PumpSwap Diverts 50% of Fees Back to Meme Coin Teams—Because ’Community’ Pays Better Than VCs

In a move that either revolutionizes DeFi incentives or proves meme coins now write their own rules, PumpSwap announces it’ll slash protocol revenue straight to creators.

How it works: Every trade fee gets split 50/50 between the platform and the token’s originating team—no middlemen, no ’governance votes’ that mysteriously favor whales.

The catch: This only applies to tokens with verified deployers, meaning your average rug-pull artist won’t qualify (though we’re sure they’ll find loopholes by lunchtime).

Wall Street analysts are reportedly clutching their pearls—’This undermines the sanctity of fee extraction!’ whispered one hedge fund manager between sips of $28 artisanal coffee.

Pump.Fun is Gearing to Increase Solana DEX Market Share with PumpSwap

According to Pump.fun, users can claim rewards directly on the platform by connecting the wallet they used to create their coins. The rewards are paid out in SOL and can be claimed anytime.

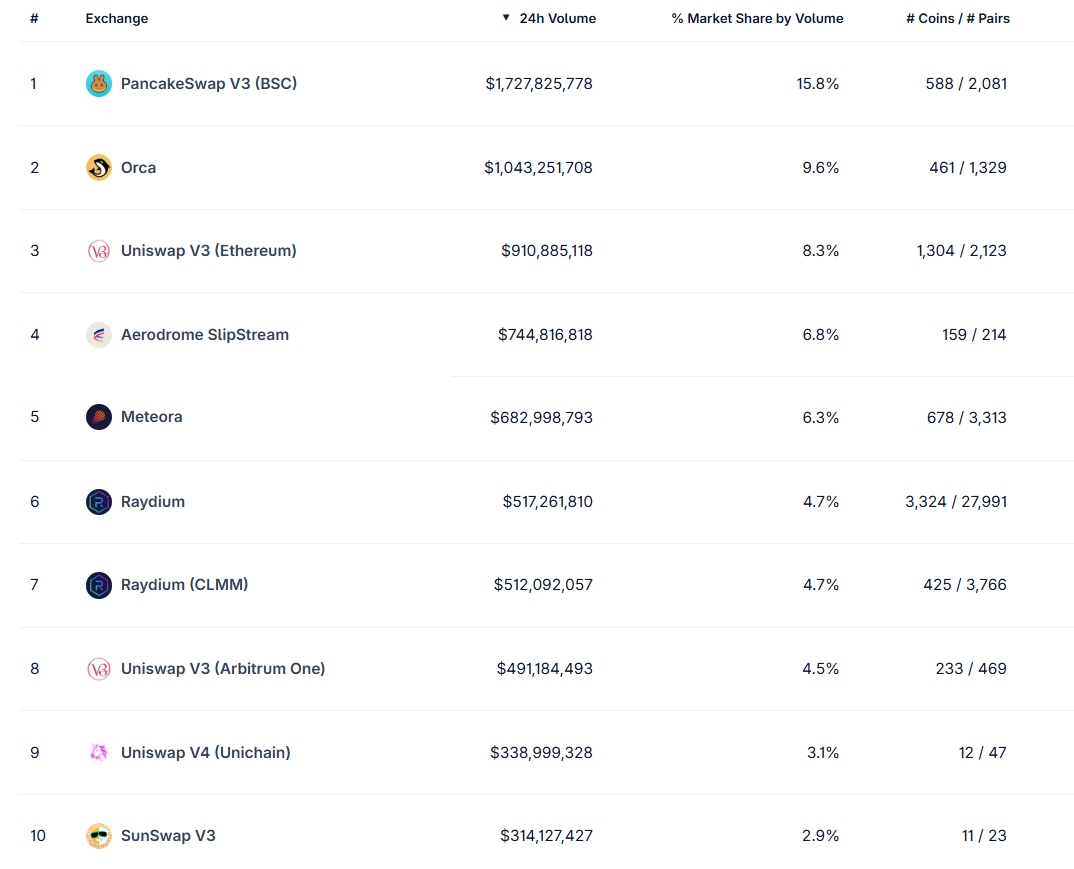

This shift could position PumpSwap as one of the most creator-friendly platforms in DeFi. It also marks a competitive MOVE against established Solana-based decentralized exchanges like Raydium.

how much do I earn?

each time someone places a trade on your coin, you earn 5 basis points (0.05%) in SOL

that means that with $10,000,000 in trading volume, you earn $5,000

this makes pump fun the most rewarding launchpad for creators BY FAR

According to CoinGecko data, Raydium currently processes more than $517 million in daily trading volume. PumpSwap, by comparison, reached $80 million daily volume just two months after launch.

The revenue-sharing model is popular in the DeFi space. However, it looks like Pump.Fun is trying to aggressively increase its market presence through engagement. The launchpad is trying to quickly capture more liquidity and grow its market share in the crowded solana ecosystem.

This revenue-sharing feature could drive stronger loyalty from developers and encourage higher-quality token launches.

As more creators seek passive income from trading activity, PumpSwap’s model may pressure other platforms to introduce similar incentives.

Pump.fun itself has seen explosive growth in 2025. Year-to-date, it has generated approximately $296 million in transaction fees, outperforming Ethereum’s $249 million during the same period.

Earlier this year, Pump.fun briefly recorded $14 million in a single day’s revenue before volumes corrected. Despite a slowdown in March, activity rebounded strongly in May with daily revenues between $1 million and $2 million.

The platform also introduced PumpSwap to streamline the trading process for new tokens, bypassing migration costs to external DEXs like Raydium. This allowed immediate listing once a token completed its bonding curve sale.

As the Solana meme coin sector continues to evolve, PumpSwap’s aggressive creator incentives could shift trading patterns and accelerate competition.