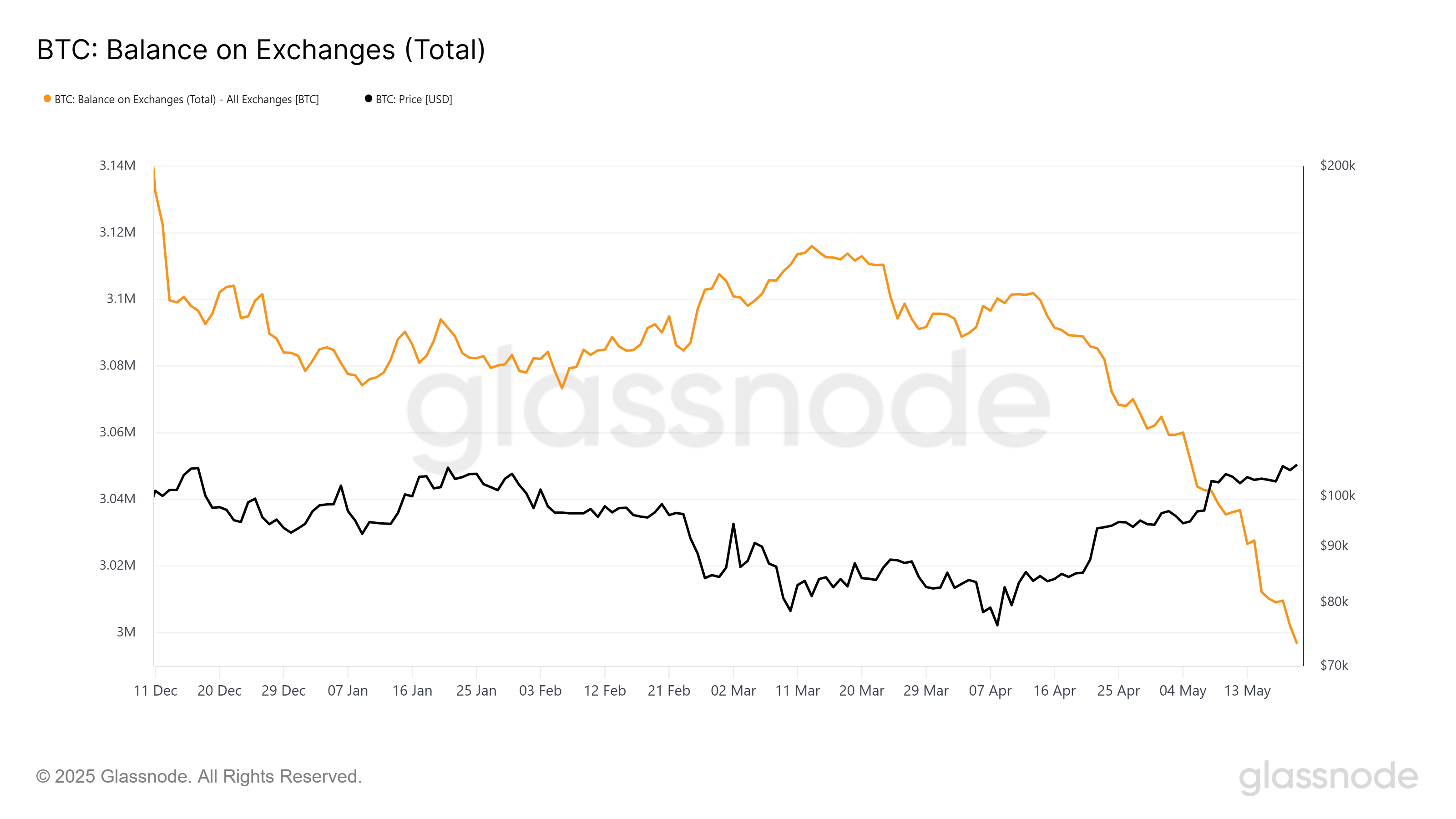

This does, however, raise the potential of profit taking at the hands of investors. However, past data shows that even during the January 2025 ATH, the exchanges did not see much inflow immediately after the ATH, which makes it likely that investors might refrain from selling until strong signs of a market top appear.

However, BTC eventually noted a downtrend as the market cooled down and profit-taking began. This led to BTC falling to $74,508 over the course of the next three months. Whether this will happen again is yet to be seen.

Nevertheless, Standard Chartered seems to be hyper bullish regarding Bitcoin. Speaking to BeInCrypto, Geoff Kendrick, Head of Digital Assets Research at Standard Chartered, stated that Bitcoin is still on course to hit $500,000 before the end of Trump’s second administration.

“As more investors gain access to the asset and as volatility falls, we believe portfolios will migrate towards their optimal level from an underweight starting position in Bitcoin.”