Shiba Inu Whales Hold Back – Is SHIB Stuck in Neutral?

Big-money SHIB traders aren’t biting—despite the meme coin’s recent volatility. Are they waiting for a catalyst, or just nursing losses from the last hype cycle?

Price action remains sluggish, trapped below key resistance levels. Retail traders keep piling in, hoping for a repeat of 2021’s absurd rally. Meanwhile, whales sip their overpriced lattes and watch.

Technical indicators flash mixed signals: some whisper ’accumulation,’ others scream ’dead cat bounce.’ The only certainty? Crypto’s favorite dog token still dances to Bitcoin’s tune.

Funny how a ’decentralized’ asset class still relies on a handful of wealthy bagholders to move the needle. Welcome to the ’free market.’

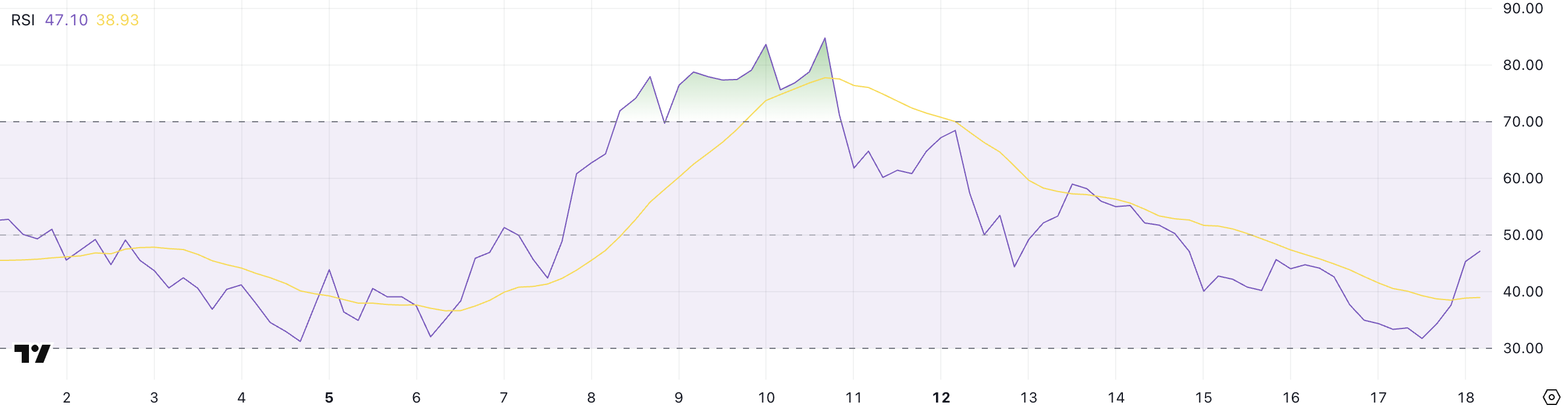

Shiba Inu RSI Recovers After Recent Drop

Shiba Inu’s RSI has climbed to 47.1, up from a low of 31.7 just a day earlier, signaling a rebound in short-term momentum. This follows a sharp pullback from 68.4 six days ago, suggesting that the recent selling pressure may be easing.

While the RSI remains below the neutral 50 level, the quick recovery points to renewed buying interest or a potential shift toward consolidation.

The Relative Strength Index (RSI) measures the speed and change of price movements, ranging from 0 to 100. Readings above 70 typically indicate overbought conditions, while values below 30 suggest an asset may be oversold.

With SHIB’s RSI now sitting NEAR the middle of the range, the asset is neither overheated nor undervalued from a momentum perspective.

This neutral position could lead to sideways movement in the near term, or if buying continues, a possible attempt to retest recent resistance levels.

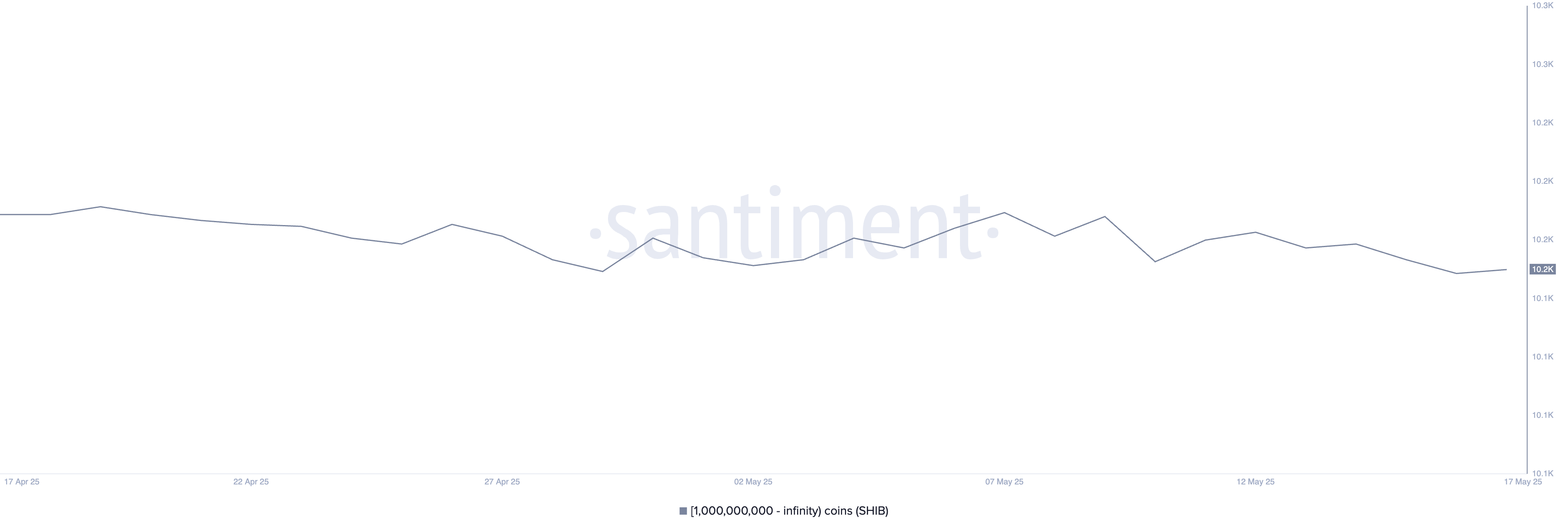

SHIB Whale Count Continues Gradual Decline

The number of shiba inu whales—those holding at least 1 billion SHIB—has declined slightly to 10,205, down from 10,232 recorded nine days ago.

While the drop may seem minor, it reflects a broader pattern of fluctuation and gradual decline in large-holder participation.

This subtle shift may suggest that some major holders are reducing exposure or taking profits during periods of market uncertainty.

Tracking whale activity is important because these addresses can influence price through large-volume moves, often signaling confidence or caution in the asset’s outlook.

Despite intermittent increases, the overall trend in SHIB whale numbers has tilted downward in recent weeks.

This could point to weakening long-term conviction among larger holders, potentially limiting upward momentum unless retail demand or new buyers step in to offset the outflows.

SHIB Price Stalls Between Key Support and Resistance

Shiba Inu is currently trading within a narrow range, facing resistance at $0.0000152 and support at $0.0000139. Its EMA lines, which previously showed strong bullish alignment, are now flattening—suggesting that upward momentum has weakened.

The price appears to be consolidating as traders wait for a decisive breakout in either direction.

If SHIB loses the $0.0000139 support, it may open the door for further downside toward $0.0000127 and possibly $0.0000123.

However, if buyers step back in and the token regains the momentum seen earlier this month, a breakout above $0.0000152 could push the price toward the next resistance near $0.0000176.