Bittensor (TAO) Loses Steam After 6.5% Weekly Rally—Can the AI Token Regain Momentum?

TAO’s recent gains are sputtering as the AI-focused crypto struggles to hold ground. The token briefly flirted with recovery before facing resistance—classic ’buy the rumor, sell the news’ behavior from traders chasing the next shiny thing.

Despite the pullback, Bittensor’s decentralized machine-learning network still has believers. But in a market where ’narrative coins’ rise and fall faster than a VC’s attention span, TAO needs more than hype to sustain its uptrend.

Watch for a decisive break above key resistance levels... or prepare for another round of ’wait-and-see’ from crypto’s notoriously impatient investors.

Bittensor Trend Weakens as Bearish Momentum Overtakes Bulls

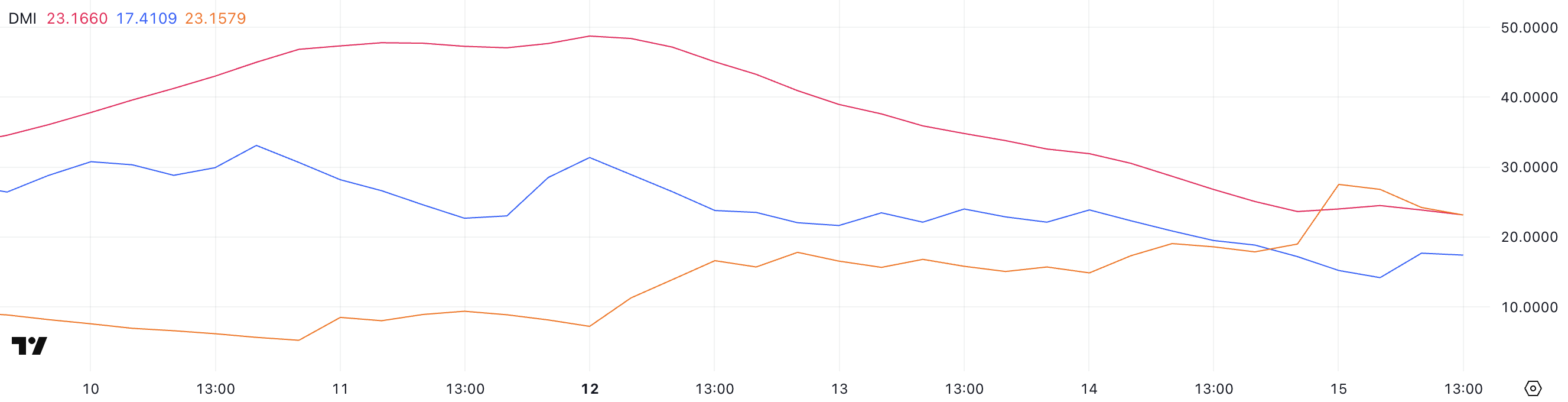

TAO’s DMI (Directional Movement Index) chart shows a weakening trend, with its ADX (Average Directional Index) falling sharply from 47 to 23.16 over the past three days.

The ADX measures the strength of a trend—regardless of direction—on a scale from 0 to 100. Values above 25 typically indicate a strong trend, while readings below 20 suggest a weak or ranging market.

TAO’s current ADX is just above 23, suggesting the recent trend is losing strength and may be nearing a transition phase. Despite that, according to CoinGecko data, Bittensor is the biggest artificial intelligence coin in the market, surpassing players like NEAR, ICP, and RENDER.

Meanwhile, the +DI (Positive Directional Indicator) has dropped from 23.87 to 17.41, signaling a decline in bullish pressure. At the same time, the -DI (Negative Directional Indicator) has risen from 17.86 to 23.15, showing that bearish momentum is gaining control.

This crossover—where -DI moves above +DI—indicates that sellers have overtaken buyers, and with ADX still above 20, the downtrend may continue to develop.

If this divergence persists, TAO’s price could face further downside pressure in the short term unless bulls re-enter to shift the momentum.

TAO Recovers but Lacks Clear Strength

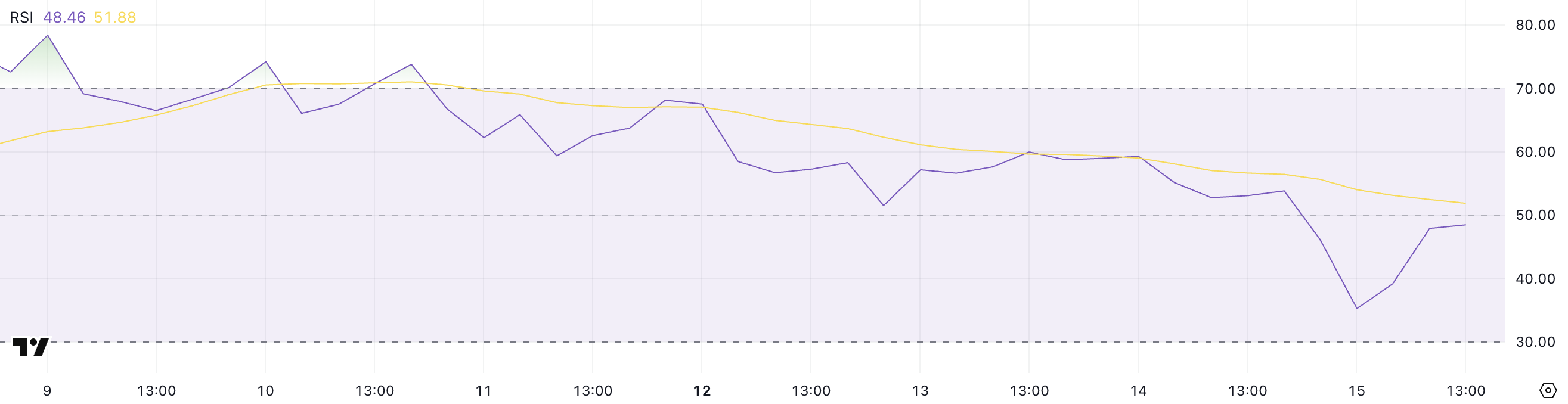

TAO’s Relative Strength Index (RSI) is currently at 48.46, after experiencing a sharp intraday dip from 53.82 yesterday to as low as 35.25 just a few hours ago.

The RSI is a momentum indicator that measures the speed and magnitude of recent price movements on a scale from 0 to 100. Typically, values above 70 suggest overbought conditions and potential for a pullback, while values below 30 indicate oversold conditions and a possible rebound.

Readings between 30 and 70 are considered neutral, with the 50 mark often acting as a balance point between bullish and bearish momentum.

TAO’s current RSI of 48.46 places it slightly below that midpoint, signaling a mild bearish bias after a brief period of stronger selling pressure.

The recovery from the 35.25 low shows that buyers have stepped back in, but the failure to hold above 50 suggests that bullish momentum remains weak. This level could reflect consolidation or indecision in the market, where TAO may trade sideways unless new catalysts emerge.

If RSI stabilizes or climbs above 50 again, it may indicate renewed strength, while another drop toward 30 WOULD increase the risk of further downside.

TAO Holds Support but Faces Key Test for Momentum Recovery

TAO recently tested key support around $417.6 and bounced back above $440, showing resilience after a brief dip. Its EMA lines still reflect a bullish structure, with short-term moving averages positioned above the long-term ones.

However, the narrowing gap between them suggests that momentum is weakening. If selling pressure returns, the trend could shift, threatening Bittensor’s leadership as the biggest AI coin.

If Bittensor regains strength, it could aim for a retest of the $492.79 resistance area, which would fully recover recent losses.

On the downside, failure to hold the $434 and $417.6 support levels would put TAO at risk of entering a sharper downtrend.

A break below these zones could drag the price down toward $380, pushing TAO below $400 for the first time in roughly one week.