Ethereum Teeters on $2,500 Cliff as Death Cross Looms and Whales Dump

Ethereum’s price tremors worsen as technical indicators flash red—the dreaded ’death cross’ emerges while sell pressure mounts. Whales are offloading stacks, and retail traders are sweating their leveraged positions.

Key factors driving the sell-off:

- The 50-day MA just sliced through the 200-day MA like a hot knife through institutional-grade butter

- Exchange reserves spike as traders flee to ’stablecoins’ (read: digital IOUs for fiat they pretend to hate)

- Options markets price in 30% volatility—because nothing says ’sound money’ like casino-level swings

If $2,500 breaks, the next stop might just be the ’generational buying opportunity’ every crypto bro promises—right before checking their liquidated positions.

ETH’s Technical Setup Turns Bearish

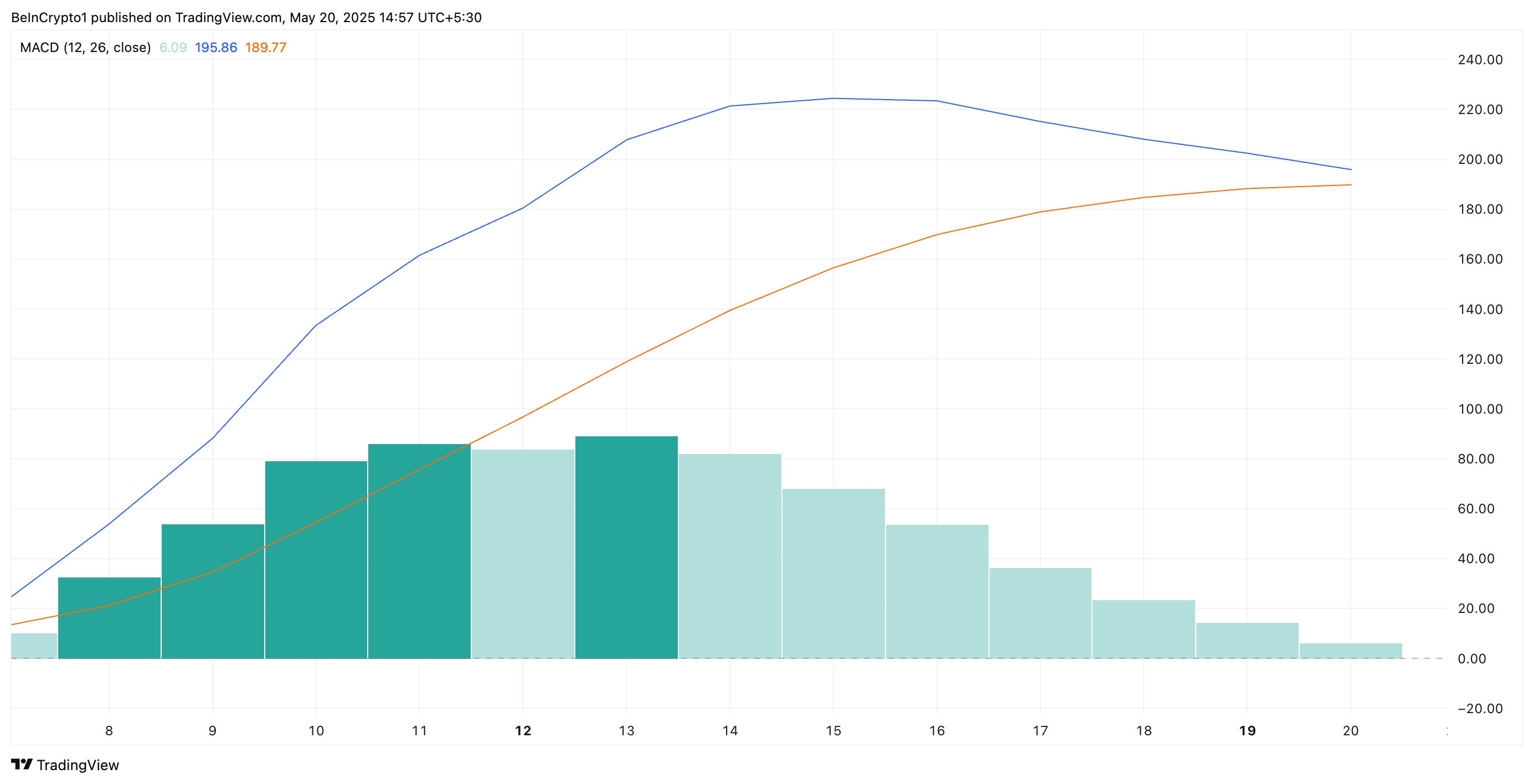

An assessment of the ETH/USD one-day chart reveals the potential formation of a death cross on its Moving Average Convergence Divergence (MACD) indicator.

This bearish pattern emerges when an asset’s MACD line (blue) breaks below the signal line (orange), signaling a shift from bullish to bearish momentum. Such a pattern often precedes significant price drops, especially when accompanied by weakening positive sentiment.

As of this writing, ETH’s MACD line is about to cross below its signal line. If this happens, the death cross WOULD confirm the brewing selling pressure and signal the start of an extended, downward trend.

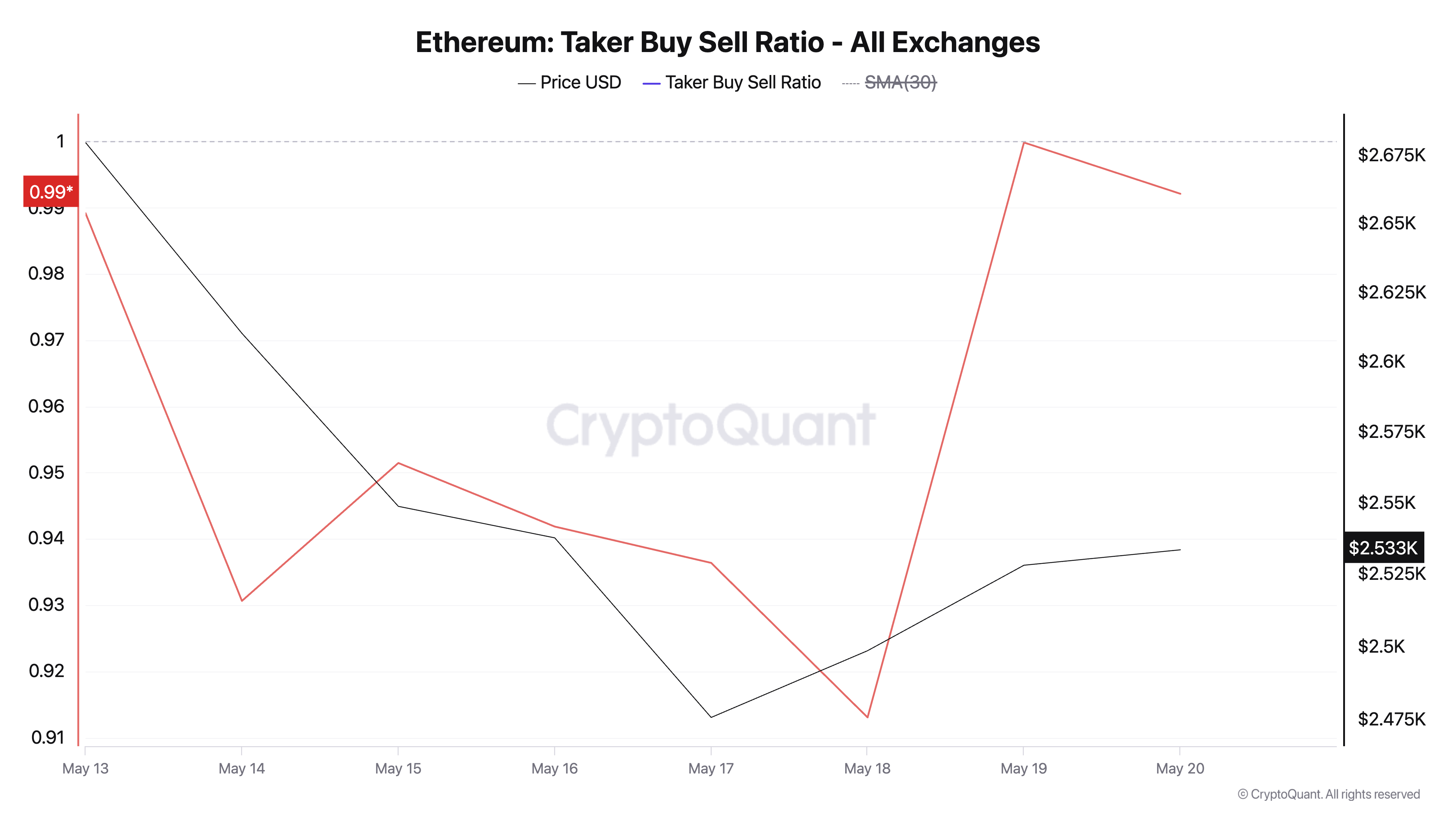

Furthermore, ETH’s Taker Buy-Sell Ratio is below one at press time, indicating persistent sell-side dominance in its derivatives market.

This metric measures the ratio between the buy and sell volumes in ETH’s futures market. A value above 1 suggests that more traders are aggressively buying ETH contracts than selling, while values below 1 indicate dominant sell pressure.

The continued prevalence of taker-sell volume suggests that, despite the price uptick, underlying demand remains weak in the ETH market.

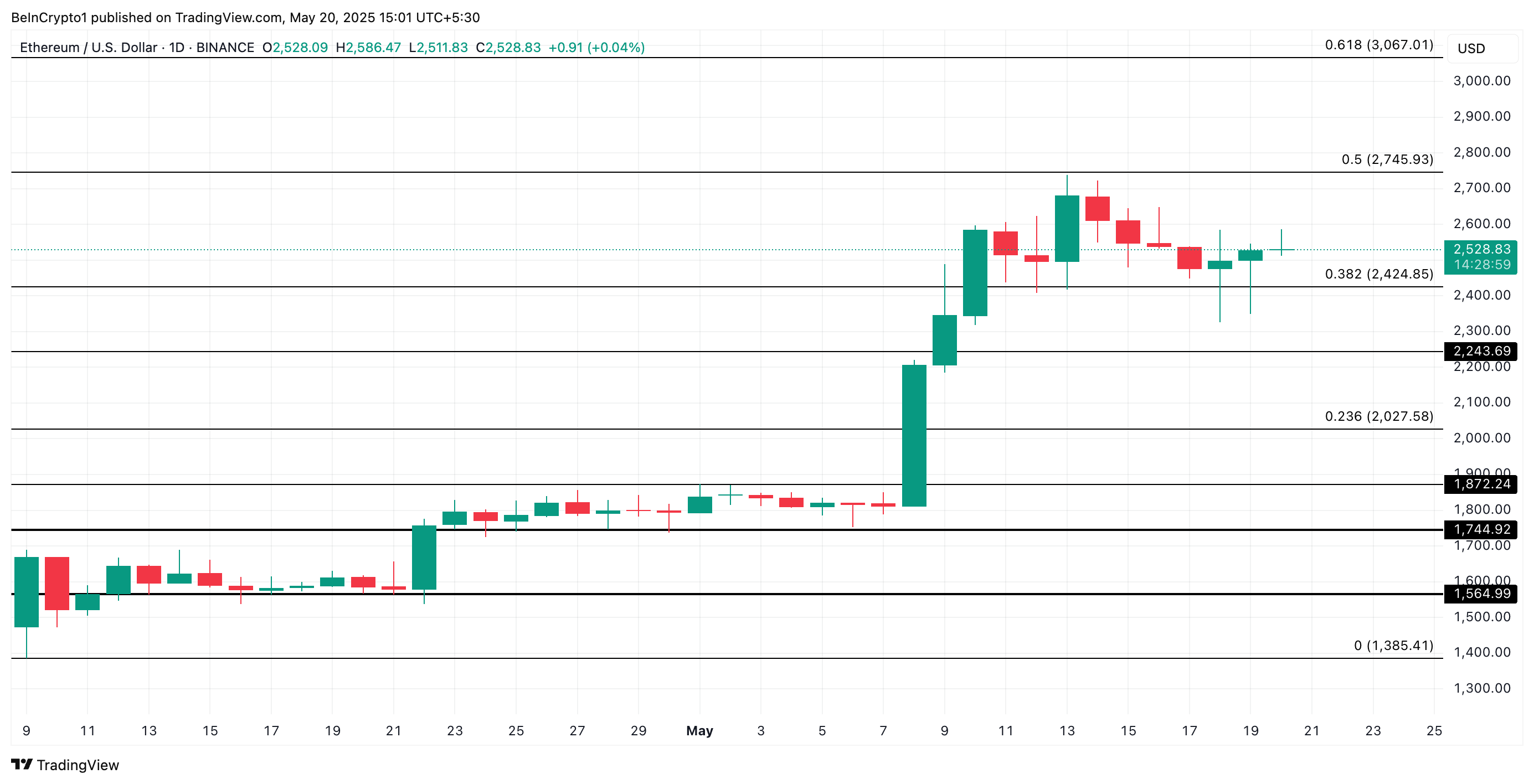

ETH Price Risks Deeper Drop as Sellers Target $2,027

At press time, ETH trades at $2,528. With waning underlying buying pressure, the leading altcoin risks dropping toward support at $2,424.

If bearish pressure strengthens at this level, ETH sellers could breach this support floor, triggering further declines to $2,027.

However, if the bulls regain dominance and new demand for ETH spikes, its price could regain strength and climb to $2,745.