USDT’s Supply Surge and Shrinking Dominance—Liquidity Powder Keg for Crypto’s Next Rally?

Tether’s printing press is running hot—USDT supply just hit another ATH while its market share slips. Here’s why that paradox might light the fuse.

Liquidity Tsunami Meets Altcoin Hunger

More USDT in circulation means more dry powder sloshing into crypto markets. But with stablecoin dominance dropping, traders aren’t just parking funds—they’re rotating into alts. Classic risk-on behavior.

The Institutional Angle

Whales use USDT as their on-ramp of choice (because nothing says ’decentralization’ like a centralized stablecoin). Now they’re deploying capital faster than a hedge fund chasing last quarter’s performance.

Watch the On-Chain Signals

Exchange inflows spiking? That’s USDT moving off sidelines. Stablecoin swaps increasing? The altcoin pump is coming. Just don’t ask about the audit quality—some miracles require faith.

Bottom line: When the stablecoin hydrant opens but dominance falls, history shows what follows. Whether it’s smart money or dumb liquidity hardly matters—price action cuts through both.

USDT Trends Suggest Crypto Bull Run Could Continue

According to data from CoinMarketCap, Tether’s market capitalization has reached a new all-time high, surpassing $151 billion.

Yesterday, Tether injected $1 billion USDT into the market. In total, the company issued $2.5 billion USDT in May alone. Since the beginning of the year, USDT’s market cap has increased by $13 billion, nearly a 10% rise.

“Over the past 20 days, $6 billion in cash has been injected into the market through newly issued USDT. Tether’s current market capitalization stands at $150 billion,” analyst Axel Adler Jr said.

Currently, USDT accounts for 62.4% of the total stablecoin market, reaffirming its dominant position. Notably, the amount of USDT issued on the TRON network has exceeded $73 billion, surpassing ethereum and making TRON the leading platform for USDT distribution.

The rising market cap of USDT serves as a strong indicator of potential buying power. When USDT’s capitalization grows, it suggests a large amount of capital is waiting to be deployed into other crypto assets. This means that even if crypto prices decline, the market could recover quickly thanks to this incoming capital.

Another bullish signal is the decline in the USDT Dominance index (USDT.D), which measures USDT’s market share relative to the total crypto market cap.

Data from TradingView shows that USDT.D has dropped from 6% in April to 4.6% at press time.

The decline in USDT.D suggests that investors are using their USDT to buy other crypto assets, such as Ethereum (ETH) or altcoins. This behavior reflects a bullish sentiment in the market. Investors seem more willing to take on risk in search of higher returns, rather than keeping funds in stablecoins as a SAFE haven.

“When Bitcoin dominance drops while Ethereum’s market share rises, it indicates that part of the USDT flow is moving into altcoins,” Axel Adler Jr. added.

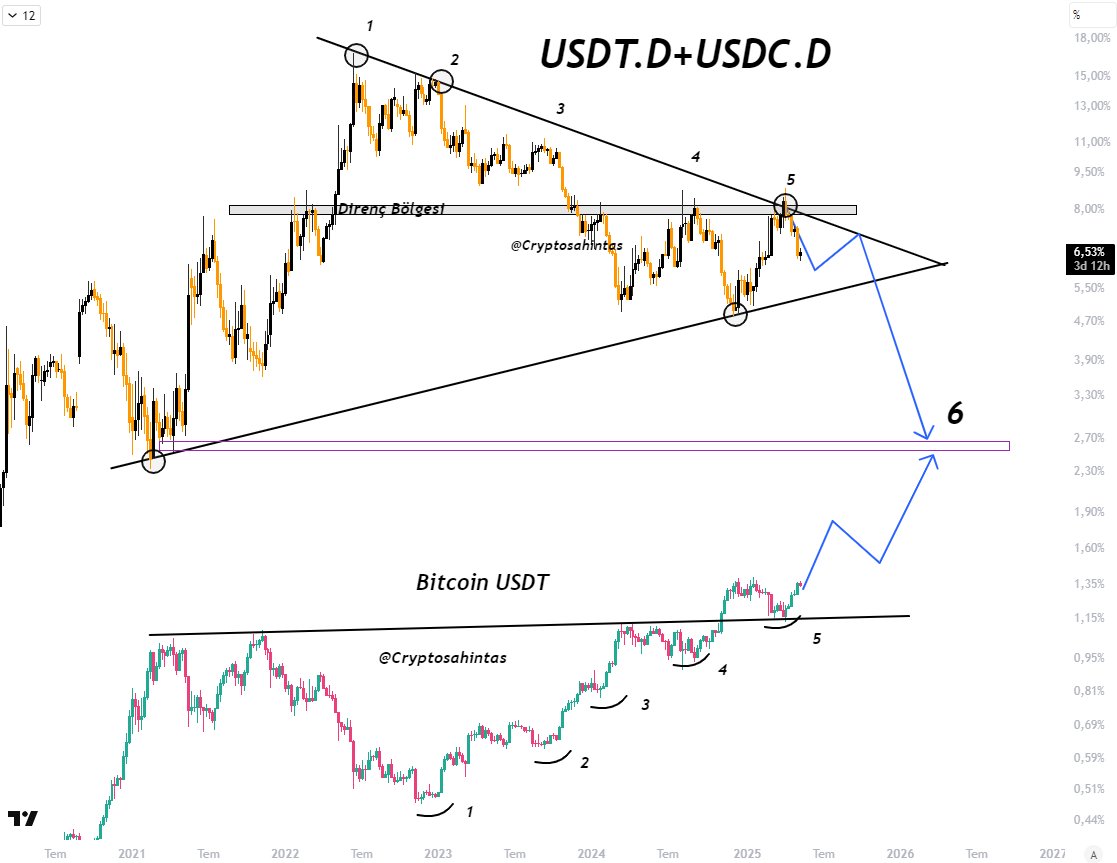

Additionally, analyst Cryptosahintas offered deeper insight by analyzing both USDC.D and USDT.D indices. He believes the combined ratio will continue to drop, which WOULD further support Bitcoin’s bullish momentum in the future.

“The dominance of Tether is gradually decreasing. I expect Bitcoin to continue its upward trajectory. Liquidity is slowly shifting toward riskier assets,” Cryptosahintas predicted.

With USDT’s market cap reaching a record high and USDT Dominance trending downward, the crypto market is showing strong signals of a potential new bull run.

However, historical data shows a lag in impact. From January to April, Tether’s market cap grew from $137 billion to $144 billion, but Bitcoin’s price still fell from $110,000 to under $75,000. This delay complicates timing predictions and highlights the challenges of interpreting market signals in real time.