Solana Stalls: Can SOL Still Crack $200 or Is the Party Over?

Solana’s blistering rally hits a speed bump—traders now question whether the ’Ethereum killer’ can reclaim its momentum. After a 30% pullback from its 2025 peak, SOL bulls face a critical inflection point.

Technical outlook: The $150 support level held this week, but volume tells the real story. Liquidity is thinning faster than a hedge fund’s patience during a bear market. If SOL loses this floor, $120 becomes the next battleground.

Macro factors: With Fed rate cuts delayed (again), altcoins face headwinds. Solana’s institutional adoption keeps it ahead of meme coin rivals—though that’s like bragging about being the smartest kid in summer school.

The bottom line: $200 remains possible if Bitcoin stabilizes, but don’t bet your DeFi yields on it. This isn’t 2021’s free-money carnival anymore.

Solana Leads DEX Market With $27.9 Billion Weekly Volume and Surging App Activity

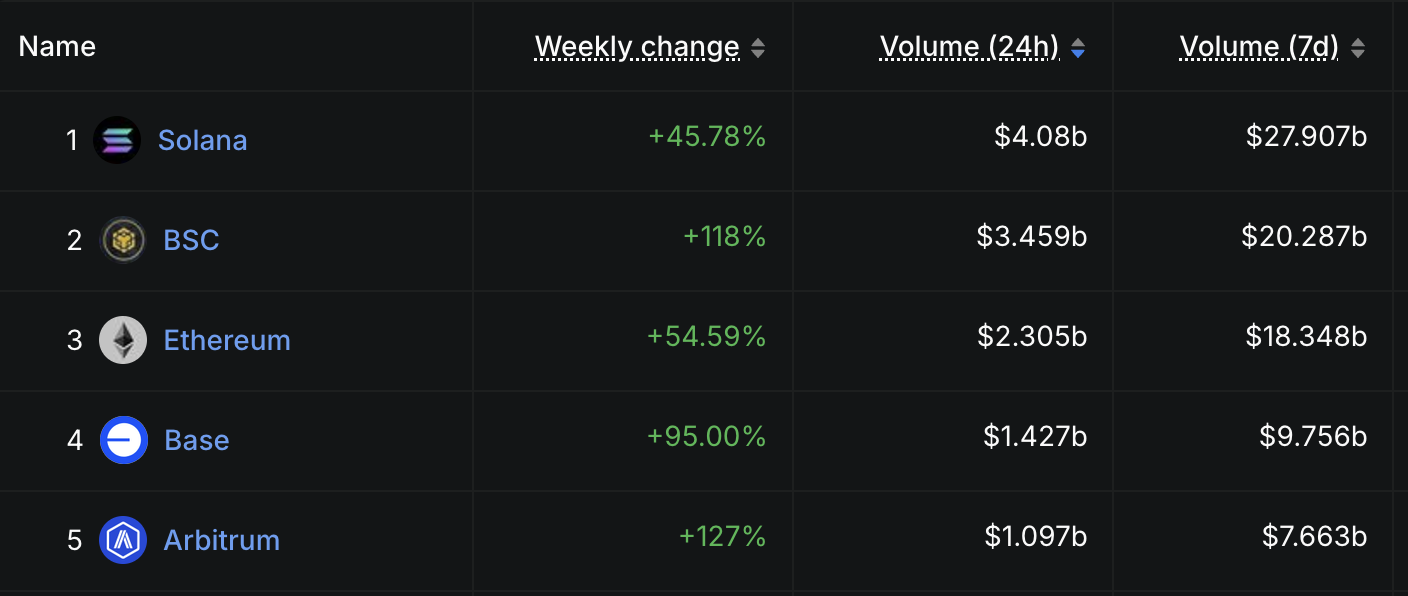

Solana continues to assert its dominance in the decentralized exchange (DEX) ecosystem, leading all chains in trading volume for the fourth consecutive week.

Over the past seven days alone, solana recorded $27.9 billion in DEX volume—surpassing BNB Chain, Ethereum, Base, and Arbitrum.

The weekly DEX volume for Solana surged by 45.78%, signaling a strong resurgence in on-chain activity after decreasing activity between March and April.

This rise is a spike and part of a broader trend, with volumes consistently staying above the $20 billion mark over the past month.

Adding to its momentum, Solana is home to four of the past week’s ten highest fee-generating apps and chains. This includes familiar platforms and newcomers, showing a healthy diversity in the ecosystem.

Believe App, a newly launched Solana-based launchpad, stands out in the recent surge. In the last 24 hours alone, it generated $3.68 million in fees—surpassing well-established platforms like PancakeSwap, Uniswap, and Tron.

Momentum Cools for SOL as Indicators Turn Neutral

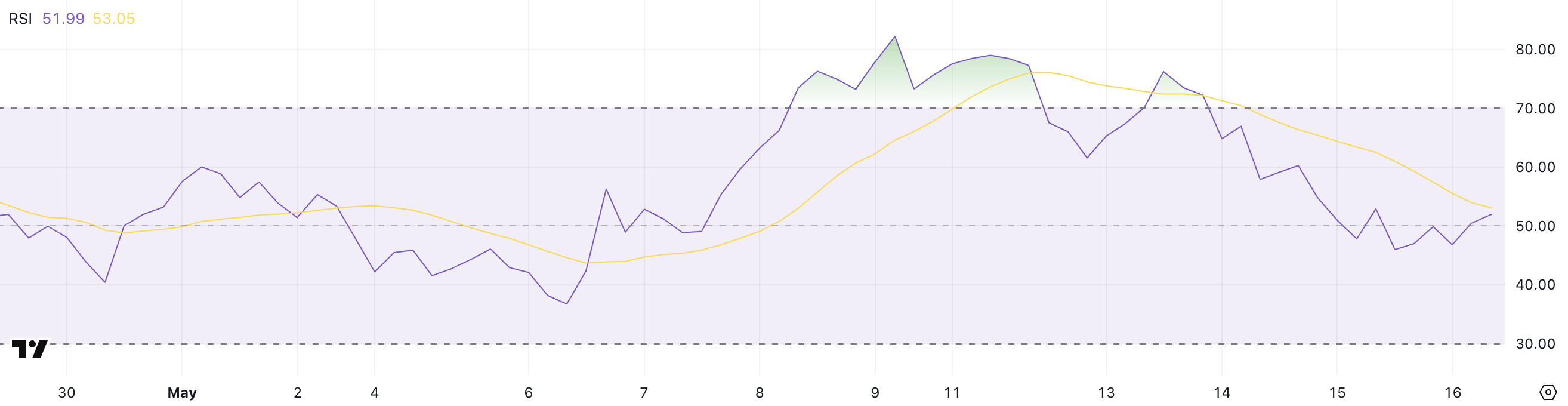

Solana’s Relative Strength Index (RSI) has dropped to 51.99, down from 66.5 just three days ago, signaling a clear loss of bullish momentum.

Over the past few days, the RSI has hovered between 44 and 50, reflecting a more neutral market sentiment after previously nearing overbought conditions.

This shift suggests that traders are more cautious, and recent gains may be cooling off.

The RSI is a momentum indicator that ranges from 0 to 100, with values above 70 indicating overbought conditions and below 30 signaling oversold territory. At 51.99, Solana sits in the neutral zone, which typically suggests a period of consolidation or indecision.

If the RSI rises above 60 again, it could point to renewed bullish strength; if it dips below 45, further downside pressure may follow.

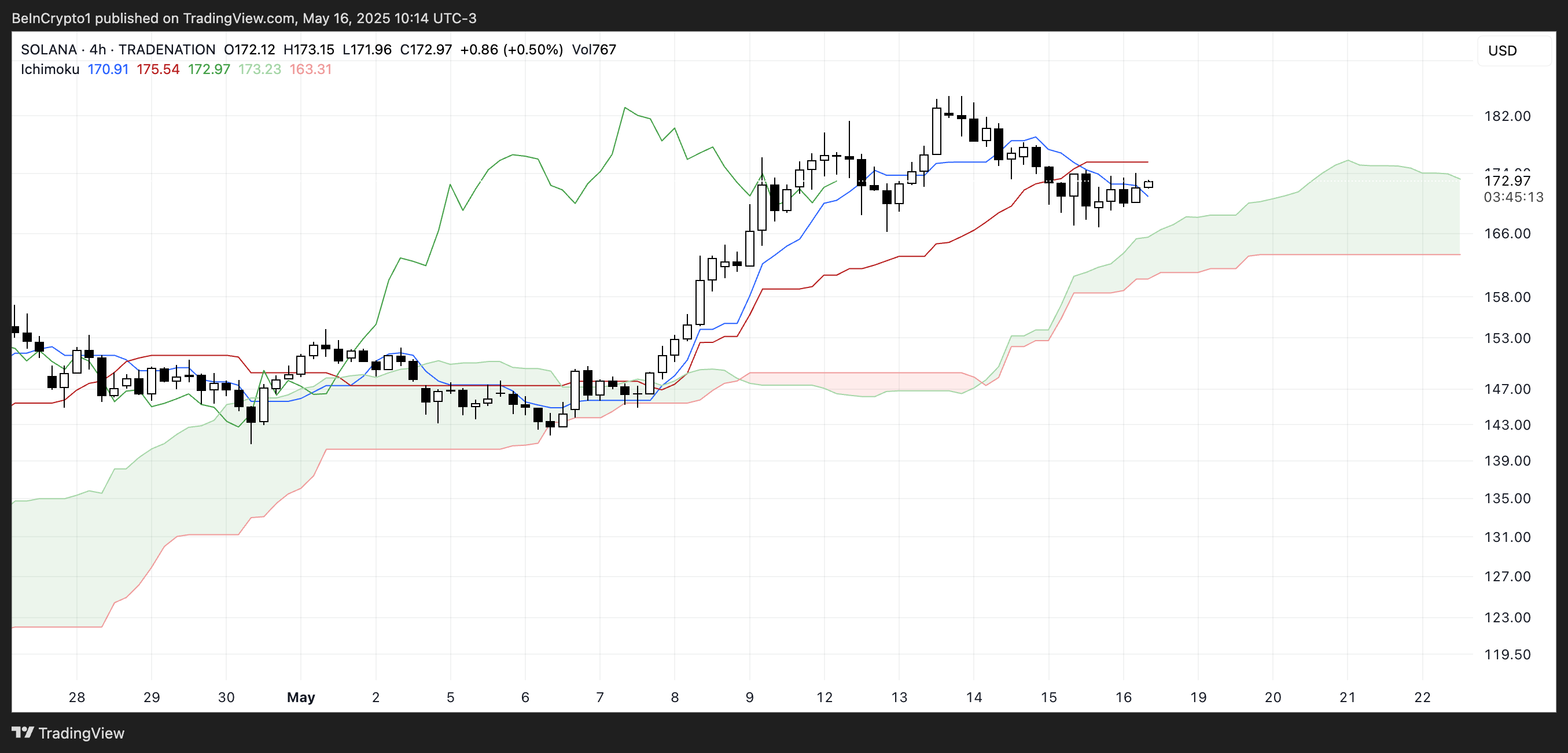

Solana’s Ichimoku Cloud chart shows a period of consolidation following a strong uptrend, with key signals now suggesting indecision.

The price is hovering NEAR the Kijun-sen (red line) and Tenkan-sen (blue line), both of which have started to flatten—indicating a slowdown in momentum.

The Chikou Span (green lagging line) remains above the candles, suggesting that the broader trend still has a bullish bias. However, the lack of distance between it and the current price action reflects weakening strength.

The Kumo Cloud (green and red shaded area) ahead is still bullish, with the leading span lines spread apart, providing support beneath the current price.

However, with candles now closely interacting with the Kijun-sen and failing to strongly break above the Tenkan-sen, the short-term sentiment appears cautious.

If the price can push decisively above the blue line, momentum may return, but any drift into the cloud could signal the start of a more prolonged consolidation phase or potential trend reversal.

Solana’s Bullish EMA Structure Faces Momentum Slowdown

Solana’s EMA lines remain bullish, with the short-term moving averages positioned above the longer-term ones. However, the gap between these lines is narrowing, suggesting that upward momentum is weakening.

Solana price recently failed to break past a key resistance level, and although a retest could open the path toward reclaiming the $200 zone, the lack of strong follow-through raises questions about the trend’s strength.

Complementing this cautious outlook, the Ichimoku Cloud and RSI indicators point to a potential cooldown. Solana recently held above an important support level but remains vulnerable—if that support breaks, further downside could follow.

The broader structure still leans bullish, but the market appears to be at a crossroads. The next MOVE likely depends on whether buyers can reclaim initiative or sellers push through key lower levels.