XRP Crushes Competition as Open Interest Soars to 3-Month Peak

XRP just pulled off a market coup—flipping rivals as derivatives traders pile in. Open interest hits levels not seen since February, signaling either genius conviction or the usual crypto herd mentality.

Bullish bets surge while Bitcoin flatlines. Guess Wall Street’s algo-traders missed the memo on ’diversification.’

One thing’s clear: when XRP whales move, they don’t whisper. Now we wait to see if this is the prelude to a breakout... or another ’buy the rumor, sell the news’ circus.

XRP Leads Market Gains

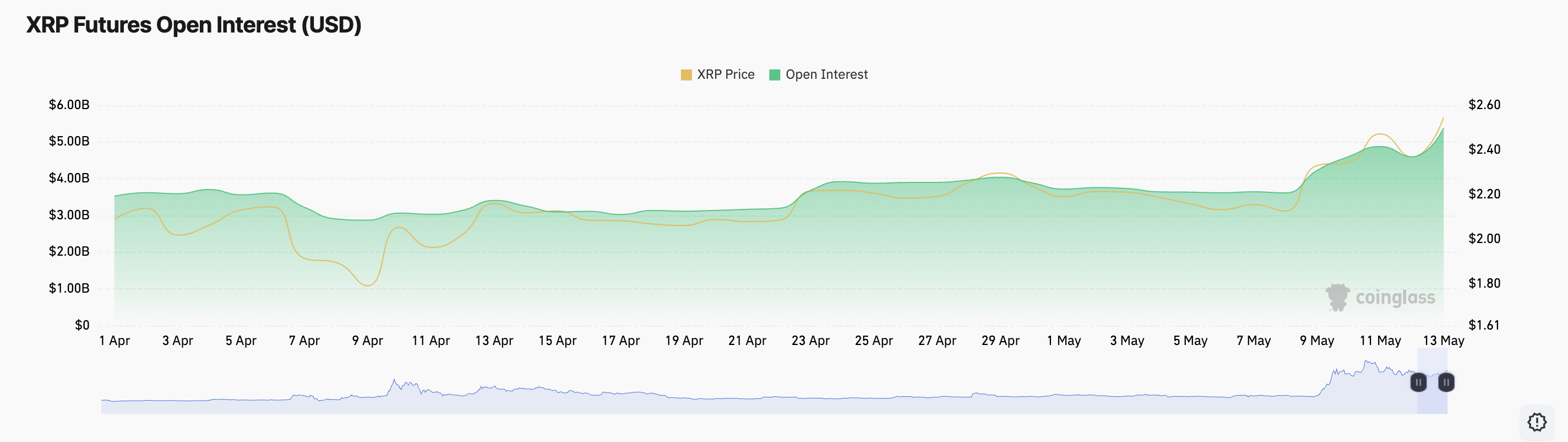

XRP’s open interest is at $5.38 billion, climbing by 17% during the review period. This surge comes despite a market cooldown, marked by a $14 billion drop in total market capitalization over the last 24 hours.

The spike in XRP’s open interest signals heightened investor engagement and growing bullish sentiment around the asset over the past day.

An asset’s open interest measures the total number of outstanding derivative contracts, such as futures or options, that have not been settled. When it rises alongside price, it indicates new money is entering the market.

In XRP’s case, the jump in both price and open interest suggests that bullish positions are increasing, reinforcing the strength of the ongoing rally.

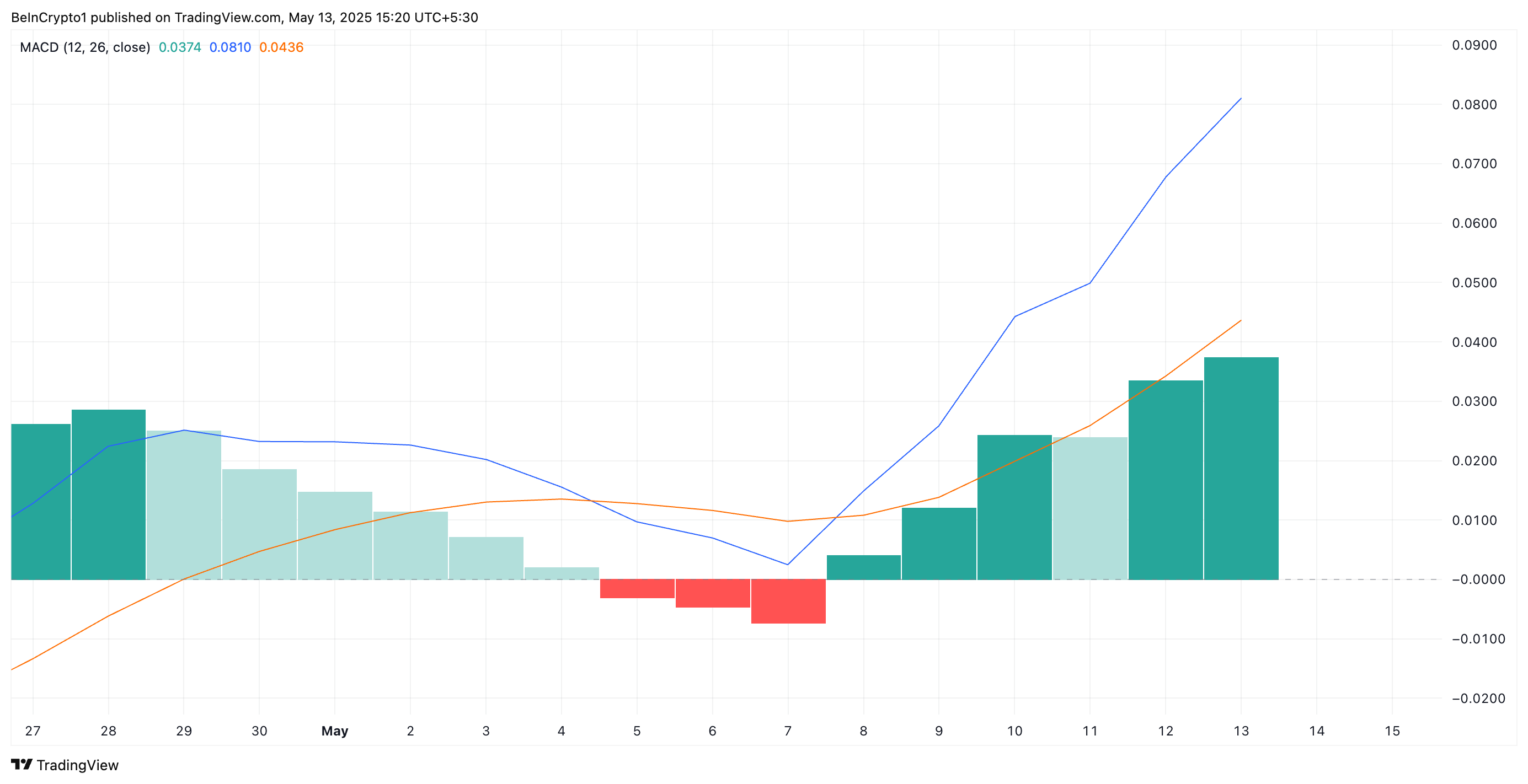

Moreover, technical indicators reinforce this bullish outlook. On the daily chart, readings from XRP’s Moving Average Convergence Divergence (MACD) show its MACD line (blue) resting significantly above the signal line (orange).

The MACD indicator identifies trends and momentum in an asset’s price movement. It helps traders spot potential buy or sell signals through crossovers between the MACD and signal lines.

As with XRP, when the MACD line rests atop the signal line, it indicates bullish momentum, suggesting that the asset’s price may continue to rise. Traders see this crossover as a buy signal. Hence, the setup could potentially drive up XRP’s demand and price.

XRP Bounces Off Key Support, Targets March High of $2.71

The XRP token currently trades at $2.55, bouncing off the support formed at $2.50. If this key support floor strengthens, it could propel its price toward $2.71, a high it last reached on March 3.

However, if selloffs resume, this bullish outlook will be invalidated. In that scenario, the token’s price could break below the $2.50 support and fall to $2.29.