Ethereum Co-Founder Jeffrey Wilcke Sparks Market Jitters With ETH Transfers

Blockchain sleuths spot seven-figure ETH movements from Wilcke’s known wallet—just as gas fees hit a 90-day low. Perfect timing or ominous signal?

The crypto-wealthy never sell—they ’rebalance portfolios.’ But when a co-founder’s wallet starts bleeding ETH, even the most diamond-handed HODLers check their liquidation prices.

This isn’t Wilcke’s first rodeo: The developer previously cashed out 9,000 ETH during the 2018 bear market. Traders now wonder if history’s rhyming—or if this is just another ’tax season’ excuse.

Meanwhile in TradFi land: Hedge fund managers clutching their 2% management fees are suddenly very interested in ’decentralized finance ethics.’

Could Wilcke Sell his Ethereum Holdings?

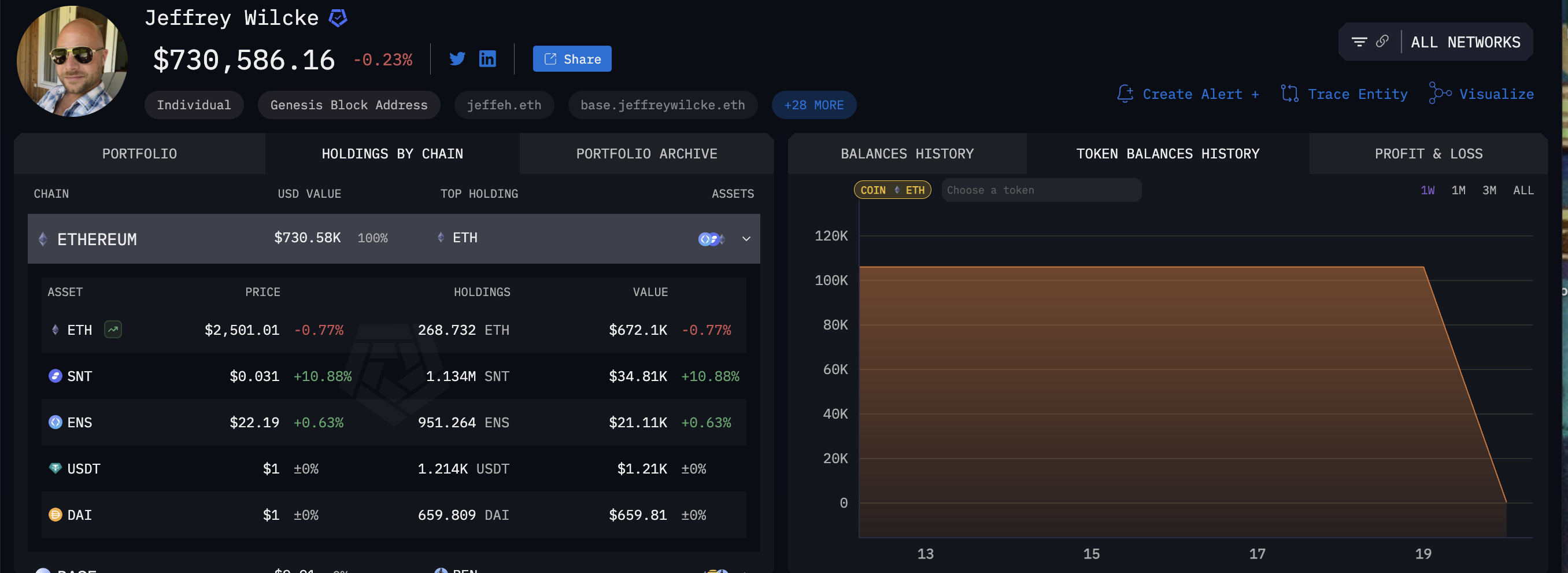

This potential ETH dump was first noticed by Arkham Intelligence, a blockchain analysis platform. Arkham found a wallet apparently belonging to Wilcke, which moved the vast majority of its Ethereum holdings in one massive transaction.

This single transfer contained over 100,000 ETH, bringing Wilcke’s remaining holdings to less than 300.

The development caused consternation in the crypto community for several reasons. The last time Wilcke moved so much Ethereum was November 28, 2024, when he transferred 20,000 ETH to Kraken.

This took place almost a week before ETH’s 12-month price peak, and it has not since recovered.

Despite recent success, Ethereum is under renewed selling pressure and a potential death cross. Therefore, a co-founder dumping his total holdings WOULD get a bearish reception. Community speculation ran rampant after the transfer first got publicized.

Could his decision be related to Ethereum’s recent leadership troubles? If Wilcke lost his faith in Ethereum, this would be a dark omen for the whole project.

However, the real story seems to have been less dramatic. For one, Wilcke personally reposted Arkham’s notice of the Ethereum transfers.

He hasn’t commented on the episode in any other way yet, but this could change. Soon afterward, Lookonchain proposed a more mundane explanation for Wilcke’s behavior. Evidence doesn’t point towards a sale at all.

“Eight newly created wallets withdrew 105,736 $ETH ($262 million) from Kraken after Jeffrey Wilcke’s deposit. It is possible that Jeffrey Wilcke did not intend to sell ETH, but just transferred them to other wallets,” Lookonchain claimed.

The community immediately relaxed after this clarification. Major whales get a lot of scrutiny, especially when they’re directly involved with the project in question. To be clear, it doesn’t look like Wilcke had any intentions to sell his holdings.

Some commentators still found it strange that Wilcke would use Kraken to MOVE this much Ethereum to a new wallet. In the grand scheme of things, it’s a minor nitpick.

Whether or not the selling pressure on ETH continues, it doesn’t seem like this co-founder will have anything to do with it.