Solana’s Golden Cross Nears—$200 Breakout Could Spark 50% Surge

Solana flirts with a bullish golden cross as it approaches $200—a technical formation that historically precedes major rallies. Traders are eyeing a potential 50% upside if the pattern confirms.

Why it matters: When the 50-day moving average crosses above the 200-day (that ’golden cross’), it’s like Wall Street’s version of a horoscope—sometimes eerily accurate, sometimes pure astrology. But in crypto? It’s enough to trigger a frenzy of leveraged longs.

Zoom out: SOL needs to hold above $185 to maintain momentum. A clean breakout past $200 could confirm the uptrend—assuming the usual suspects (macro conditions, Bitcoin’s mood, and a certain ETF issuer not tweeting nonsense) don’t intervene.

Bottom line: In a market where ’technical analysis’ often means ’guessing with lines,’ Solana’s chart is actually starting to look interesting. Just remember—past performance is no guarantee of future results (said every compliance officer ever).

Solana Shows Potential

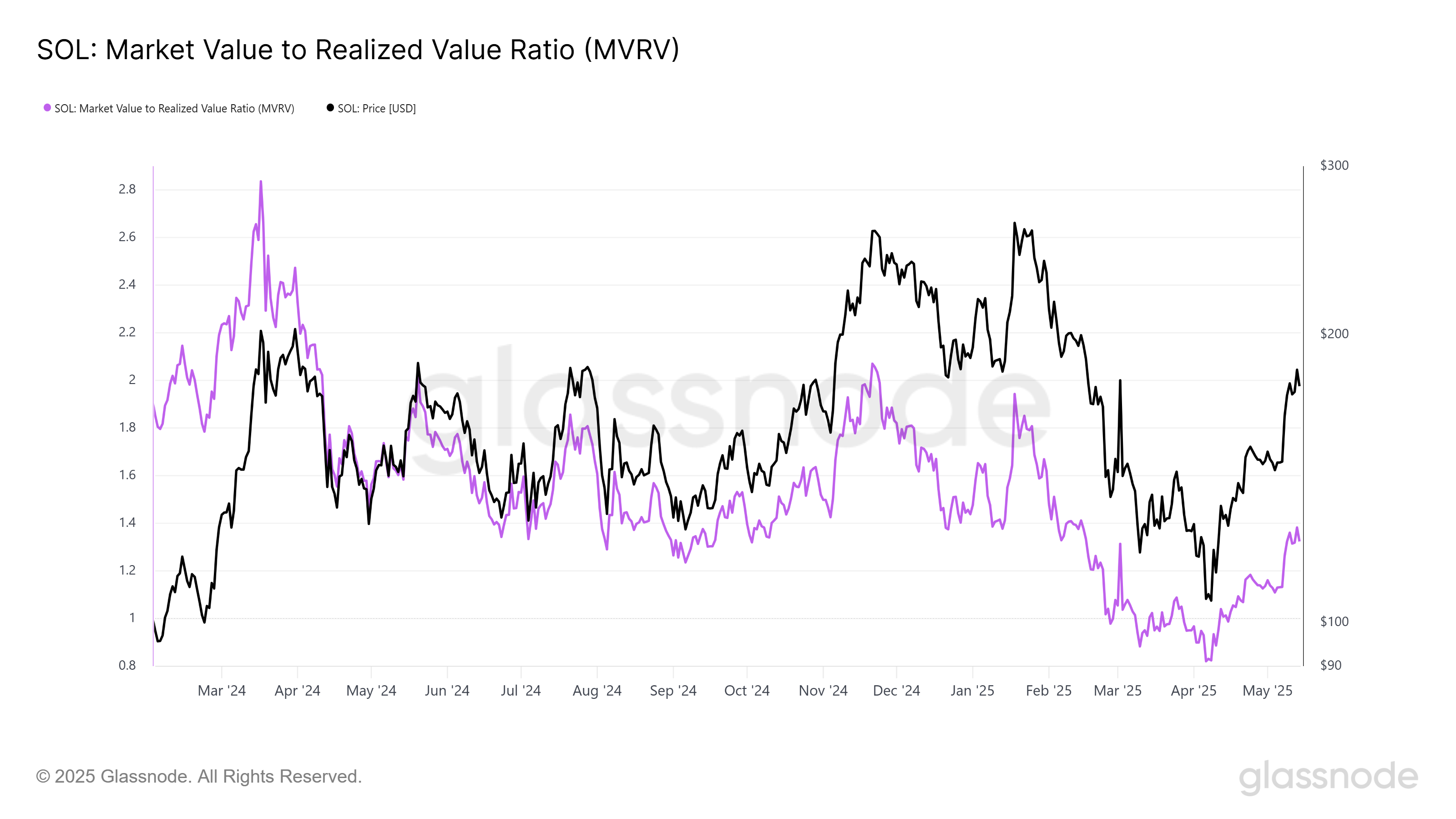

The MVRV ratio for solana currently stands at 1.3, indicating the token is far from overbought. Historical data shows an overbought threshold near 1.8, suggesting Solana has room to grow before facing a potential price correction. This positions SOL for further upward movement without immediate risk of reversal.

Investors can find reassurance in this metric, as it suggests the altcoin’s recent gains are sustainable. The healthy MVRV ratio indicates Solana’s price growth is supported by fundamentals rather than speculative excess, reducing the likelihood of a sharp pullback.

Technical indicators highlight a significant shift in Solana’s momentum. The 50-day exponential moving average (EMA) is about to cross above the 200-day EMA, ending a death cross that lasted over two months. This crossover will confirm a Golden Cross, a bullish signal often followed by extended upward trends.

The previous Golden Cross for Solana lasted nearly 17 months, driving substantial price appreciation. While this new bullish phase might be shorter, it could still provide a solid foundation for gains in the near to mid-term, attracting increased investor interest.

SOL Price Faces Resistance

Currently, Solana trades around $172 and is facing resistance at $178. Successfully flipping this resistance into support is crucial for the altcoin to MOVE past $201. Given the positive momentum indicators, a rally in the coming days appears likely.

The macro target for Solana is a 51% rise, reaching $262 by the end of Q2. Achieving this WOULD recover losses seen in early 2025 and position SOL to challenge its all-time high beyond $295. However, securing $221 as a support is a key step to sustaining this upward move.

Conversely, if broader market conditions weaken, Solana may fail to breach the $200 level. This could lead to a decline back to $161 or even $148, negating the bullish thesis and putting the ongoing uptrend at risk.