Fluid DEX Under Fire as ETH Swings Expose Rebalancing Gaps

Decentralized exchange Fluid faces mounting criticism as traders report liquidity pool instability during Ethereum’s latest volatility spike. The platform’s automated rebalancing mechanism—touted as a ’set-and-forget’ solution—allegedly failed to adjust positions fast enough, leaving some LPs nursing losses.

Rebalancing roulette: While Fluid’s docs promise ’dynamic exposure management,’ users complain the system lags behind violent ETH price moves. One yield farmer claims a 14% slippage hit during Wednesday’s flash dip—’like watching a self-driving Tesla plow into a hedge fund’s champagne cart.’

Behind the numbers: Ethereum’s 48-hour, 22% price swing tested DEX resilience across DeFi. Fluid’s TVL dropped 9% post-event as cautious LPs pulled funds—just as Wall Street quant shops were tweeting ’risk-adjusted’ stablecoin yields (with 200-page disclaimers).

Code vs. chaos: The incident reignites debate about whether algorithmic rebalancing can ever outpace crypto’s volatility. As one developer put it: ’You can’t arbitrage market structure when the market’s having an existential crisis.’

Ethereum Volatility Triggers Losses for Fluid DEX

Fluid DEX launched in October 2024, when ETH traded around $4,400. The platform promised to generate liquidity of up to $39 for every $1 total value locked (TVL), attracting many LPs to provide liquidity to pools like USDC-ETH.

However, since early 2025, ETH’s price dropped below $1,400 at one point and now hovers around $2,550. This sharp decline caused severe impermanent losses. According to Fluid’s report, the pool’s automated rebalancing mechanism — designed to optimize profits — became the primary source of these losses.

“While the pool performs exceptionally well when prices stay within range (accruing strong fees for LPs), high volatility triggers rebalancing. This happens gradually through trades routed via the pool — from ~$3,800 to ~$1,560, and now ~$2,340. The rebalancing mechanism incurs realized losses for LPs that outweighed fee income,” Samyak Jain, co-founder of Fluid, said.

Rebalancing mechanisms in AMMs like Fluid automatically adjust the pool’s asset ratio to maintain a balanced value based on mathematical formulas. This approach ensures stable liquidity and optimizes trading fee income, especially in high-volume pools.

However, the risks are significant, particularly in volatile pools like USDC-ETH. When asset prices fluctuate heavily, they trigger impermanent loss. This means LPs may suffer losses compared to simply holding the assets outside the pool.

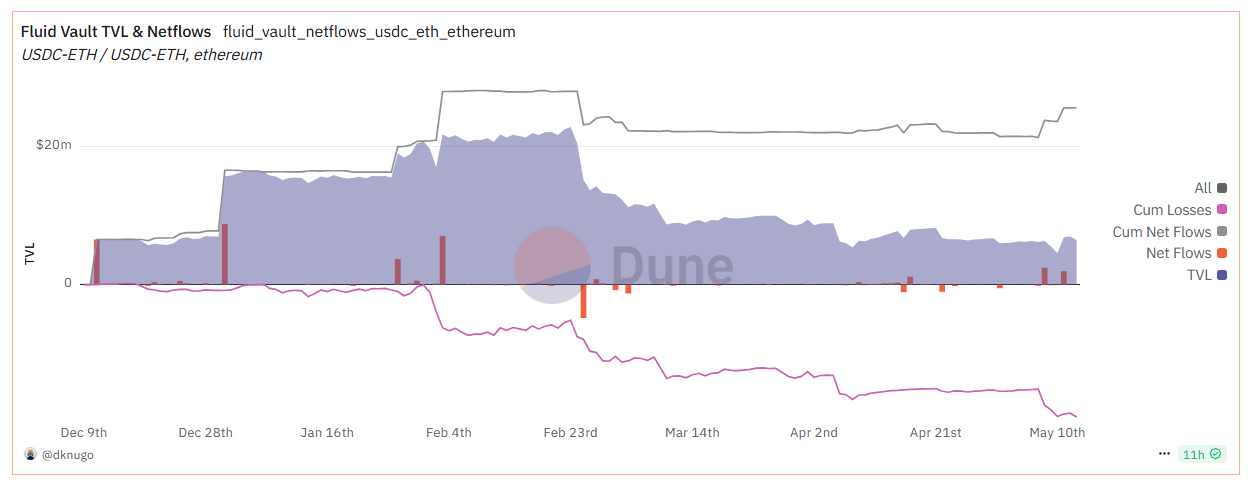

Data from Dune Analytics shows a sharp drop in Fluid Vault’s TVL. As of mid-May 2025, cumulative losses for LPs reached $19 million.

Tensions escalated when DeFi news provider DefiMoon publicly criticized Fluid and paid Key Opinion Leaders (KOLs) for failing to warn users about the rebalancing risks.

DefiMoon claimed that Fluid heavily promoted the pool, promising high yields and even suggesting it could surpass Uniswap, one of the top DEXs. However, they said the platform barely mentioned the rebalancing risks, leaving many inexperienced LPs with heavy losses.

“None of them ever mentioned rebalancing as a potential issue and I’m pretty sure neither of them put a single dollar of capital into this pool!” DefiMoon stated.

Still, Samyak Jain defended the platform. He emphasized that Fluid’s stablecoin pools are still performing well and continue to generate strong returns for LPs. He also denied the $19 million figure, claiming the ETH-USDC pool only suffered “partial loss” due to general market volatility, not due to any flaw in Fluid itself.

Fluid proposed a compensation plan to support affected LPs. It offered 500,000 FLUID tokens, worth $2.6 million, with a one-year vesting schedule.

The Fluid DEX case serves as a warning to the DeFi community. Understanding risks is crucial before providing liquidity to any pool.