HBAR Nears $70M Liquidation Cliff—But This Bull Flag Says Higher Prices Are Coming

Hedera’s native token flirts with danger as $70 million in leveraged positions hang in the balance. Yet the chart paints a different story—a textbook uptrend forming just as the suits on Wall Street start pretending they ’always believed in DLT’.

Price action defies liquidation fears: HBAR’s consolidating near monthly highs, printing higher lows while shorts sweat. The pattern? A bull flag that’d make even the most jaded trader glance twice.

Meanwhile, crypto’s favorite game of ’musical chairs’ continues—another day, another nine-figure leverage wipeout waiting to happen. But this time? The technicals suggest the bulls might just dodge the bullet.

HBAR Traders Are In Danger

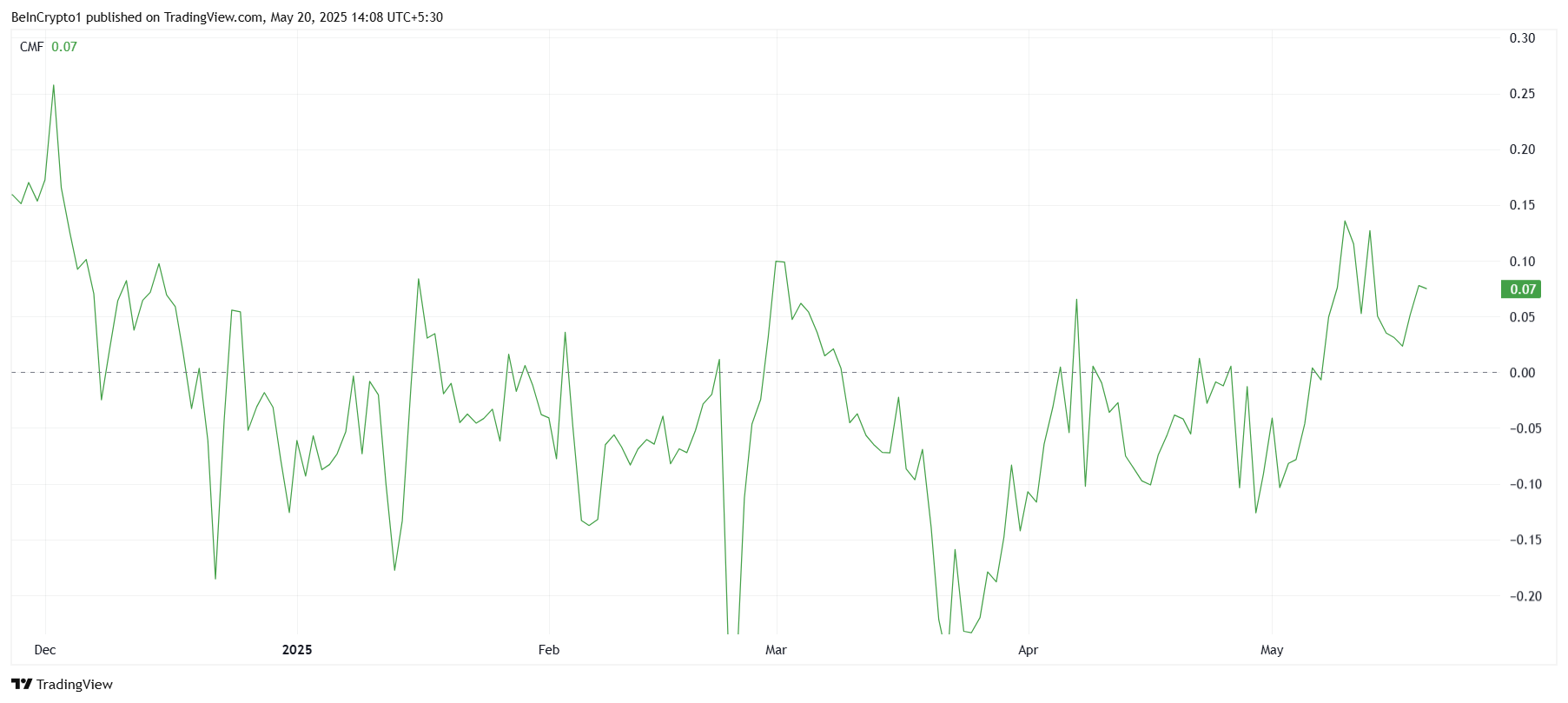

The Chaikin Money FLOW (CMF) indicator shows strong inflows into HBAR, signaling that investor sentiment is bullish. The CMF has bounced above the zero line for the first time since December 2024, showing strong demand.

The inflows indicate that investors continue to pour money into the asset, bolstering the price movement. With the CMF turning positive, the likelihood of sustained growth for HBAR increases, as long as the broader market maintains its bullish tone.

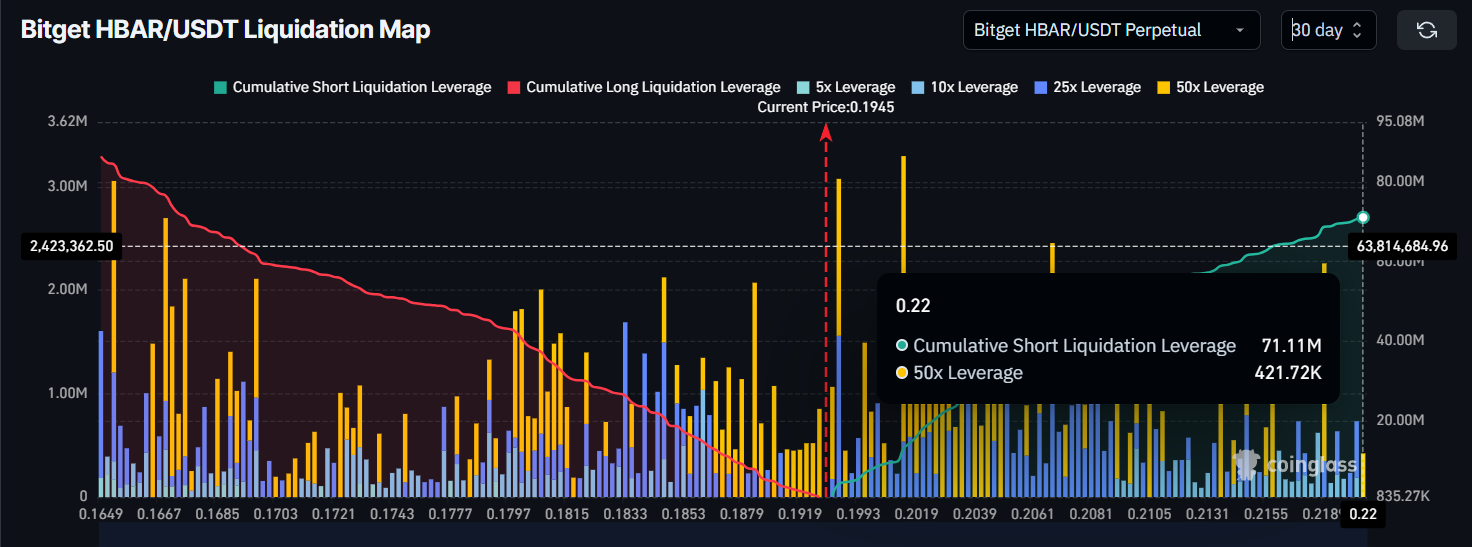

The liquidation map for HBAR, which tracks short positions, indicates that traders betting against the asset could face significant losses if the price continues to rise. HBAR’s current price sits at $0.19, not far from the key resistance level of $0.22. If HBAR breaches this resistance, approximately $70 million worth of short positions could be liquidated, leading to further upward pressure. This scenario highlights the intense battle between bullish investors and bearish traders.

Short traders who bet against HBAR are now at risk, as the broader market sentiment pushes the altcoin higher. The increasing momentum fueled by the strong inflows will likely catch many short positions off guard, forcing them to liquidate. If this liquidation occurs, it could lead to a sharp rise in the price of HBAR, further solidifying its bullish outlook.

HBAR Price Continues Its Incline

HBAR is currently trading at $0.194, just below the significant resistance level of $0.200. The altcoin has shown consistent growth over the past month, and with the current positive market sentiment, it is likely to continue rising. A successful break above $0.200 could confirm the bullish momentum and open the path for further gains.

Should HBAR manage to flip $0.200 into support, a rise to $0.220 WOULD likely follow, triggering the $70 million in short liquidations. This would create additional upward pressure, accelerating HBAR’s price move and potentially pushing it higher in the short term.

However, if HBAR fails to maintain its upward trajectory and falls below the uptrend line, the price could slip under the $0.182 support level. Such a decline would likely bring HBAR to around $0.167, invalidating the current bullish outlook. Therefore, traders should closely monitor these key levels to determine the next steps for HBAR’s price action.