Metaplanet’s Stock Soars to 3-Month Peak After $104M Bitcoin Bet—Because What Could Go Wrong?

Tokyo-listed Metaplanet just became the latest corporate giant to ride the Bitcoin hype train—and investors are eating it up.

The firm’s stock surged to its highest level in three months after announcing a jaw-dropping $104 million Bitcoin purchase. Because nothing says ’financial strategy’ like doubling down on an asset that swings 10% before lunch.

Why This Matters:

Metaplanet joins the ranks of MicroStrategy and Tesla in betting big on crypto. Whether this is visionary or desperate depends on which side of the ledger you’re standing on.

The Market’s Verdict:

Shareholders cheered the move, pushing the stock up—proving once again that in 2025, the quickest path to a rally is slapping ’Bitcoin’ in a press release.

The Cynic’s Take:

Another day, another company using volatile crypto to distract from its core business. At least they didn’t buy NFTs.

Metaplanet Stock Benefits From Bitcoin Purchases

According to the official disclosure, the latest transaction was valued at 15.19 billion yen (approximately $104.3 million). Metaplanet’s average buying cost was 15.13 million yen, equivalent to $103,873 per BTC.

“From July 1, 2024, to September 30, 2024, the Company’s BTC Yield was 41.7%. From October 1, 2024, to December 31, 2024, the Company’s BTC Yield was 309.8%. From January 1, 2025, to March 31, 2025, the company achieved a BTC Yield of 95.6%. Quarter to Date, from April 1, 2025, to May 19, 2025, the Company’s BTC Yield is 47.8%,” the statement read.

Metaplanet issues zero-coupon ordinary bonds to fund these purchases. In May 2025, it issued bonds worth $64.7 million. This includes $24.7 million from the 12th Series issued on May 2, $25 million from the 13th Series approved on May 7, and $15 million from the 15th Series issued on May 13.

The company now holds a total of 7,800 Bitcoin, with an aggregate investment of 105.38 billion yen, or roughly $712.5 million. The average historical purchase price across its Bitcoin holdings stands at 13.5 million yen per BTC, approximately $91,343 per coin.

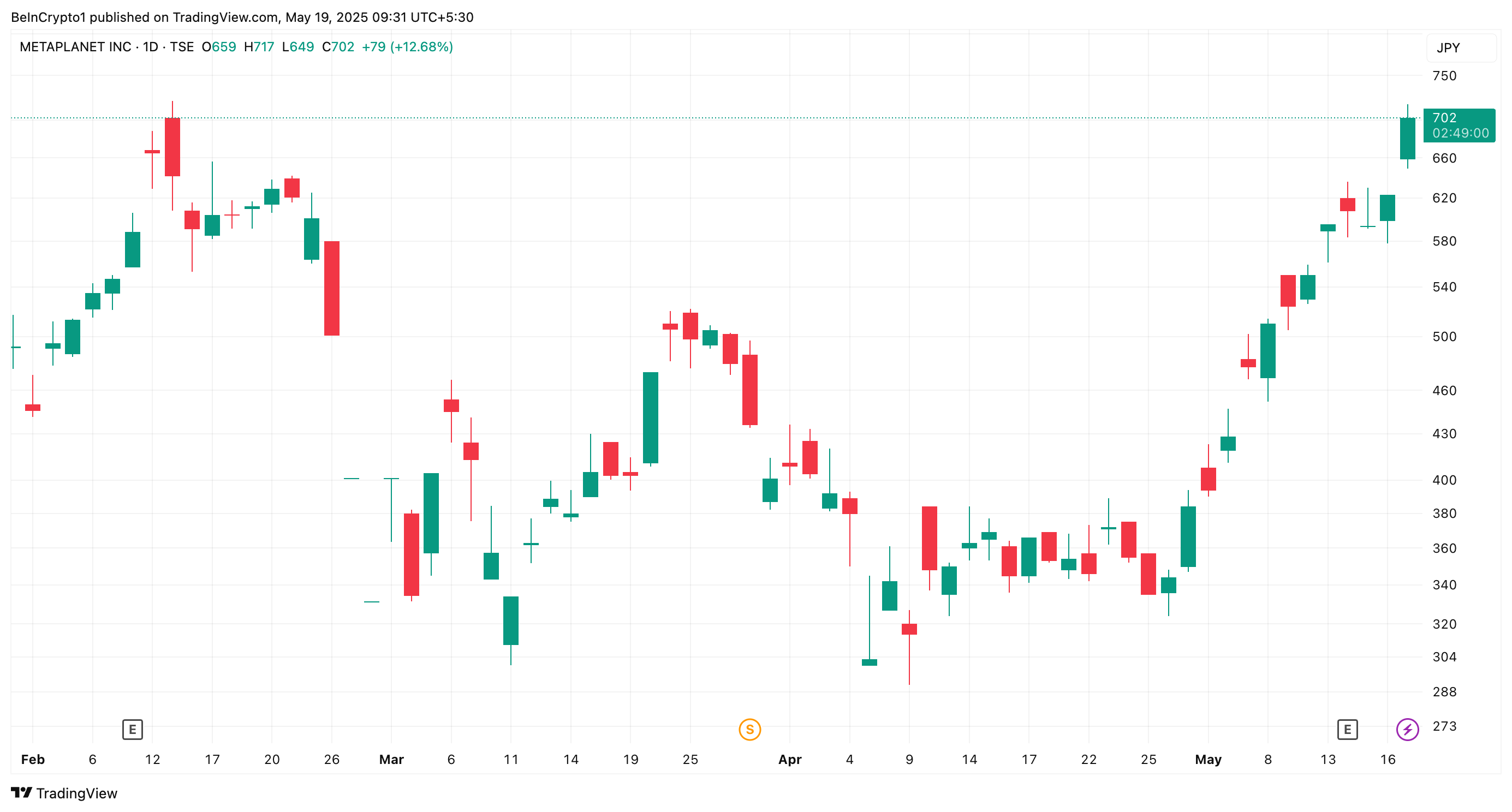

Meanwhile, following the news, Metaplanet stock, 3350.T, appreciated by 12.6%, according to Yahoo Finance data. At press time, its trading price was 702 yen ($4.8), marking highs last seen on February 13.

Over the past month alone, 3350.T’s value has increased by 101.7%, greatly benefiting from Bitcoin’s latest rally. In fact, since adopting a bitcoin reserve strategy, the stock prices have increased over 15-fold.

The firm’s financial performance further supports this upward trajectory. In its Q1 FY2025 earnings report, Metaplanet disclosed revenues of $6 million, with 88% derived from Bitcoin options trading.

This highlighted the important role BTC plays in its financial success. As the firm continues integrating Bitcoin into its economic strategy, it is setting a new benchmark for corporate crypto adoption in the region.