US States Drop $632M on Strategy’s Stock—Just in Time for Q1 2025 Volatility

State treasuries just made a $632 million bet on Strategy’s stock—because nothing says ’prudent fiscal management’ like chasing Q1 performance.

Active allocation or desperate FOMO? The move comes as public pension funds scramble to hit unrealistic return targets. Meanwhile, retail investors get memes and margin calls.

Bonus cynicism: At least they didn’t YOLO it into a degen crypto farm. This time.

US States’ Combined MSTR Holdings Reach $632 Million

Bitcoin Laws founder, Julian Fahrer, highlighted the disclosure on X (formerly Twitter). The states increased their MSTR exposure by approximately 91.5% compared to their reported holdings of $330 million in Q4 2024.

“A collective increase of $302m in one quarter. The average increase in holding size was 44%,” Fahrer wrote.

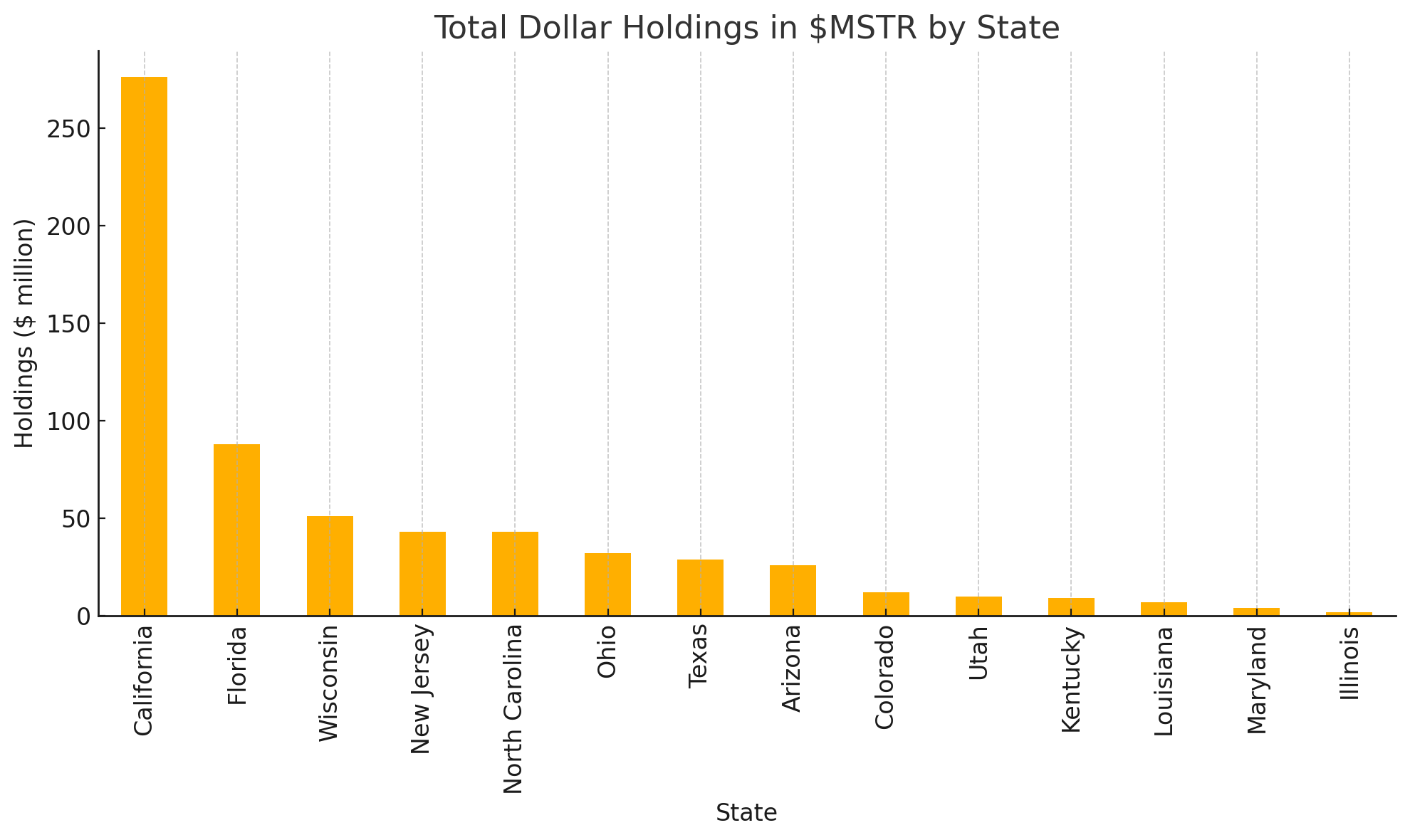

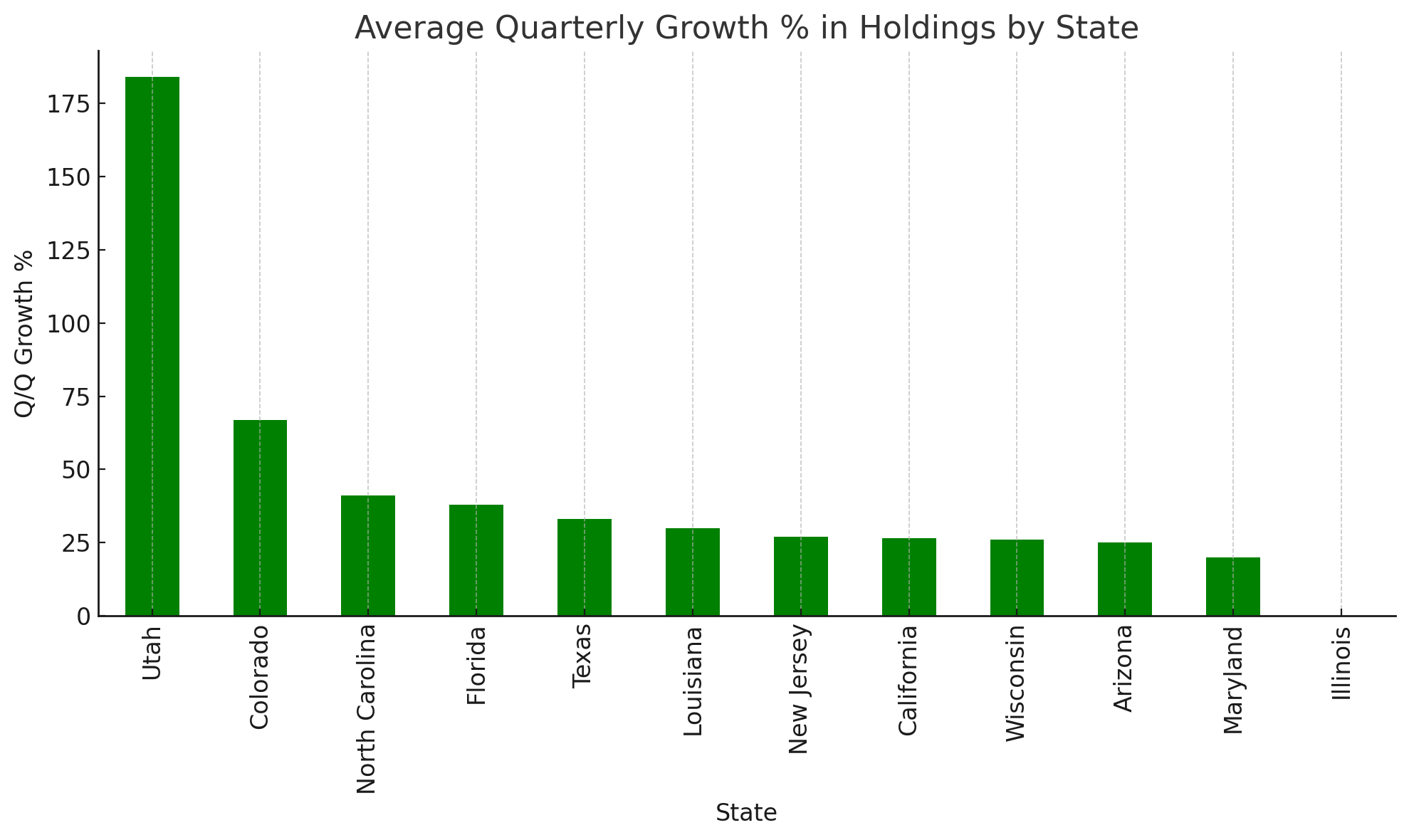

California stands out as the largest investor. The state holds $276 million in MSTR shares across two major funds: the State Teachers’ Retirement System (CalSTRS) and the Public Employees Retirement System.

CalSTRS holds 336,936 shares, reflecting an 18% growth. In addition, the Public Employees’ Retirement System holds 357,183 shares. It increased its stake by 35%, adding 92,470 shares in Q1 2025.

Florida follows with holdings worth $88 million in the State Board of Administration Retirement System. This represents 221,860 shares and a 38% quarterly growth. North Carolina and New Jersey both have $43 million in MSTR. The former’s Treasurer manages 107,925 shares, and quarterly growth was 41%.

In New Jersey, the Police and Firemen’s Retirement System holds 33,628 shares (40% growth). The Common Pension Fund D has 76,615 shares (14% growth).

Arizona, where the governor recently vetoed a bitcoin reserve bill, has continued stockpiling MSTR. Its holdings have grown by 25%. As of the latest data, it holds 66,523 MSTR shares ($26 million).

Wisconsin’s Investment Board holds 127,528 shares valued at $51 million, growing 26% in the last quarter. The growth points to increased confidence in MSTR.

Yet, the Investment Board’s decision to fully divest from BlackRock’s iShares Bitcoin Trust (IBIT) highlights a cautious approach toward certain crypto investments. According to the latest 13 F filing, in Q1 2025, the board offloaded its entire $300 million stake in IBIT.

“Surprising that State of Wisconsin Investment Board sold their Bitcoin ETF shares for a couple of reasons. One being that they still have a $50 million position in MSTR,” Fahrer said.

Notably, despite holding a more modest 25,287 shares valued at $10 million, Utah has the highest quarterly growth rate of 184%, indicating rapid recent accumulation.

Colorado comes in next, with a strong quarterly growth of 67%. The state’s Public Employees Retirement Association holds 30,567 shares worth $12 million.

Meanwhile, MSTR itself has seen strong gains in 2025. According to Yahoo Finance data, its value has appreciated by 37% year-to-date.

In fact, with Bitcoin’s recent rally, MSTR prices climbed to $430 on May 9, marking its highest price since December 16, 2024. Nonetheless, the stock fell 19.7% over the past day, closing at $397.