Made in USA Crypto Gems Heating Up This Weekend – 5 Tokens Breaking the Mold

Wall Street’s playing catch-up while homegrown crypto projects quietly eat their lunch. Here’s what’s moving as traders pivot stateside:

1. The DeFi Disruptor: One token’s governance overhaul just flipped the script—yield farmers are piling in despite the SEC’s usual grumbling.

2. The Privacy Play: Zero-knowledge proofs meet US regulatory nods. Ironic, considering DC still can’t define ’crypto’ properly.

3. The Stablecoin Upstart: Forget Tether’s murky reserves—this audited dollar peg actually passes the smell test.

4. The Meme Coin Gone Legit: Started as a joke, now processing more TXs than some Layer 1s. Dogecoin who?

5. The Energy Token: Proof-of-work that doesn’t make environmentalists scream? Even Goldman’s research desk is quietly taking notes.

Betting against American innovation hasn’t worked since 1776—but maybe hedge with some dry powder for the inevitable 20% weekend swing.

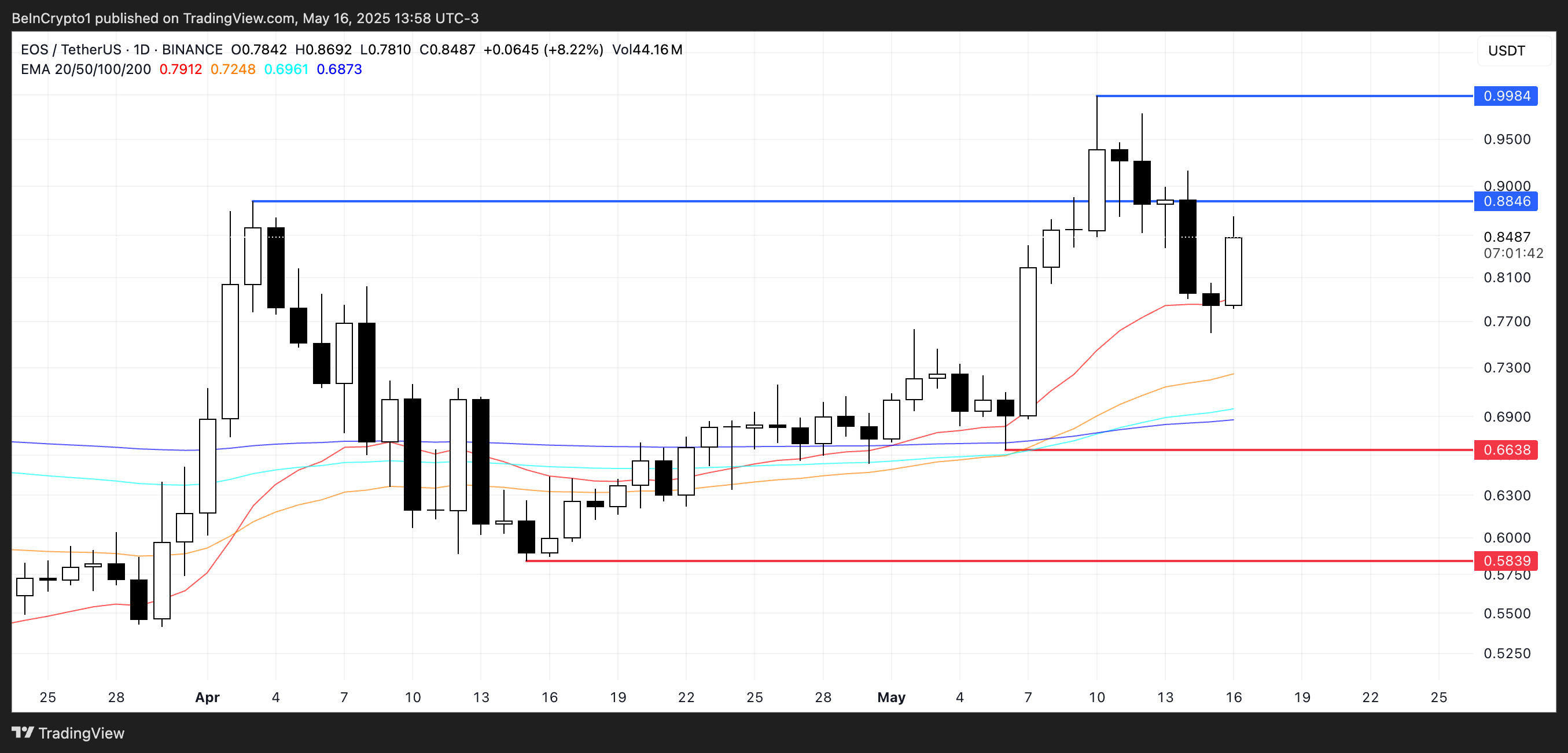

EOS

EOS is up nearly 7% in the last 24 hours, sparked by World Liberty Financial’s surprise $3 million purchase of the token. The move has stirred controversy across the crypto community, especially given WLFI’s recent $125 million loss from allegedly selling ETH at a local bottom.

While some have raised concerns about potential market manipulation, there’s currently no hard evidence of foul play. EOS, which has spent much of the past year trading below $0.50, briefly surged over 9% following the news, reigniting interest in a project many considered dormant.

Technically, if bullish momentum persists, EOS could break above the key resistance level at $0.88. A clear breakout there may open the door for a run toward the psychological $1 mark.

However, if sentiment shifts and the rally fades, EOS could retest support at $0.663. A break below that WOULD likely trigger further downside, potentially dragging the token back toward the $0.58 region.

Ondo Finance (ONDO)

Real-world asset (RWA) tokenization is gaining serious momentum. The sector reached an all-time high of $22.5 billion, up 5.87% in the last 30 days.

Private credit accounts for $13.1 billion of the total, highlighting growing institutional interest in bridging TradFi with blockchain infrastructure.

Amid this surge, ONDO has emerged as one of the largest players in the RWA space, despite its token price slipping over 3% in the past 24 hours. Still, ONDO is up 16.2% over the last month, reflecting sustained investor confidence in the narrative.

Looking ahead, if bullish sentiment returns, Ondo could test resistance at $1.04. A breakout above that level may push the price toward $1.20.

However, if the correction deepens, the token faces key support levels at $0.86 and $0.819.

Should the downtrend accelerate, ONDO may fall further to $0.73 or even $0.663, making short-term price action heavily dependent on whether the broader HYPE around RWA and Made in USA coins continues or fades.

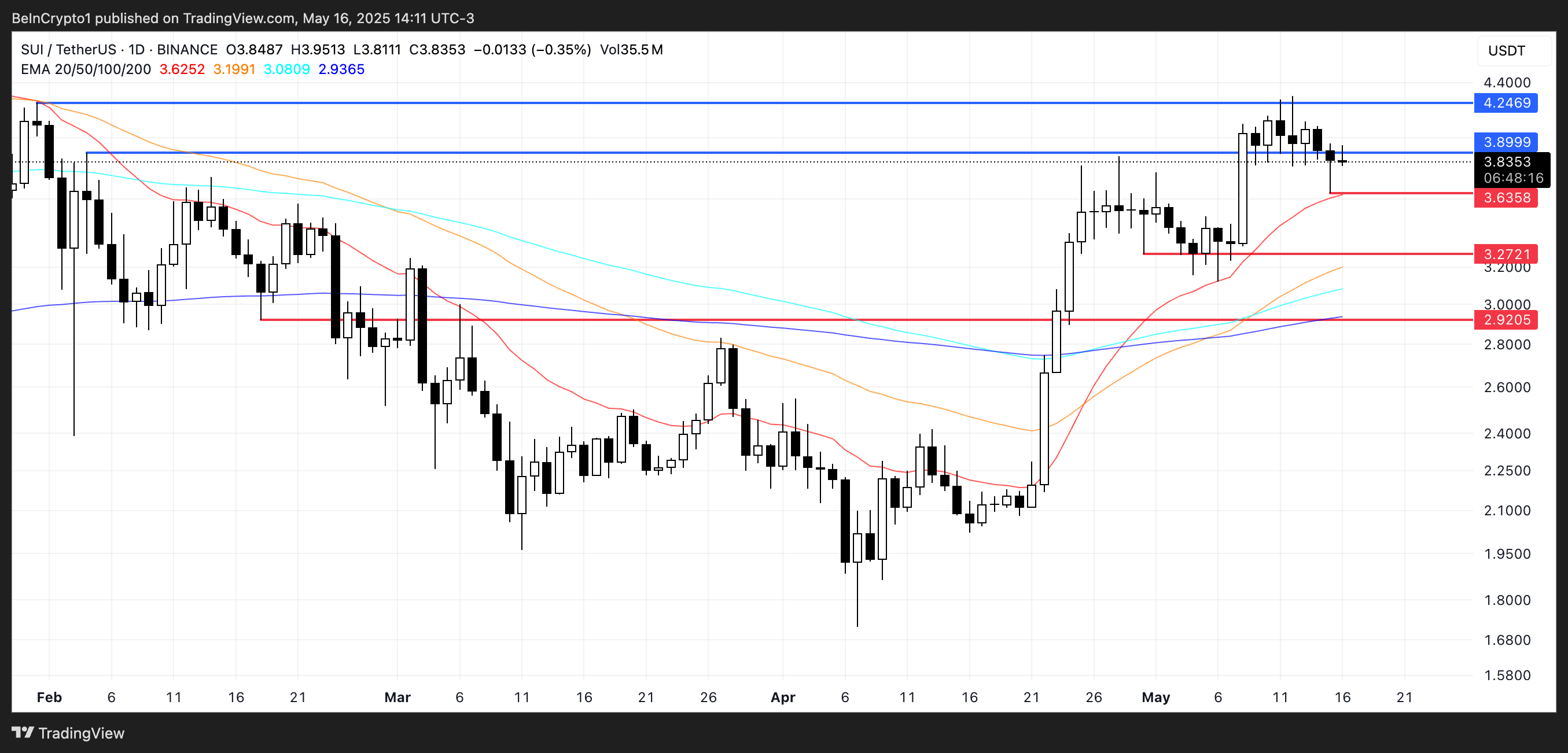

SUI

SUI has been gaining traction in recent months thanks to its growing meme coin ecosystem and expanding DEX infrastructure.

While its DEX volume surged 36.7% over the past week, it recorded the smallest increase among the top eight chains and currently ranks sixth in total DEX volume.

Despite this, market interest remains strong, with sui up 83% in the last 30 days—though it has cooled slightly, slipping 1.25% over the past week.

Technically, SUI’s EMA lines still indicate bullish momentum.

If buyers regain control, the token could test resistance at $3.89, and a breakout there may open the path toward $4.24.

On the downside, if SUI fails to hold support at $3.63, the next targets are $3.27 and potentially $2.92 in the event of further selling pressure.

Kaspa (KAS)

Kaspa (KAS) has delivered strong performance recently, climbing 18.5% in the last seven days and 56.7% over the past month. Its market cap now stands at $3.17 billion, even as 24-hour trading volume has dipped by 20% to $99.38 million.

EMA indicators suggest a potential golden cross formation, which could signal further upside. If momentum continues, KAS may test resistance at $0.155, and a successful breakout could push the price toward $0.188, making it one of the most interesting Made in USA coins for the weekend.

However, if the trend weakens, key support levels lie at $0.114 and $0.103. Losing those could trigger a deeper correction, with downside targets as low as $0.082.

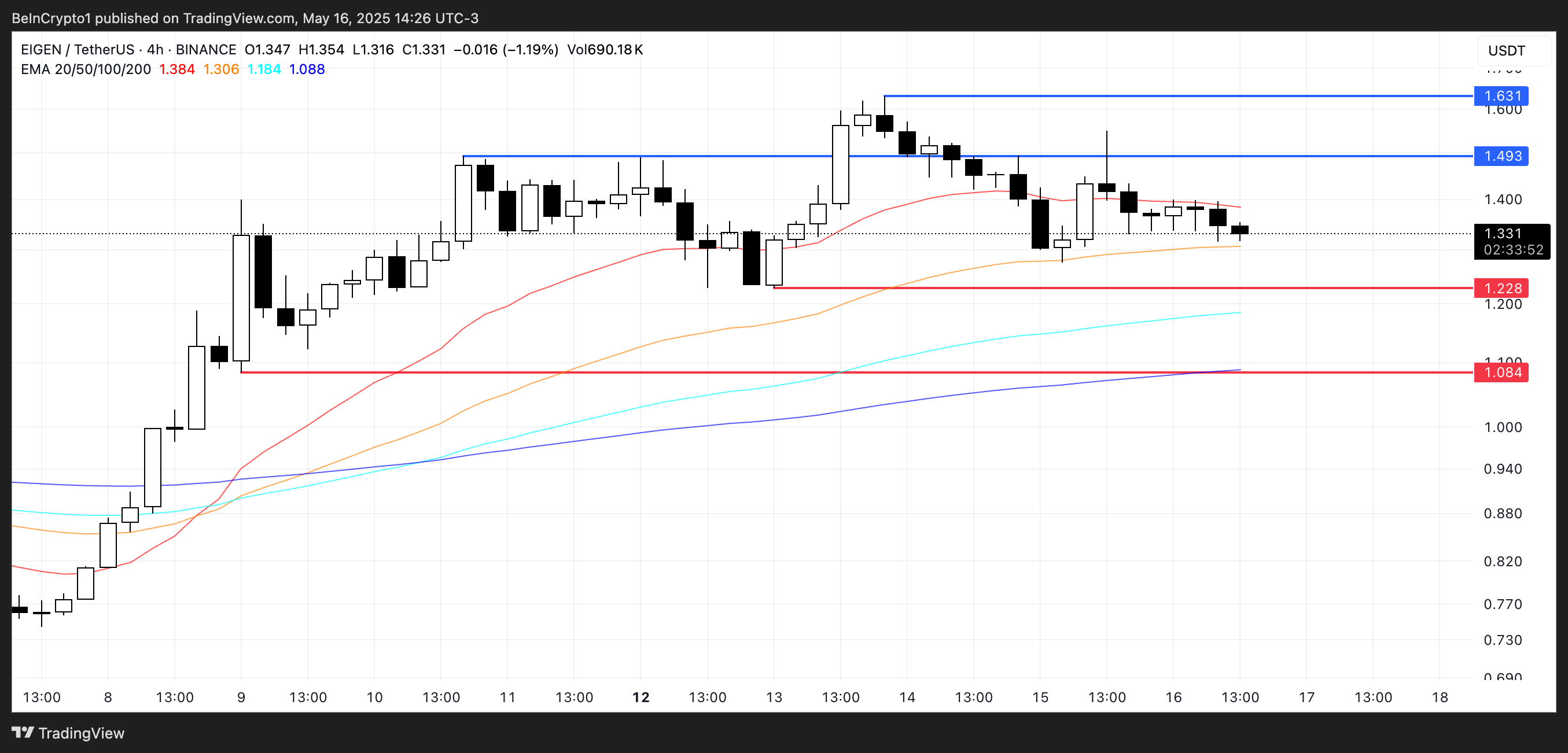

Eigenlayer (EIGEN)

EigenLayer (EIGEN) has seen mixed price action this week—up 16% over the past seven days, but down 11% in the last 24 hours alone.

The recent drop pushed its price below $1.40 and dragged its market cap under the $400 million mark, signaling a potential cooldown after last week’s rally.

Despite the pullback, EIGEN’s EMA lines remain in a bullish formation. If the downtrend continues, the token may test key support at $1.22, with further downside possible toward $1.084 if that level fails.

However, if EigenLayer regains its prior momentum, it could retest resistance at $1.49, and a breakout there may pave the way for a MOVE toward $1.63.