Sleeping Giant Awakens: PEPE Whale Swipes 2 Trillion Tokens from Binance in Midnight Raid

A dormant PEPE whale just flexed its muscles—yanking 2 trillion tokens (worth roughly $3.2 million) off Binance in a single transaction. The move sent shockwaves through meme coin circles, with traders scrambling to decode whether this signals a bullish revival or just another crypto-rich entity playing hot potato with bags.

Timing is suspicious—right as PEPE tests key resistance levels. Either someone’s betting big on a breakout, or we’re witnessing the crypto equivalent of a billionaire buying lottery tickets for fun. Classic decentralized finance: where ’investment strategy’ sometimes means ’vibes and a prayer.’

PEPE Trading Explodes as Whale Shifts $29 Million Tokens From Binance

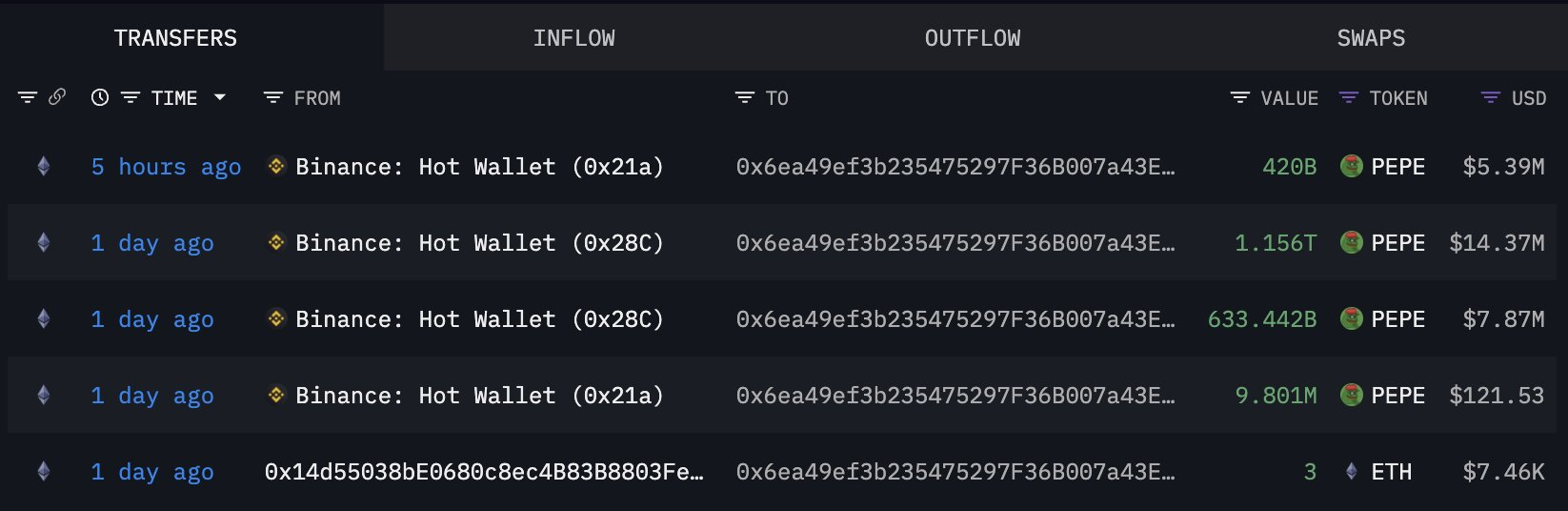

On May 17, blockchain analytics firm Lookonchain reported that a whale initiated a major transaction involving Pepe tokens. The investor withdrew 1.79 trillion PEPE—valued at $22.23 million—from Binance into a newly activated wallet.

A day later, the whale withdrew another 420 billion PEPE tokens, worth roughly $5.39 million, from the crypto trading platform.

As a result, the whale has now removed 2.21 trillion PEPE tokens, worth $29 million, from Binance in two separate transactions during a 24-hour period.

Market observers noted that these actions have effectively reduced Binance’s PEPE reserves by about 2%.

The withdrawals, directed into self-custody wallets, suggest a deliberate accumulation strategy and signal the whale’s confidence in the token’s long-term value. Typically, such behavior reflects a shift away from short-term speculation toward a buy-and-hold approach.

Meanwhile, the whale’s return and the rapid accumulation of tokens coincided with a Pepe Price rally.

According to BeInCrypto data, the meme coin has surged over 10% in the last 24 hours and now trades at $0.00001345. This marks a staggering 87.5% gain in the past month alone.

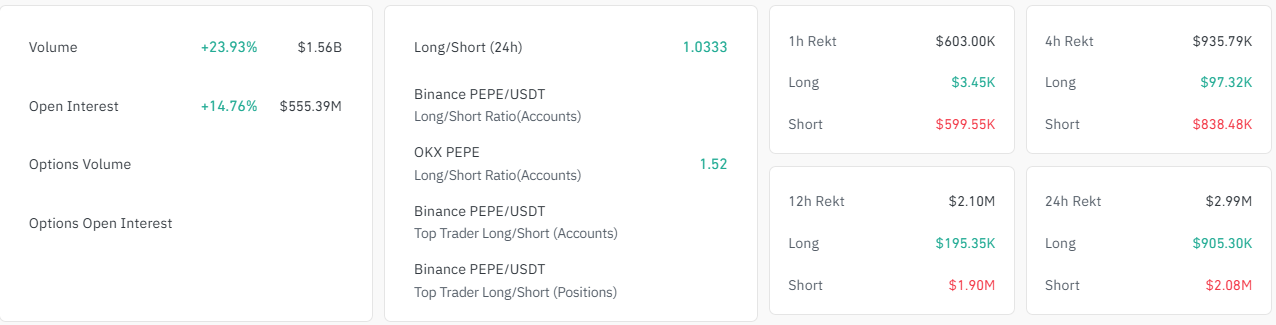

Moreover, the rally has had Ripple effects across the digital asset’s derivatives markets.

CoinGlass data shows that short positions betting against PEPE’s price surge faced roughly $2 million in liquidations over the past 24 hours. During the same period, long traders also saw losses amounting to about $907,000.

At the same time, open interest in PEPE futures jumped 15%, topping $500 million—a level last seen in January. Open interest measures the total value of active, unsettled futures contracts and is commonly used to gauge market sentiment and trading activity.

This fresh wave of activity, driven by a large investor, reinforces PEPE’s status as a leading digital asset. It also places the token among the most closely tracked meme coin in today’s volatile market.