$5B FTX Payout Looms—Will Altcoins Explode in June 2025?

FTX’s massive $5 billion repayment plan is set to hit wallets next month. Crypto traders are already placing bets—will this trigger the long-awaited altcoin season or just line the pockets of VCs (again)?

Market mechanics 101: When that much liquidity floods back into crypto, history says it doesn’t just sit in stablecoins. But with regulators circling like vultures and Bitcoin sucking up all the ETF oxygen, altcoins face an uphill battle for attention.

Pro tip: Watch Ethereum’s dominance ratio. If it cracks 20% as the FTX cash lands, expect a speculative frenzy across second-tier tokens. If not? Enjoy another round of ‘narrative-driven’ pump-and-dumps—courtesy of your friendly neighborhood crypto hedge funds.

FTX’s $5 Billion Repayment Could Fuel June Altseason — But Momentum Is Fading

FTX will distribute over $5 billion to approved creditors on May 30, marking one of the largest single-day payouts in crypto bankruptcy history.

Many analysts believe this sudden liquidity injection could reignite altcoin momentum in June, as recipients may look to reinvest in the market.

That Optimism briefly aligned with market structure—between May 7 and May 13, Bitcoin dominance dropped sharply from 65.5% to under 62.2%, a nearly 5% decline that fueled speculation that an altcoin season was underway.

However, that sentiment has since cooled: from May 14 to May 20, BTC dominance climbed back 3%, reversing much of the prior week’s shift and suggesting capital is rotating back into Bitcoin.

Another key signal, the ETH/BTC ratio, tells a similar story. Between May 7 and May 13, ethereum gained significantly against Bitcoin, with the ratio climbing almost 38%, further amplifying the belief that a broader altcoin breakout was beginning.

But in the following week—May 14 to May 20—that same ratio dropped 8.7%, indicating weakening relative strength for ETH and dampening altseason expectations.

These shifts suggest that while the FTX payout may inject fresh capital, the altcoin season narrative is losing momentum—at least for now.

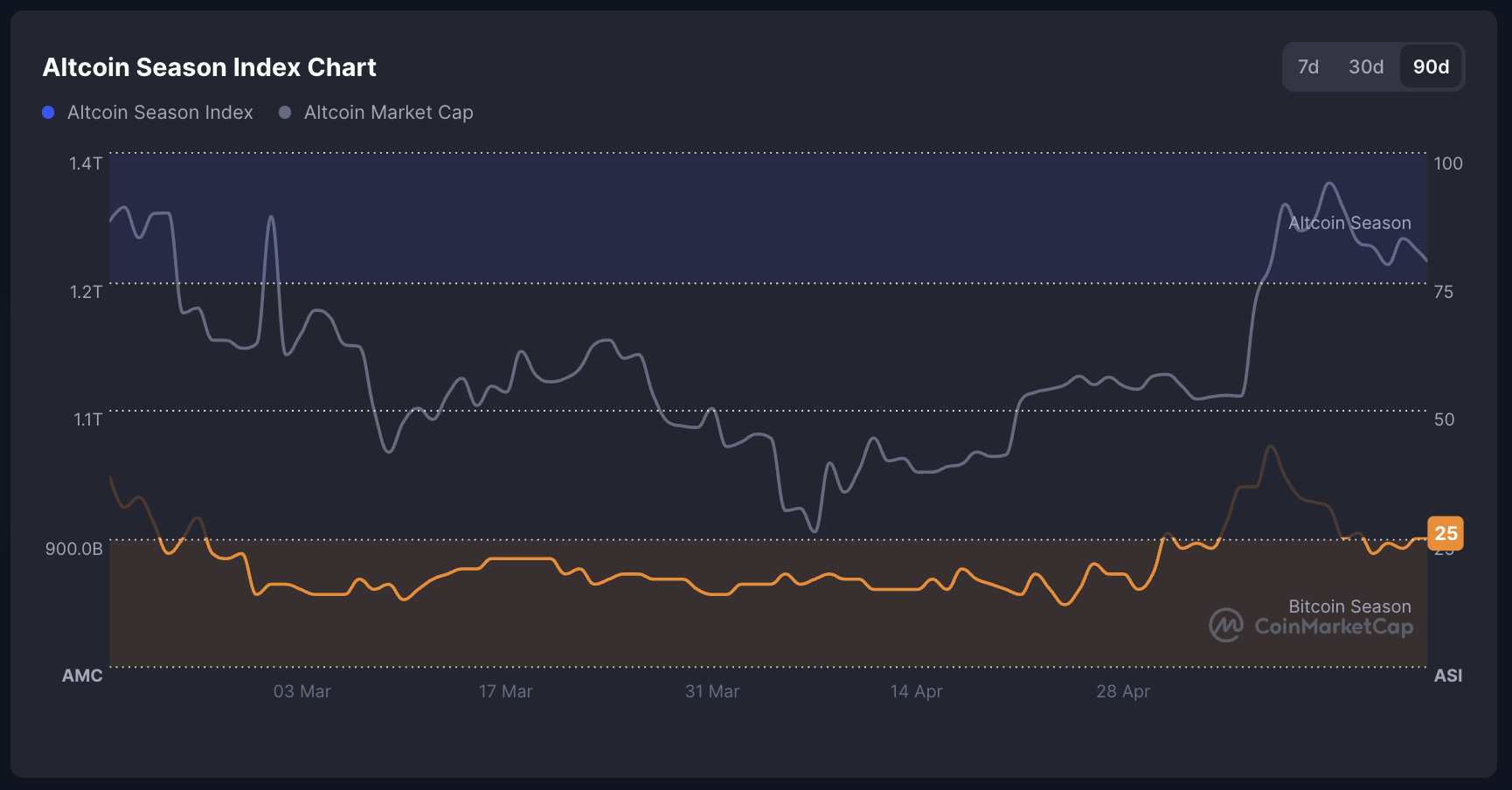

Altcoin Momentum Fades as Index Hits 25 — Will FTX Liquidity Change That?

The total crypto market cap, excluding Bitcoin, is currently at $1.17 trillion, up from $1.01 trillion on May 7 but down sharply from $1.26 trillion on May 13.

This trend suggests that while altcoins saw a brief wave of inflows in early May, the momentum has weakened, with nearly $90 billion exiting the space in just one week. The pullback highlights a lack of sustained confidence in a full-scale altcoin rally.

However, the upcoming $5 billion liquidity injection from FTX repayments on May 30 could restore the capital altcoins need to reignite momentum and possibly spark an altcoin season in June.

Meanwhile, the Altcoin Season Index, tracked by CoinMarketCap, has dropped from 43 on May 9 to 25—officially entering bitcoin Season territory.

The index measures how many of the top 100 coins (excluding stablecoins and wrapped assets) have outperformed Bitcoin over the last 90 days. A score above 75 signals Altcoin Season, while below 25 indicates Bitcoin dominance.

With only a quarter of top coins outperforming BTC, the index confirms that Bitcoin is currently back in control, though the upcoming liquidity surge could still flip the trend.