HBAR Dips—But Traders Double Down on Hedera’s Long Game

Hedera’s native token takes a breather after its rally, yet derivatives data reveals stubborn bullish positioning. Here’s the breakdown.

The cold hard numbers: Open interest holds near record highs despite 18% pullback from last week’s peak—classic ’buy the rumor, sell the news’ behavior gets flipped on its head.

Why the conviction? Enterprise adoption metrics (hi, BlackRock) keep accumulating like a banker’s bonus. Network upgrades slashing transaction fees to $0.0001 don’t hurt either.

The kicker: HBAR futures funding rates stayed positive even during the cooldown. Translation? Crypto degens are paying premiums to maintain leverage—a rarity in altcoin land.

Meanwhile, traditional finance still can’t decide if blockchain is a threat or a spreadsheet upgrade. Place your bets.

Hedera Traders Bet on Upside

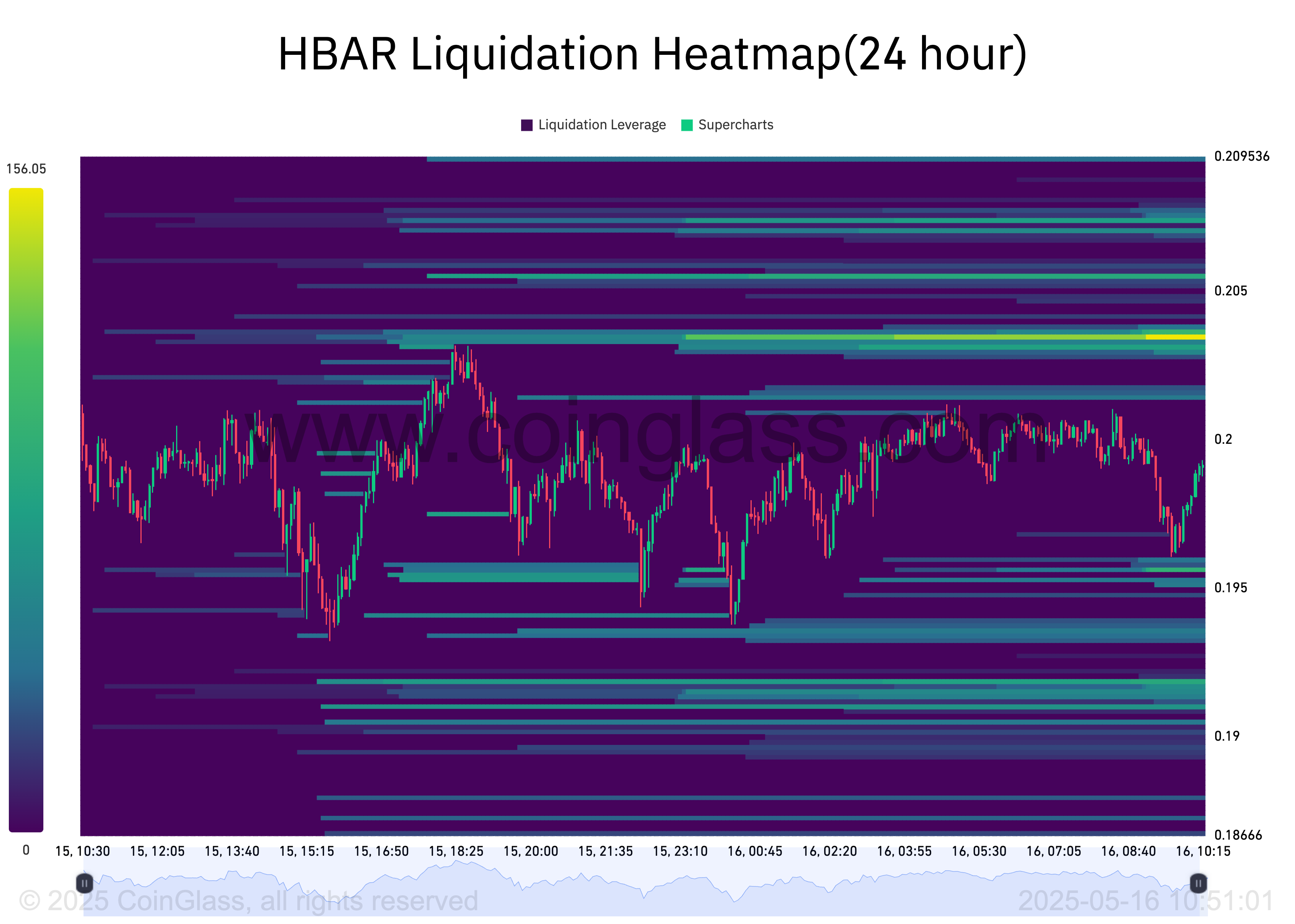

HBAR’s liquidation heatmap indicates a significant concentration of liquidity at the $0.203 price region. Traders use liquidation heatmaps to identify areas where large numbers of Leveraged positions are likely to be liquidated if the price reaches certain thresholds.

Such zones often act as magnets for price action, as the market tends to MOVE toward these areas to trigger liquidations and allow fresh positions to open.

Therefore, for HBAR, the concentration of significant liquidity at the $0.203 price region indicates a strong interest from traders to buy or close short positions around that level. This sets the stage for a potential price rally in the near term.

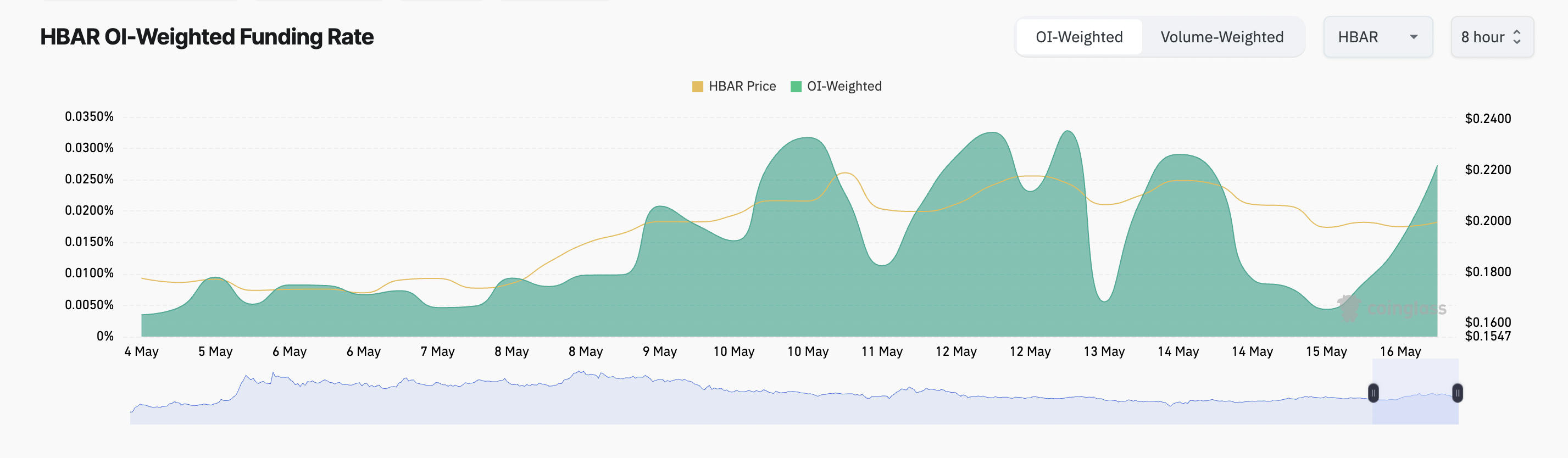

Furthermore, HBAR’s funding rate remains positive amid its lacklustre price performance. At press time, it stood at 0.027%, reflecting ongoing demand for long positions.

The funding rate is a periodic payment exchanged between traders holding long and short positions on perpetual futures. It is designed to keep the contract price close to the underlying asset’s spot price.

When its value is positive like this, long traders pay those holding short positions, a bullish signal suggesting they expect prices to rise.

HBAR Eyes $0.23 as Buying Pressure Builds

On the daily chart, the slight uptick in HBAR’s Chaikin Money FLOW (CMF) today confirms the resurgence in buying pressure. At press time, the CMF sits at 0.06.

This indicator measures the Flow of money into and out of an asset. A positive CMF value indicates that buying volume outweighs selling volume, signaling investor accumulation.

For HBAR, this trend reinforces the idea that demand for the token is strengthening despite recent price consolidation. If this continues, the token’s price could climb to $0.23.

However, HBAR’s price could break below $0.19 if selling pressure gains momentum.