Bitcoin at a Crossroads: Can the OG Crypto Still Deliver Profits in 2025?

As Bitcoin wobbles near its 2024 ATH, Wall Street analysts are locked in a cage match over its future. Bulls point to institutional adoption—BlackRock’s ETF now holds more BTC than MicroStrategy. Bears sneer at ’digital gold’ that drops 20% when Elon Musk tweets.

The real question? Whether Bitcoin’s volatility is a feature or a bug for profit-seekers. Mining rewards just halved again, squeezing margins tighter than a hedge fund’s bonus structure. Meanwhile, Ethereum and Solana are eating Bitcoin’s lunch in DeFi—proving you can teach an old chain new tricks, but only if it bothers to learn them.

One thing’s certain: the ’HODL forever’ crowd looks nervous every time Tether prints another billion. Maybe Satoshi should’ve coded a ’sell button’ after all.

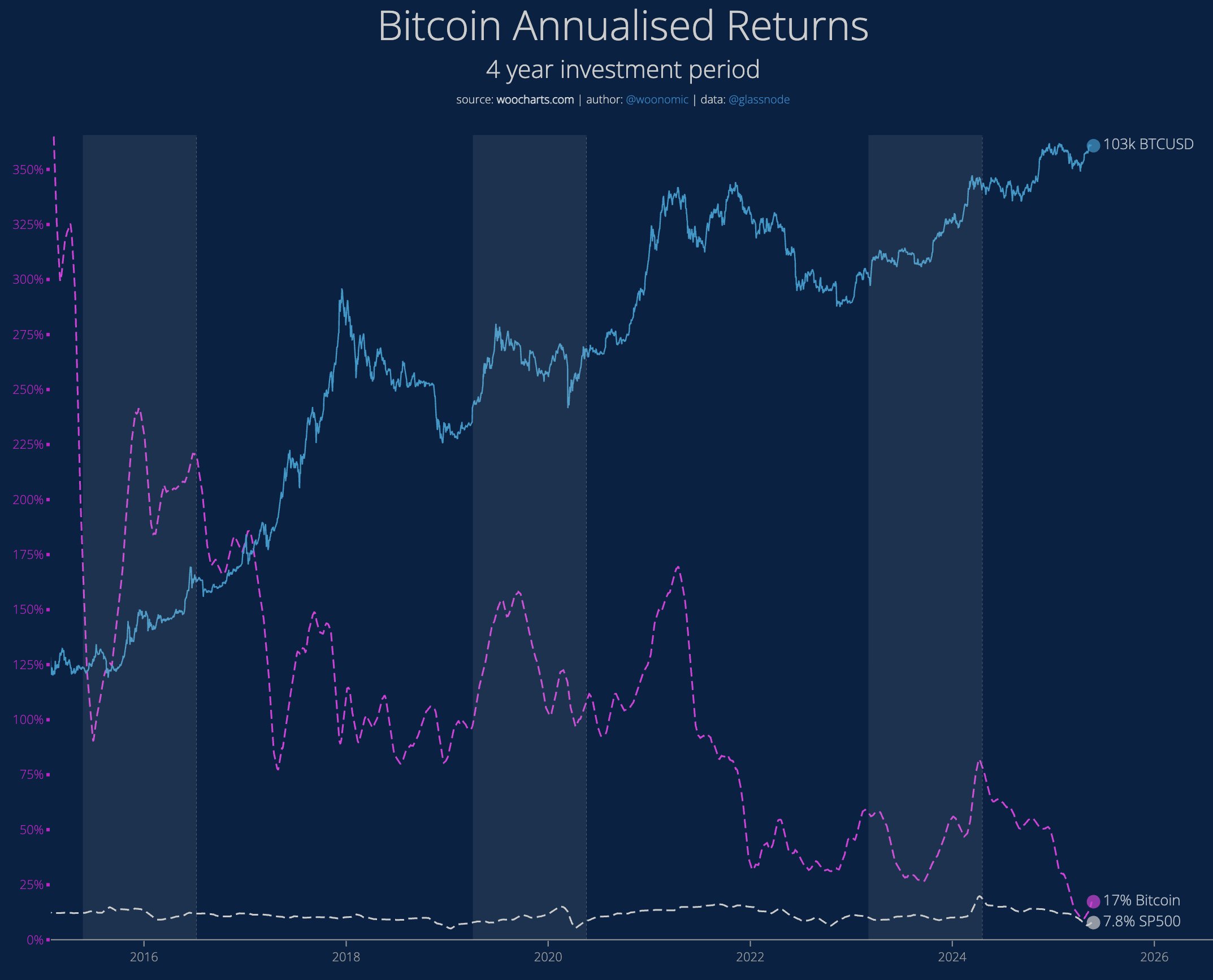

Willy Woo predicts Bitcoin’s CAGR will decline and stabilize at 8%

Woo shared a chart titled “Bitcoin Annualised Returns,” showing that Bitcoin’s compound annual growth rate (CAGR) has dropped sharply, from over 100% in 2017 to around 30–40% after 2020.

That was the period when major institutions, including corporations and governments, began accumulating Bitcoin.

“People think BTC is like a magical unicorn that climbs to infinity on moonbeams. Here’s the actual CAGR chart. We are well past the 2017 year where we’d see many 100s of percent growth,” Willy Woo said.

Woo forecasts that Bitcoin’s CAGR will continue to decline over the next 15–20 years and eventually stabilize around 8%. This rate aligns with long-term monetary growth (5%) and GDP growth (3%). He emphasized that even with a lower CAGR, Bitcoin will still outperform most other publicly traded assets.

However, investor and author Fred Krueger disagreed. He pointed out that bitcoin has already increased 7x from its December 2022 low, now trading at $103,000 as of May 2025.

Additionally, in a recent interview, Arthur Hayes went even further. He predicted that Bitcoin WOULD reach $1 million before the end of Donald Trump’s current term. He expects the price to hit $250,000 by the end of 2025, representing a 1,000% increase in just four years.

GDP and liquidity growth seen as key drivers of Bitcoin’s future gains

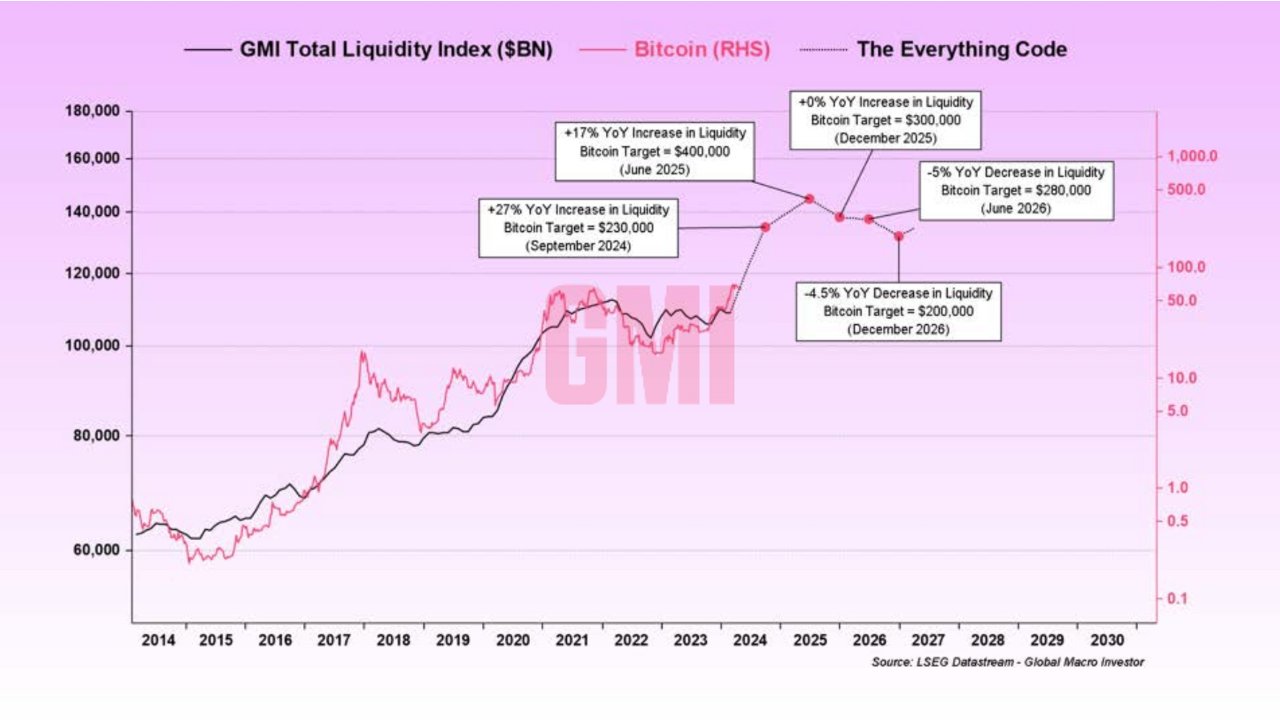

Woo’s prediction is largely based on GDP expansion and monetary growth. Meanwhile, Paul Guerra, Head of Social at RealVision, offered deeper insights on the matter.

Discussing liquidity, he argued that traditional diversification strategies may no longer work in today’s market environment. That’s because assets like stocks, bonds, Bitcoin, and real estate now tend to MOVE together, driven by a single key factor: liquidity.

“The true driver of markets is liquidity — the amount of money flowing through the system,” Paul said.

The Global Liquidity Index is currently growing at 8% annually. To understand liquidity, Paul suggested that we must first understand GDP. He presented a formula for GDP growth:

But today, population growth and productivity are declining worldwide. As a result, governments are being forced to inject liquidity to sustain GDP and support rising debt.

“Populations are AGING. Productivity gains are FLAT. Debt is EXPLODING. To keep GDP alive and service people’s debt, governments have only one tool: Pump liquidity,” Paul explained.

As a result, liquidity is expected to increase at an even faster rate. Paul predicted that Bitcoin could reach $300,000 by the end of 2025 and enter what he calls the “Banana Zone.” This term describes periods of massive asset price increases fueled by abundant liquidity.

Historical examples include Bitcoin’s 19,900% gain from 2013–2017, and Ethereum’s 699,900% surge in previous cycles.

Still, these analyses focus heavily on macroeconomic factors while overlooking potential technical risks. For instance, concerns are growing that advancements in quantum computing could threaten trust in Bitcoin’s long-term viability.